-

Stephen Moore drew swift and unusually pointed criticism after President Trump picked him to be a governor of the Federal Reserve, with at least one prominent Republican economist calling on the Senate to block the appointment.

March 25 -

Robust public discussion from a diverse array of stakeholders has informed regulators working to reform the Community Reinvestment Act, but it has also included some misleading claims, writes a top OCC official.

March 25 Office of the Comptroller of the Currency

Office of the Comptroller of the Currency -

Agency concerned about the number of "risky" mortgages being approved; Brian Kelly, who runs The Points Guy website, can determine if a card succeeds or fails.

March 25 -

Banks and credit unions may be moving one step closer to federal legislation freeing them to serve legal pot businesses, but the path to enactment is still fraught with huge challenges.

March 24 -

The Democrats are asking the OCC and the CFPB to use their authority to remove Tim Sloan, who became CEO in 2016.

March 22 -

In the second lawsuit of its kind, more than a dozen of the world's largest banks are accused of price fixing on roughly $486 billion of bonds issued by Fannie Mae and Freddie Mac.

March 22 -

The bureau had already proposed removing the underwriting portion of the rule, but a judge in Texas has indefinitely delayed the other key component as well.

March 22 -

Alongside identity-document scanning and other ID verification, the two companies are offering real-time checks of lists of suspicious persons. The goal: keep money launderers out of the banking system.

March 22 -

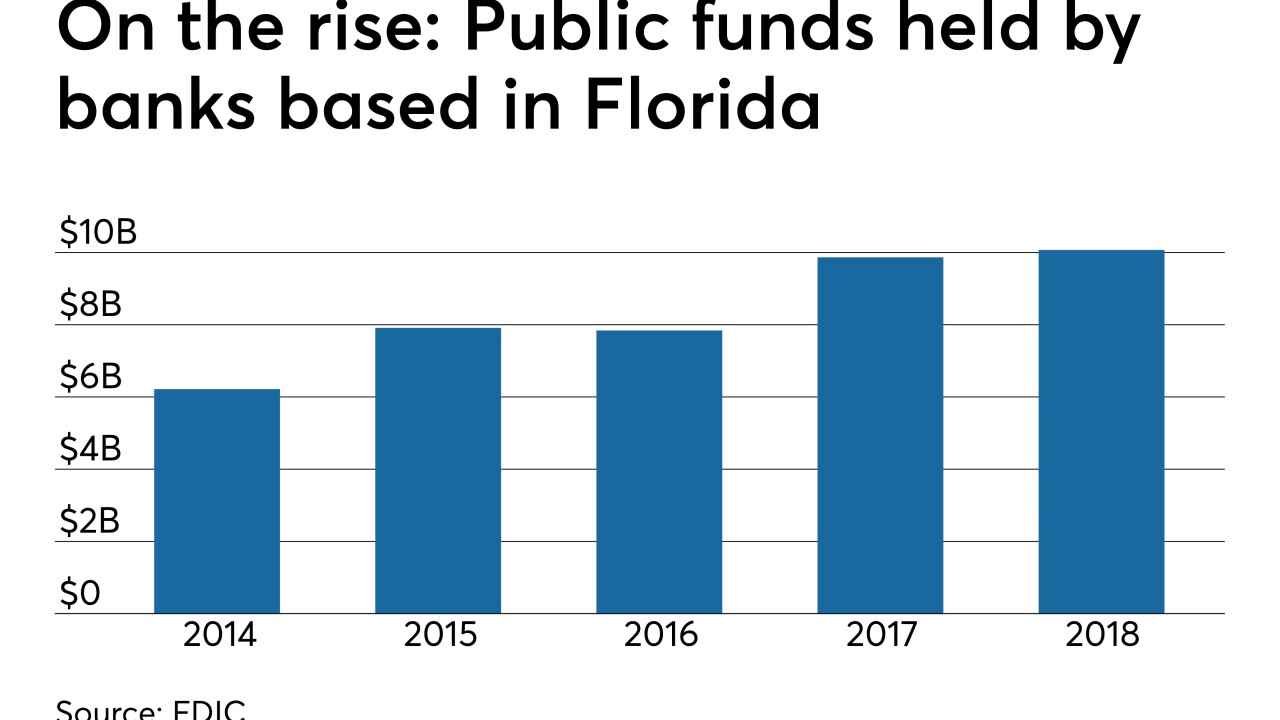

State law bars credit unions from accepting deposits from cities, counties and other government entities. Florida banks say it should stay that way unless tax advantages for credit unions are removed, but credit unions counter that banks are trying to stifle competition.

March 22 -

Moore is a founder of the conservative Club for Growth and served on the editorial board of The Wall Street Journal.

March 22