-

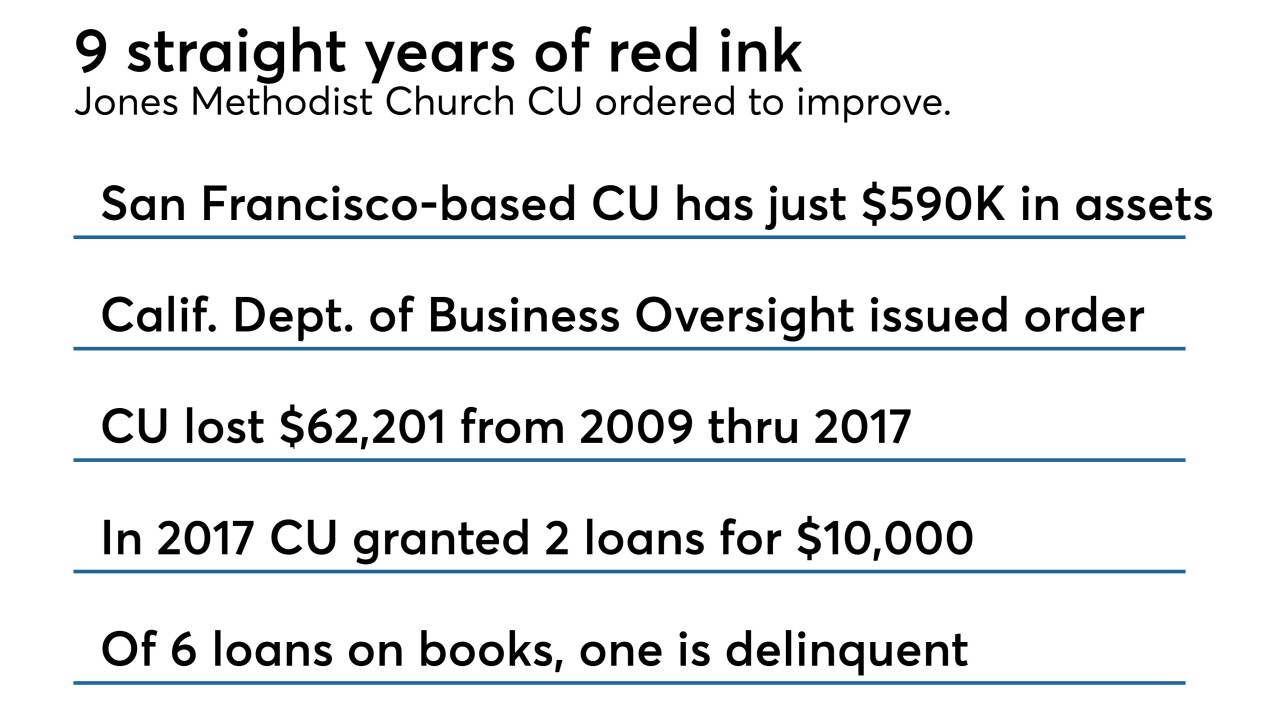

Jones Methodist Church Credit Union has been ordered to address "unsafe or unsound practices" following nine years of losses and other problems.

October 10 -

The group is launching an "educational campaign" to praise the role played by House and Senate members in unwinding certain provisions of the Dodd-Frank.

October 10 -

It's difficult to predict exactly what might be the next threat to the financial system. Here's a roundup of some prime suspects.

October 9 -

Despite a mandate in the Dodd-Frank Act, policymakers have not yet finalized a rule reforming excessive pay on Wall Street.

October 9 Public Citizen

Public Citizen -

Fintechs can get what they need from a traditional bank charter with the FDIC, as long as the agency is willing to play ball and step up its approach to innovation.

October 9

-

Analysts are split on whether cyber threats have evolved enough for lawmakers to finally grant the National Credit Union Administration third-party vendor oversight.

October 9 -

The heavy workload is not limited to implementing the financial regulatory reform bill enacted last spring, as the agencies also work to craft reforms of the Community Reinvestment Act and adjust key capital measures for the biggest banks.

October 8 -

Speaking at an industry conference Thursday, two tech executives and a community banker said that community banks should be allowed to experiment with new products without worrying about running afoul of regulators.

October 5 -

The company is offering short-term installment loans to its clients’ customers; even institutions not accused of wrongdoing may pay a price.

October 5 -

Readers weigh in on infighting at the Consumer Financial Protection Bureau, react to a push for open banking in the United States, consider small-dollar bank loans and more.

October 4