-

Comptroller of the Currency Joseph Otting says the revised Community Reinvestment Act will provide more credit access to communities in need and won't, as some had feared, create new thresholds for grading banks.

May 20 Office of the Comptroller of the Currency

Office of the Comptroller of the Currency -

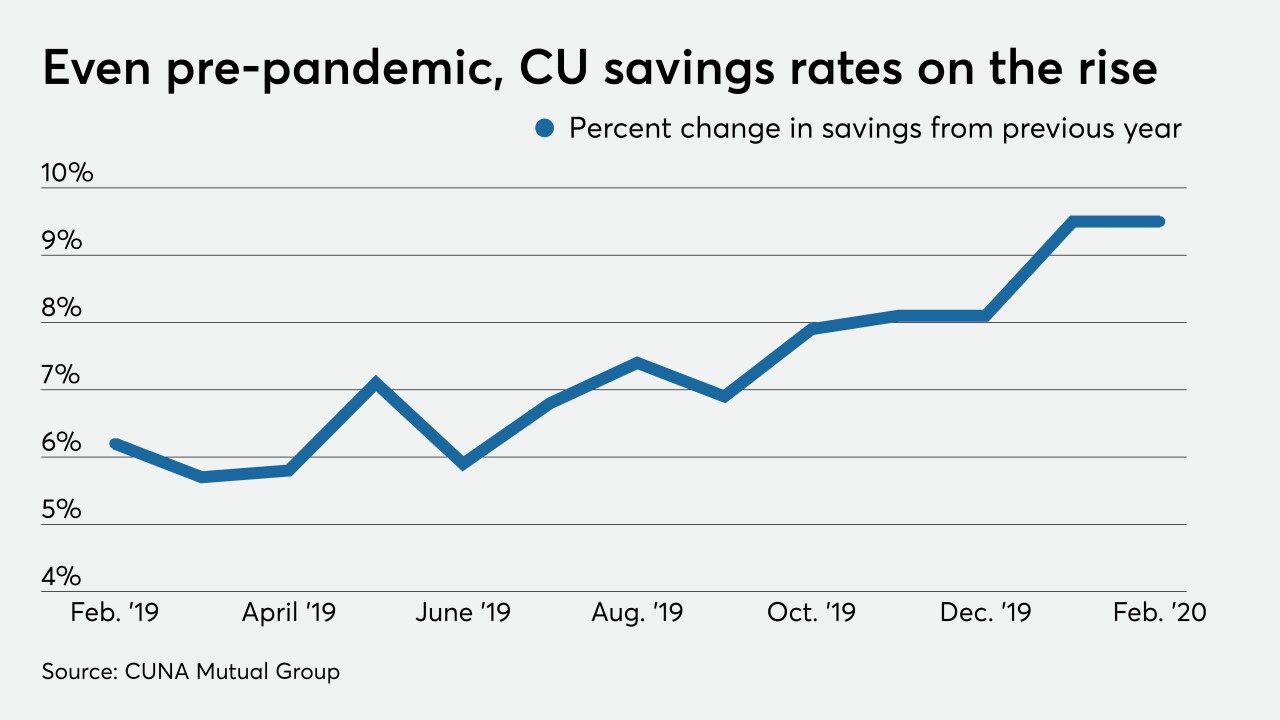

Recent tweaks to Reg D have blurred the line between checking and savings accounts, opening up the possibility for new innovation in those products.

May 20 -

The final regulation will significantly revise a December proposal, responding to concerns from stakeholders. Meanwhile, in a surprising move, the regulator who had championed the reforms is expected to resign this week.

May 19 -

Director Mark Calabria, who abandoned the Fannie and Freddie capital proposal written by his predecessor, said he expects a revised framework to be ready “very soon.”

May 19 -

The agency has freed companies from reporting requirements and provided flexibility on exams to help them deal with COVID-19 fallout. It has also finished other regulatory relief efforts that were in the pipeline before the pandemic hit.

May 18 -

The order's removal allows the Delaware company to pursue more opportunities in its payments business.

May 18 -

The two mortgage giants said they would begin the process of hiring outside firms to help raise capital that will be needed to exit conservatorship.

May 18 -

The government's latest stimulus package cleared the House on Friday but a number of key credit union priorities didn't make the cut.

May 18 -

Operation HOPE Chief Executive John Hope Bryant talks about how the Community Reinvestment Act influenced him at the age of 9 and eventually led to the founding of his nonprofit, which works with banks to help communities in need. But he says the 1977 law is outdated.

May 18 Operation HOPE Inc.

Operation HOPE Inc. -

Bankers call credit unions’ latest efforts to ease limits on member business lending opportunistic. Credit unions say they're trying to help with the recovery effort.

May 18