-

ChoiceOne Financial Services would pay about $180 million to acquire Fentura Financial in a bid to expand in Detroit's suburbs. The deal would create a bank with more than $4 billion of assets.

July 25 -

But following the gross domestic product and personal consumption expenditures reports, Treasury yields and mortgage rates fell.

July 25 -

The Raleigh, North Carolina-based bank grew loans and deposits in the second quarter as it won back business from former customers of the failed Silicon Valley Bank. First Citizens bought the remains of SVB last spring.

July 25 -

Third-party origination operations are also going to Mr. Cooper in the $1.4 billion deal, in which the seller cited interest in improving its capital position.

July 25 -

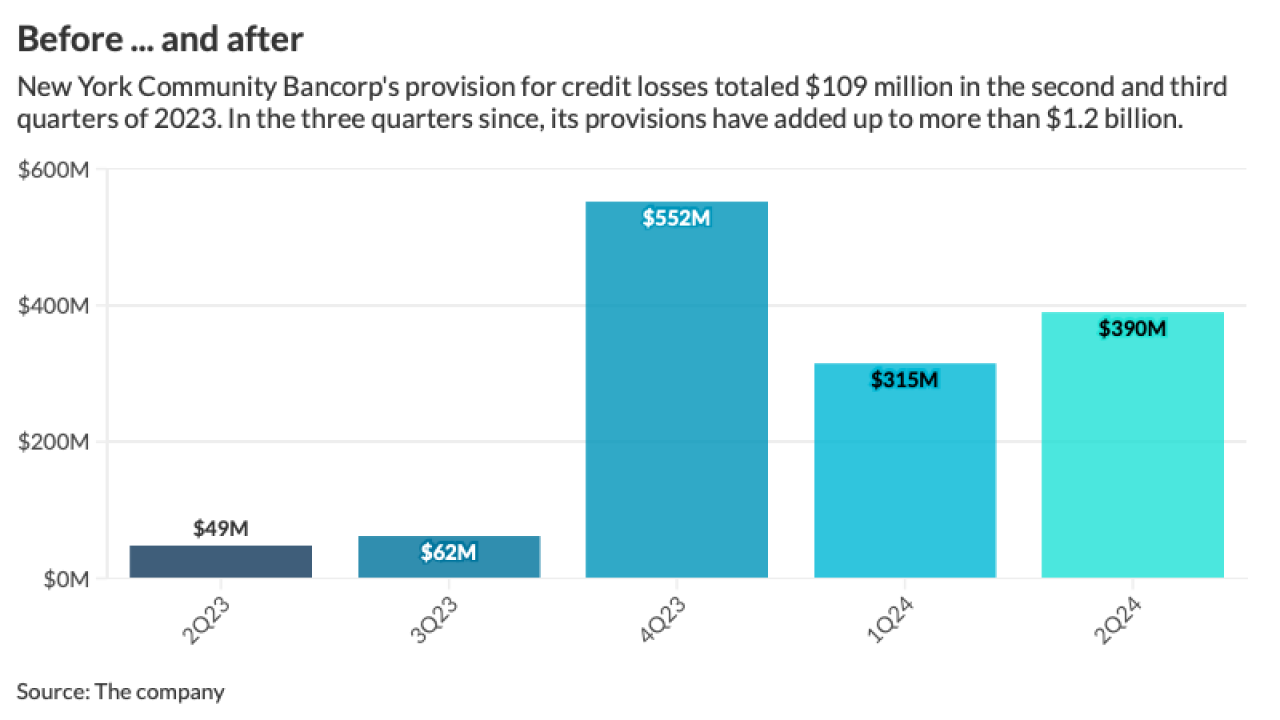

The parent company of Flagstar Bank reported a net loss of $323 million for the second quarter after boosting loan-loss provisions and recording a steep increase in net charge-offs. Still, it says it's making progress on a turnaround plan, including by agreeing to the sale of its mortgage servicing business.

July 25 -

The $72.8 billion-asset bank lowered its guidance for net interest income, explaining that while business prospects on the island are relatively rosy, its stateside opportunities for loan growth look weaker.

July 24 -

The embattled Long Island-based bank announced the hiring of nine new senior executives. Most of them have ties to CEO Joseph Otting, who previously held the top job at the OCC and OneWest Bank.

July 24 -

The $73.5 million all-stock deal, slated to close early in 2025, would create a bank with more than $3 billion of assets.

July 24 -

A rising number of check fraud cases involving counterfeit checks is compounding the already-serious problem of fraud in one of the oldest payment methods widely available.

July 24 -

Old National Bancorp's earnings remained strong as it continued its expansion into the southeast with its recent $344 billion acquisition of CapStar. Executives said they foresee similar growth for the remainder of the year.

July 23