-

The ratings firm evaluated 4,100 loans to assess the state of 41 banks' commercial real estate risk. It found that the lenders should be holding, on average, about twice the amount of reserves they currently have for office loans.

July 9 -

The Cincinnati bank has agreed to pay a total of $20 million to settle a lawsuit by the Consumer Financial Protection Bureau over fake bank accounts and to resolve separate violations involving force-placed auto insurance.

July 9 -

The Sacramento-area institution moved quickly and decisively to fill the gap created by the loss of First Republic and Silicon Valley Bank. A first-quarter rise in Bay Area deposits is a sign of bigger gains to come, San Francisco Bay Area President DJ Kurtze says.

July 8 -

The bank acquired these business purpose non-qualified mortgage loans originated by Civic Financial Services in the PacWest Bancorp deal.

July 5 -

Marcus Castilla was recently named director of the Oklahoma bank's digital banking unit for service members; he shares what Roger offers today and some plans for the future.

July 5 -

A law that took effect this week allows Florida consumers to ask state regulators to investigate why a financial institution canceled an account or rejected a loan application. The law, which applies to federally chartered banks, could lead to a legal battle over the limits of state powers.

July 4 -

The OCC's new Vital Signs initiative gives bankers an important tool to help them assess the financial health and stability of their customers, and to help them build a strong foundation for the future.

July 4

-

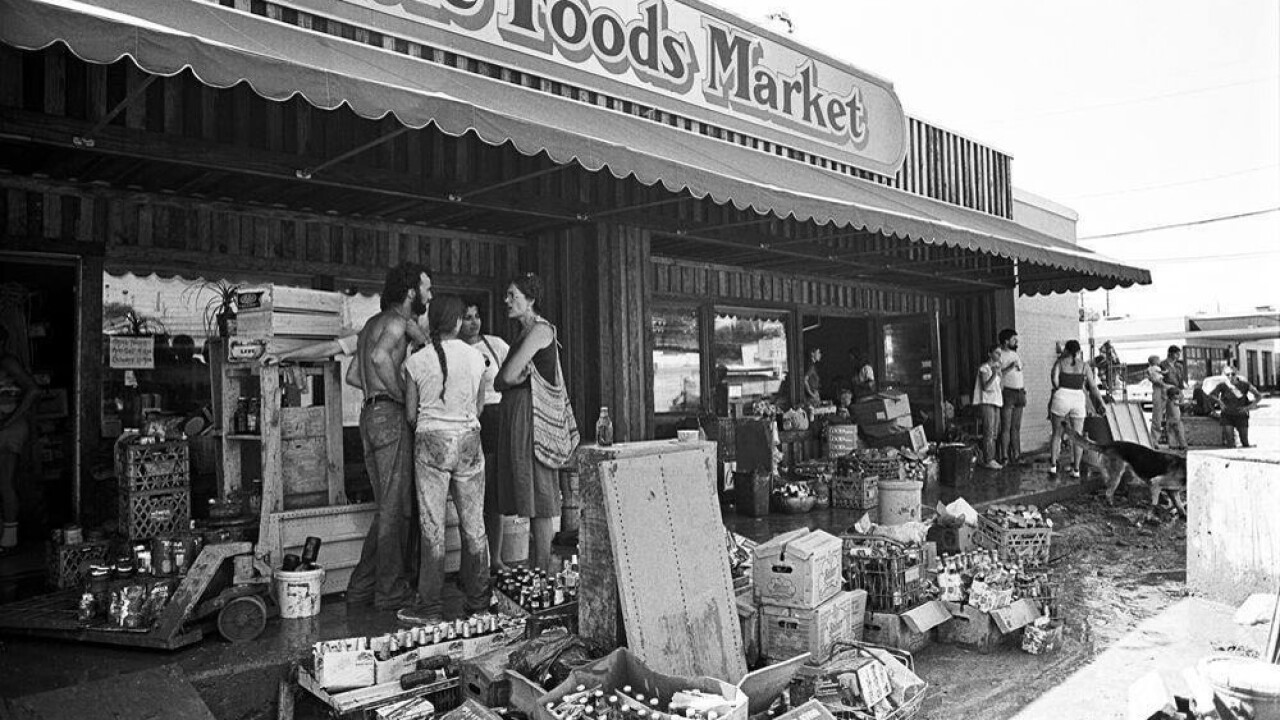

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

July 3 -

The focus should be on the millions of Americans whose credit reports contain serious errors, and who are increasingly desperate for relief.

July 3

-

With the line between banks and fintechs growing ever blurrier, financial services supervisors ought to consider adjusting regulation to fit the kinds of activity an institution is engaged in.

July 3