-

Past is not prologue, and a successful strategy for becoming a top-performing bank in 2020 is very different from what it might have been just six months ago.

June 5

-

Two years ago, the Tulsa, Okla., company expanded its Native American casino lending business nationwide. It seemed like a great plan until the coronavirus pandemic struck.

June 3 -

John Dugan says a successful effort by banks to alleviate the economic damage of the pandemic could boost the industry's reputation.

June 3 -

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

June 1 Ludwig Advisors

Ludwig Advisors -

The takeaway from the PPP rollout is that bankers must protect their reputations and limit their risk appetites as they participate in further government-backed rescue programs.

May 29 -

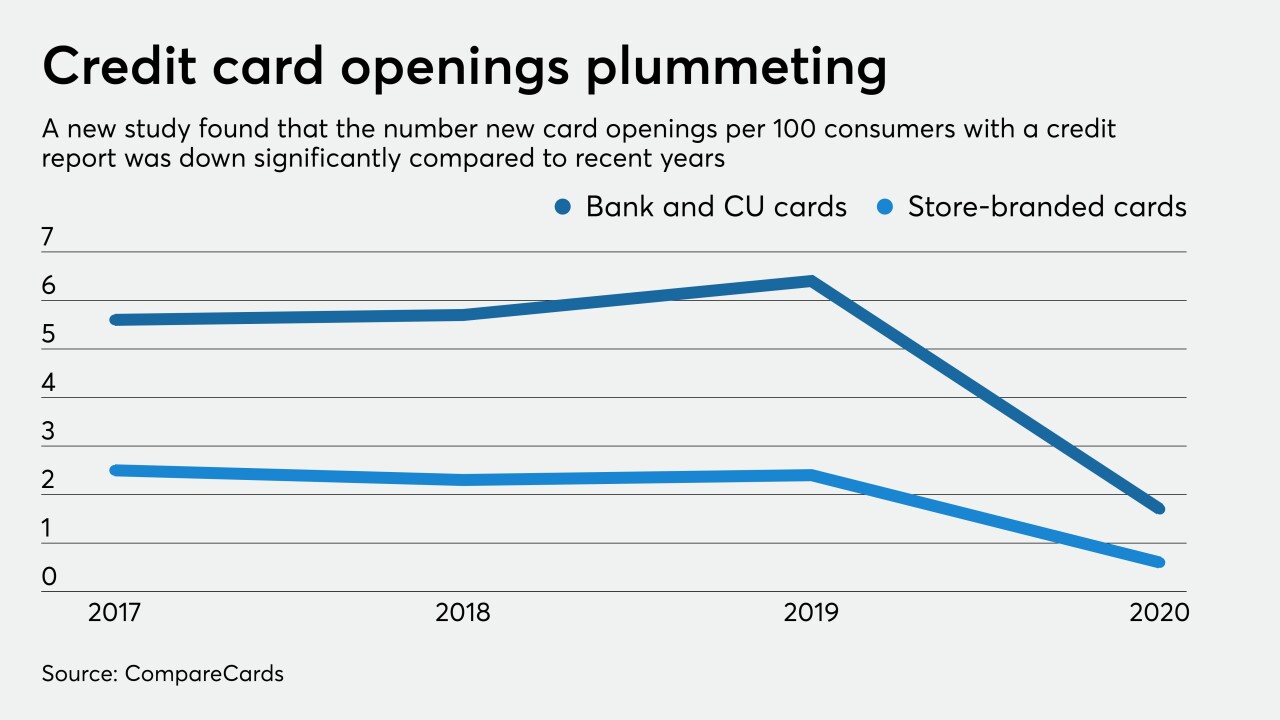

The drop is likely from both a decline in consumer demand and lenders becoming more cautious, according to CompareCards.

May 22 -

Lenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

May 19 -

The regional wants to “play offense” with the proceeds of its $17 billion BlackRock stake; shares of some bank shares jumped 6% Thursday but remain well behind the rest of the market.

May 15 -

Institutions need to think about revenue streams and portfolio diversification as the coronavirus affects much of the U.S. economy.

May 8 Alliant Credit Union

Alliant Credit Union -

Cybercrime has emerged as one of the biggest potential sources of risk to the financial system over the last 20 years, and cybersecurity is a paramount concern to bankers everywhere. But can the internet be made more secure?

April 29