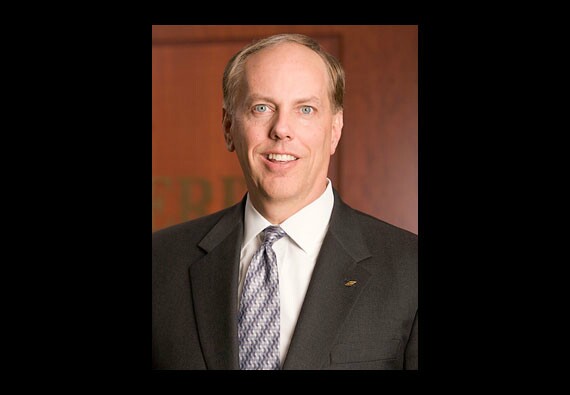

William Cooper, TCF Financial

Total compensation: $8.9M

Change from 2010: 310%

Company ROAA: 0.6%

Total return on company stock: 19%

GMI compensation risk rating: High concern — Top executives eligible for discretionary cash bonuses, "which undermines a pay-for-performance philosophy"

Paul Greig, FirstMerit

Total compensation: $6.4M

Change from 2010: 15%

Company ROAA: 0.8%

Total return on company stock: 14%

GMI compensation risk rating: High concern — CEO pay includes restricted shares that simply vest over time, and was worth more than four times the median for other top executives, raising "concerns about internal pay equity"

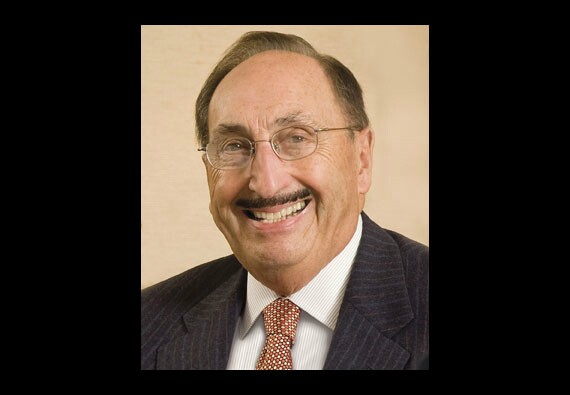

Louis Cappelli, Sterling Bancorp

Total compensation: $5.2M

Change from 2010: 29%

Company ROAA: 0.6%

Total return on company stock: 2%

GMI compensation risk rating: Moderate concern — Large gap between CEO pay and pay for other top executives, and Tarp restrictions on compensation ended when Sterling repaid the government in early 2011

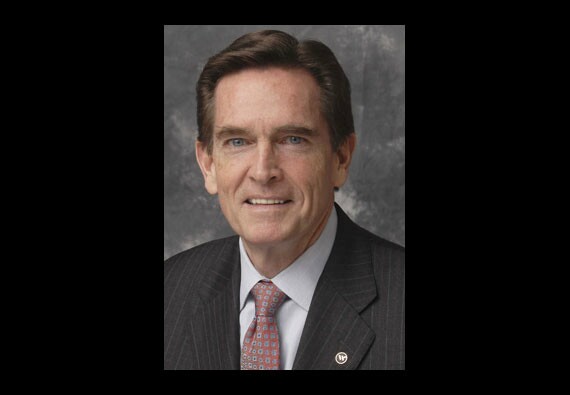

James Smith, Webster Financial

Total compensation: $5M

Change from 2010: 68%

Company ROAA: 0.8%

Total return on company stock: 19%

GMI compensation risk rating: High concern — Large gap between CEO pay and pay for other top executives, and Tarp restrictions on compensation ended when Webster repaid the government in 2010

Greg Becker, SVB Financial

Total compensation: $4.6M

Change from 2010: 138%

Company ROAA: 0.9%

Total return on company stock: 20%

GMI compensation risk rating: High concern — Steep climb in

Base salary in recent years, and one-year performance period for some awards is too short

Martin Dietrich, NBT Bancorp

Total compensation: $4.5M

Change from 2010: 51%

Company ROAA: 1.1%

Total return on company stock: 6%

GMI compensation risk rating: Moderate concern — Long-term and annual incentives both tied to earnings per share, "indicating that executives are being rewarded twice for a single achievement"

Monte Redman, Astoria Financial

Total compensation: $4.5M

Change from 2010: 20%

Company ROAA: 0.4%

Total return on company stock: 17%

GMI compensation risk rating: Moderate concern — Restricted stock awards simply vest over time

Matthew Wagner, PacWest Bancorp

Total compensation: $4.2M

Change from 2010: 24%

Company ROAA: 0.9%

Total return on company stock: 6%

GMI compensation risk rating: Moderate concern — failure to implement clawback provisions