The next Fed chair

"Honestly, I like them all," Trump told reporters during a press conference. "I have a great respect for all of them. But I'll make a decision over the next very short period of time."

A decision is expected within the next couple weeks. Trump has little flexibility as Janet Yellen's term as chair is due to expire early next year, and any candidate would need to be vetted by the Senate Banking Committee and voted on by the full chamber, an often lengthy process.

It remains unclear if Trump wants a big change in direction at the Fed. As a presidential candidate, he was critical of Yellen, but he has warmed to her as the stock market and the economy have done well during her tenure. He is set to meet with Yellen on Thursday to discuss whether she would be interested in being reappointed. (The final five candidates were first reported by T

The president has a rare opportunity to reshape the entire Fed board so early in his term. His first pick, Randal Quarles, was sworn in Monday as vice chairman of supervision, but three other spots on the seven-member board are currently vacant. If Trump does not pick Yellen as the next chair, she could also choose to leave the board, which would open a fourth spot.

Following is who he is considering for the Fed chair slot:

Janet Yellen

It still seems more likely than not that the president will choose someone else for the spot, if only so that he can make his own pick and not reappoint one inherited from his predecessor. Yet keeping Yellen would avoid any potential market uncertainty surrounding the choice and give him a Fed chair who's obviously qualified for the role.

Jerome Powell

Powell is a former visiting fellow at the Bipartisan Policy Center and worked for the Treasury Department in the George H.W. Bush administration.

Kevin Warsh

Gary Cohn

But that changed dramatically after Cohn reacted poorly to Trump's comments following violence in Charlottesville in July. Cohn was outspoken that the president did not strongly condemn Nazis and other white supremacists taking part in a rally there. Since then, the relationship between Trump and Cohn is said to have cooled. Yet he remains in the running.

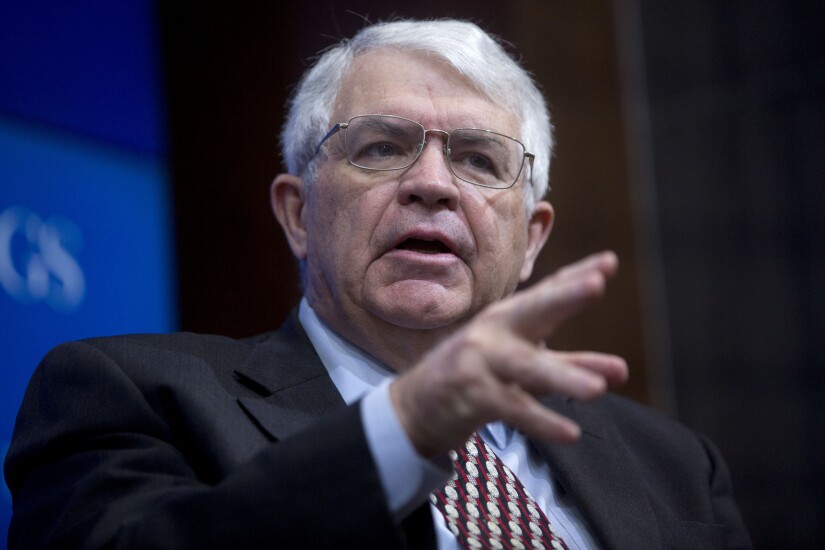

John Taylor

Taylor is a former Treasury undersecretary for international affairs in the George W. Bush administration and a former member of the Council of Economic Advisers for President George H.W. Bush.