Fintechs' vulnerability apparent in Capital One data-access flap

(Full story

Square quietly withdraws bank application

(Full story

Why RBC, JPMorgan are backing a new standard for financial apps

(Full story

Banks seek new blood to fill evolving CRO role

(Full story

Crypto money laundering up threefold in 2018: Report

(Full story

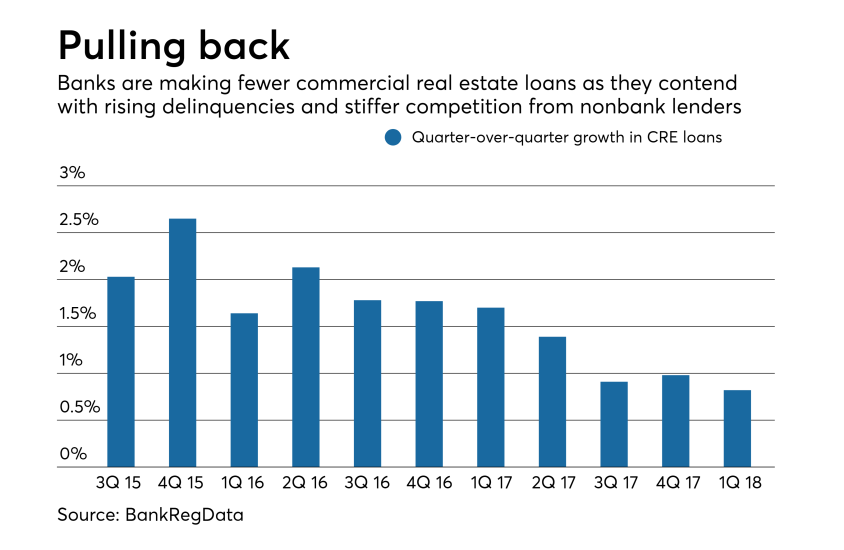

What's behind the slowdown in CRE lending

(Full story

What happens to CFPB if Mulvaney gets picked as Trump's chief of staff?

(Full story

Pressure mounts on FDIC, Fed to follow OCC's small-dollar lead

(Full story

How Pat Toomey could shape banking policy

(Full story

Corporate customers want retail's bells and whistles, too

(Full story