Flagstar snags Regions exec to oversee growing branch network

(Full story

Recapitalized Florida bank brings in new leadership

(Full story

Manafort mortgage bought bank CEO spot as Trump adviser: Prosecutors

(Full story

This month could be a turning point in fintech regulation

(Full story

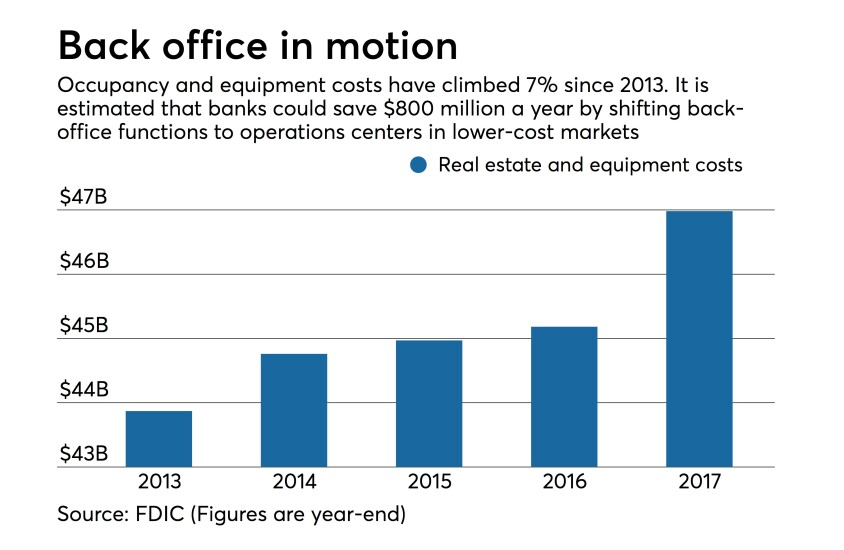

Back-office innovations help banks dump costly real estate

(Full story

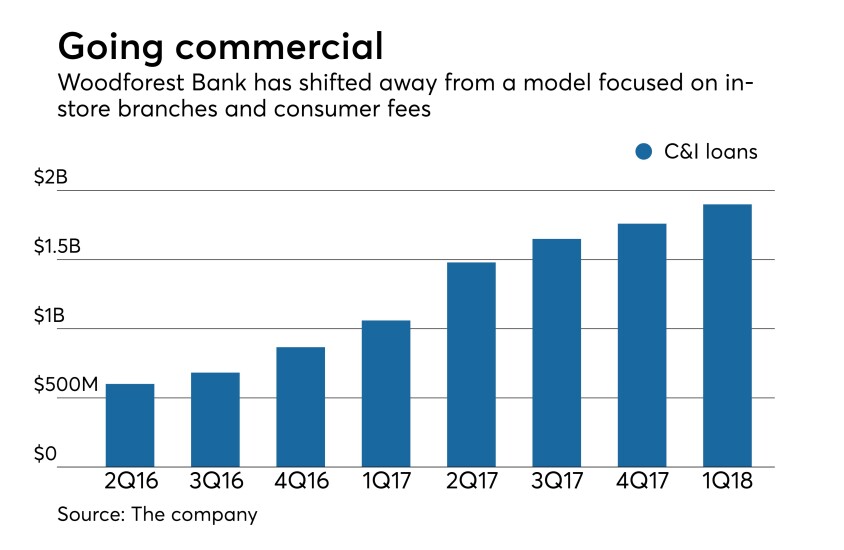

Big shift in store for Walmart's largest banking partner

(Full story

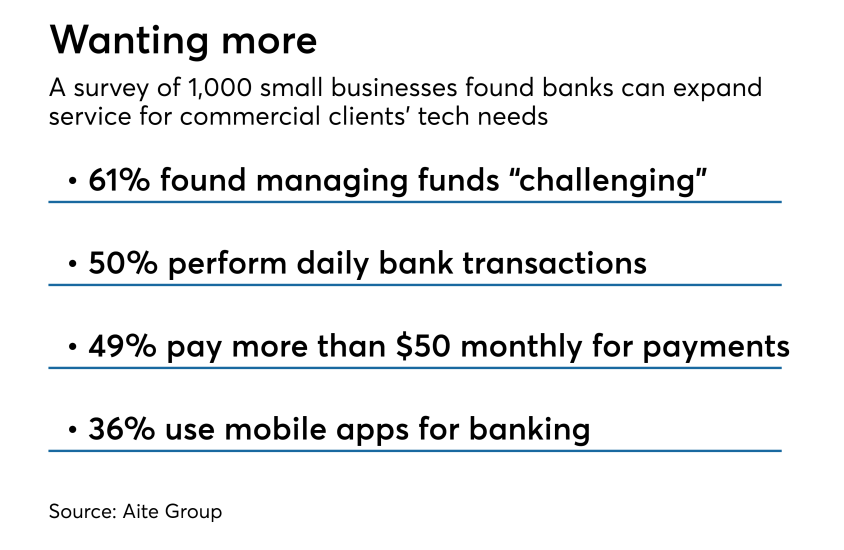

Banks play catch-up in fintech for small-business clients

(Full story

Supreme Court shuffle: 5 possible reverberations for banks

(Full story

Why BNY Mellon, Fidelity use AI sparingly

(Full story

Umpqua names CEO, CTO for innovation unit Pivotus Ventures

(Full story