Big-Bank Threat

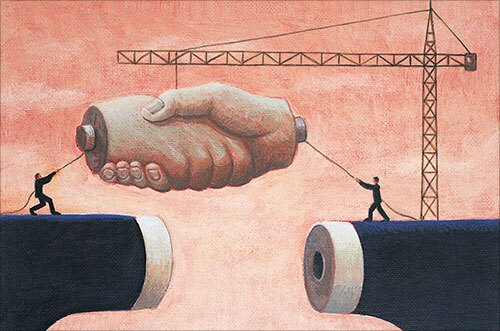

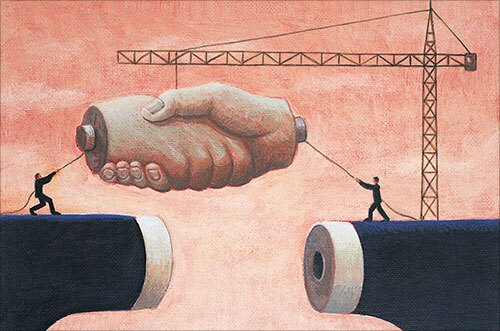

Power in Frenemies

Privately Held Banks Thrive

Stability in Ag Lending

De Novo Slump

Mortgage Relief

Though changes to bank capital rules previewed by Federal Reserve Vice Chair for Supervision Michelle Bowman in February being viewed as welcome, experts say other more significant hurdles — not all of them regulatory — are keeping banks on the sidelines of mortgage servicing and lending.

The proposed national trust charter company would be a wholly owned subsidiary of Morgan Stanley. The application was filed on Feb. 18.

Fulton Financial received the necessary approvals to acquire Blue Foundry Bancorp; Wells Fargo named Dennis Devine head of business banking; JPMorgan hired two Bank of America health care veterans while shuffling leadership; and more in this week's banking news roundup.

Preferred Bank moved a $115 million block of loans to nonaccrual status after the borrower, which is battling fraud charges leveled by other banks, began missing payments.

A final rule published by the Office of the Comptroller of the Currency Friday will formalize a 2021 interpretive guidance allowing national trust banks to perform non-fiduciary custody. The banking industry complained that the rule runs counter to the traditional scope of the charter.

The payments company will fire about 40% of its employees, with CEO Jack Dorsey attributing the move to the impact of artificial intelligence. While investors cheered the move, analysts also raised questions about the company's functionality, and Dorsey said other companies will make similar moves.