(Image: Thinkstock)

On why he left Wells Fargo (WFC) after it stopped selling delinquent consumer debt to outside collections agencies:

Related Article:

On a possible delay in implementing the qualified mortgage rule by the Consumer Financial Protection Bureau:

Related Article:

(Image: Thinkstock)

Richard Cordray on the shot in the arm provided his Senate confirmation as the CFPB's permanent director:

Related Article:

(Image: Bloomberg News)

On trying to spot the cause of the next financial crisis before it's too late:

Related Article:

On the government's interest in pursuing False Claims Act cases against mortgage lenders:

Related Article:

On whether regulators will hold banks accountable for the ways in which employers use payroll cards:

Related Article:

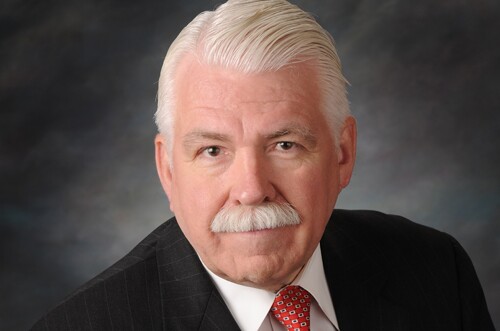

Stephen Marsh, chairman of the $3.1 billion-asset Enterprise Financial Services in St. Louis, on why it was important for his bank to fully repay its $35 million in Tarp aid:

Related Article:

Kenneth Lehman, an investor in Delmar Bancorp, a $432 million-asset bank in Salisbury, Md., on why he agreed pay $6 million in cash and cancel 5,000 shares of preferred stock for a 40% stake:

Related Article:

U.S. Attorney Jenny Durkan of the Western District of Washington on why she prosecuted James Bishop (who pled guilty), the former head of the failed Summit Bank in Burlington, Wash., for hiding millions of dollars in loan losses:

Related Article:

(Image: Thinkstock)

Rick Lyon, the head of commercial real estate banking for Capital One, on the challenge of preserving the independent spirit of a niche lender it company has agreed to buy:

Related Article:

(Image: Thinkstock)

On why bankers may increasingly try to remain in their jobs after selling to competitors:

Related Article:

Joseph Smith, monitor of the national mortgage settlement, on his view that JPMorgan Chase (JPM) and Bank of America (BAC) and other banks are not yet out of the woods in terms of complying with the terms of their $25 billion settlement:

Related Article:

(Image: Bloomberg News)