In opposition to new curbs on overdraft fees:

Related Article:

On U.S. Bank and other companies testing mobile coupons:

Related Article:

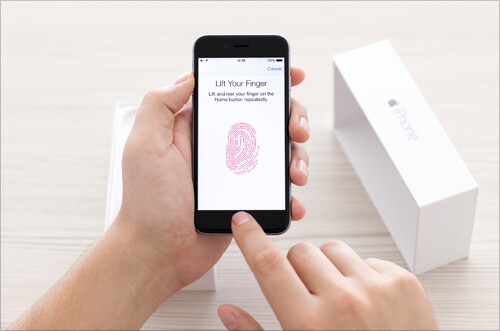

On the need to increase the font size on mobile banking apps, among other things, to accommodate seniors:

Related Article:

On a startup aiming to help financial institutions bank pot businesses via an electronic payments solution:

Related Article:

On a proposal that would ban arbitration clauses that prevent consumers from bringing class action lawsuits:

Related Article:

On how criminals game rules determining when banks scrutinize transactions over $10,000 (via <a href="https://twitter.com/faisal_pfi/status/726199731509153792" target="_blank">Twitter</a>):

Related Article:

Agreeing with an op-ed that urges systemic risk regulators to target specific activities and products rather than individual companies:

Related Article:

On the need to simplify digital banking experiences regardless of customer's age:

Related Article: