Mulvaney to drop public complaints against firms, change CFPB name

(Full story

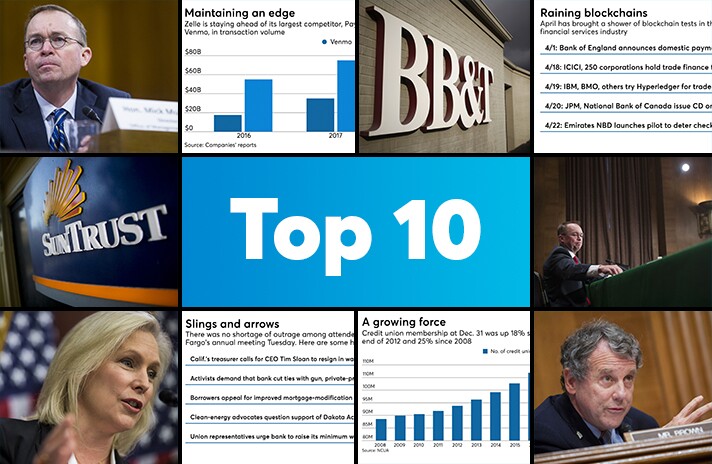

Zelle's bumpy ride toward ubiquity

(Full story

What other banks can learn from BB&T's glitch

(Full story

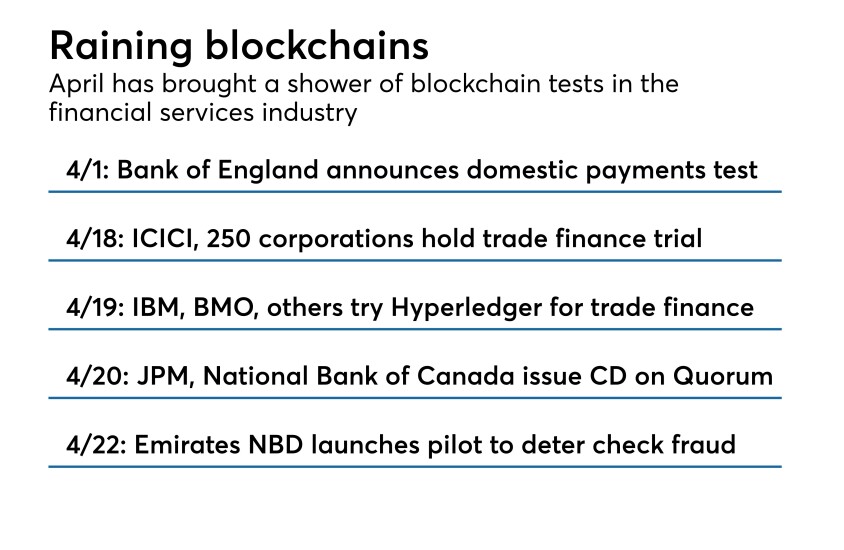

Spinoff rumors or not, JPMorgan Chase's blockchain unit is evolving

(Full story

Former SunTrust employee said to have stolen customer data

(Full story

Mulvaney response to CFPB data security gaps baffles cyber experts

(Full story

The New York senator offers legislation to empower U.S. post offices to take deposits and make loans.

(Full story

'Wells Fargo, you're the worst': Scenes from testy annual meeting

(Full story

Do credit unions still warrant a tax exemption?

(Full story

CFPB's Mulvaney gives unexpected gift to Democrats

(Full story