MB Financial to exit national mortgage lending

(Full story

Regions to sell insurance business to BB&T

(Full story

BofA, Citi plan next-gen branches

(Full story

Bank of America launches a (mostly) digital mortgage

(Full story

Digital wealth tools help banks reel in new assets, talent

(Full story

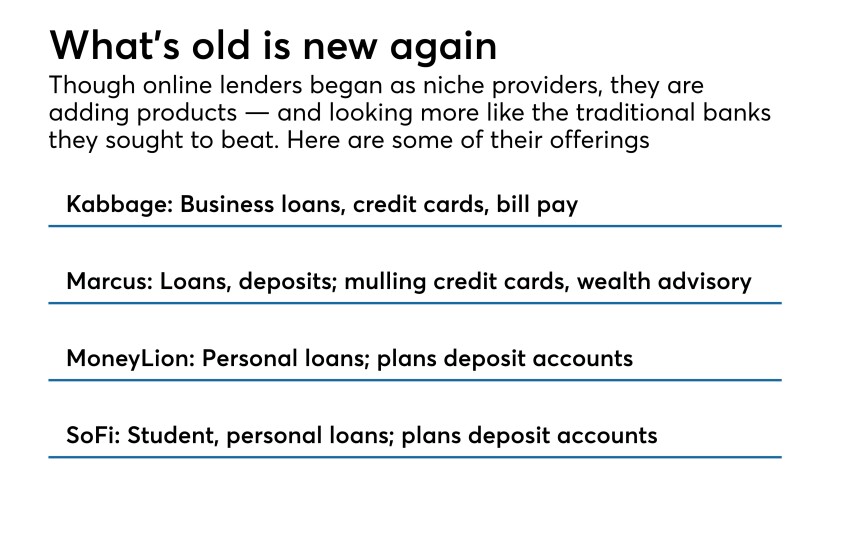

Online lenders adopt the model they sought to disrupt

(Full story

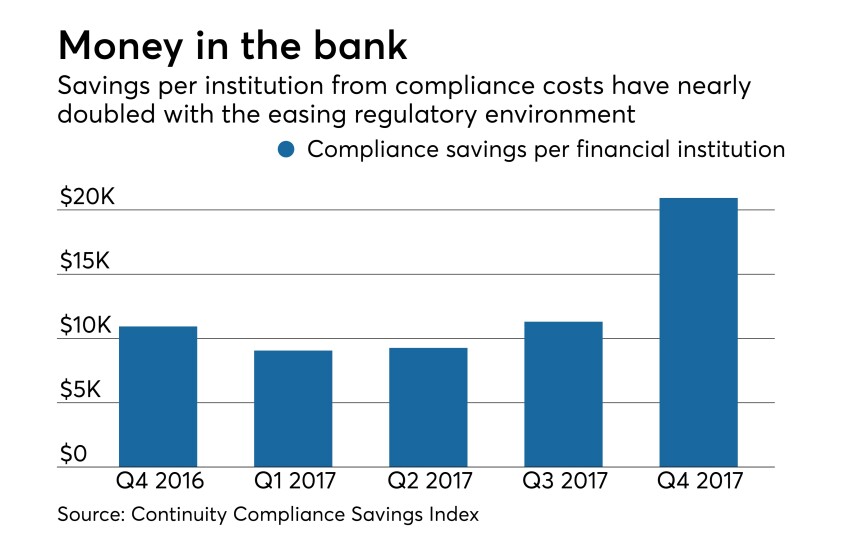

Bank regulatory actions under Trump fall to historic lows

(Full story

5 items on OCC chief's reg relief to-do list

(Full story

Credit unions are buying more banks. Get used to it.

(Full story

Regulators are fueling another housing boom

(Full story