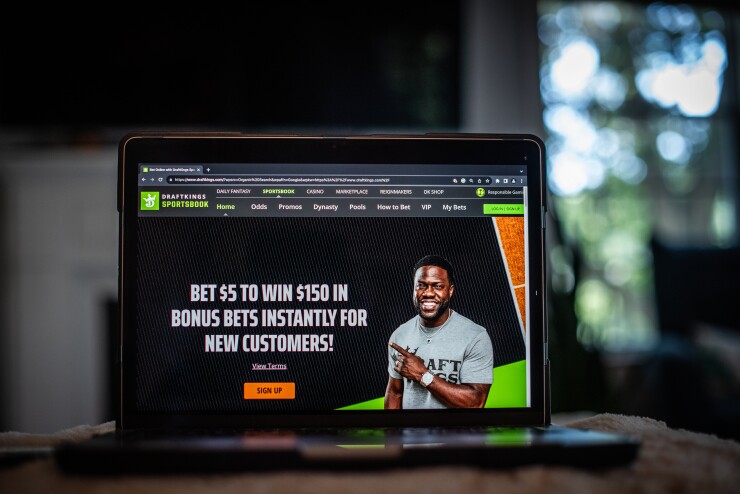

The online gambling operator DraftKings has banned the use of credit cards to fund customer accounts in its U.S. casino and sports book operations.

The move, which became effective Monday, follows a $450,000 fine of DraftKings by Massachusetts regulators who found that the company improperly accepted credit card funds from customers. Massachusetts is one of several U.S. jurisdictions that have legalized sports betting, but prohibit the use of credit cards to fund customer accounts.

DraftKings will continue to allow customers who play daily fantasy sports — which are found on a separate part of its website from its sportsbook — to fund their accounts with credit cards.

The Boston-based gambling company says that it did not revise its credit card policy because of regulatory factors.

"The change is intended to help customers avoid cash advance fees and higher interest rates often associated with this payment method and otherwise improve the deposit experience," a DraftKings spokesperson said in a statement.

Three other operators of online sportsbooks — FanDuel, ESPN Bet and BetMGM — did not respond Monday to inquiries about their credit-card policies.

As legal gambling has

First, as DraftKings noted in its statement, wagers that are funded with credit cards tend to be more expensive than those that rely on other payment methods, since card companies typically classify gambling transactions as cash advances.

The cash advance fees are generally

Separately, there have been concerns that allowing consumers to fund wagers with credit cards will fuel gambling problems.

Iowa state Sen. Tony Bisignano, a Democrat, was a key architect of a Hawkeye State law that allows online sports gambling, but bans the use of credit cards in those transactions. Bisignano told American Banker after the law took effect that putting limits on how gamblers can fund their activities makes sense considering gambling's addictive potential.

"Credit is credit. And gambling has its addiction side," Bisignano said. "If you mesh the two together, at some point someone will gamble their future away."

DraftKings was ordered to pay the $450,000 fine in Massachusetts after the state's Gaming Commission found that the company did not implement sufficient controls to prevent the use of credit card funds in players' accounts.

"Even after discovering this non-compliance, DraftKings repeatedly failed to implement successful corrections to its platform to remedy the issue for nearly a year while also repeatedly reporting that the issue had been resolved," the commission wrote in

DraftKings told the Massachusetts regulators that "the root cause of this issue was an internal communication breakdown" and pointed to what it described as "an anomalous sequence of events."

The company was ordered to develop a corrective plan and to have an independent audit conducted to review certain transactions from 2023. It must also return more than $83,000 of credit card funds to 218 customers.