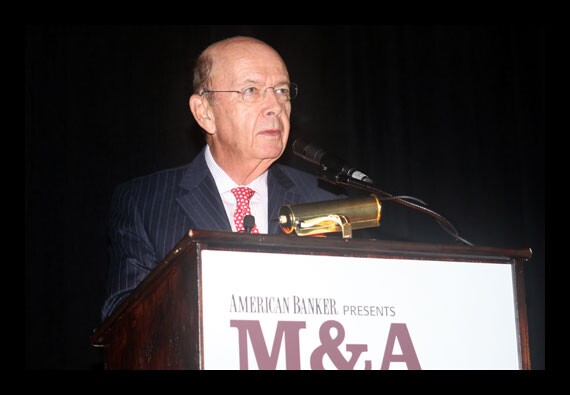

Investor Cries Foul

—Wilbur Ross, chairman and CEO of WL Ross & Co. (Image: Michael Chu)

Regulators Fight Back

—Federal Reserve lawyer Amanda K. Allexon (Image: Bloomberg News)

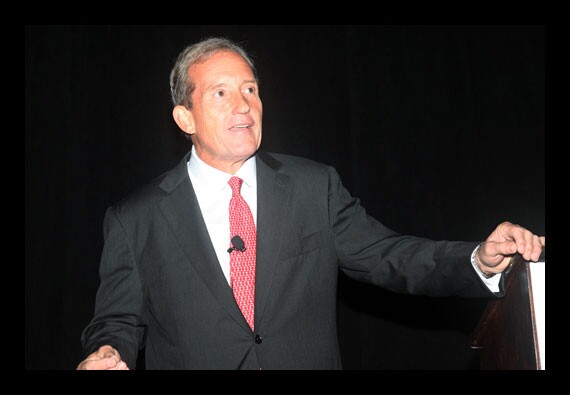

Cautious Forecast

Tough Love For Community Banks

—Greg Mitchell, CEO of First PacTrust (FPTB) (Image: Michael Chu)

The Dodd-Frank Effect (Small Banks)

—

The Dodd-Frank Effect (Big Banks)

—

Problem Bank List as Lead Sheet

—

Another Failure Surge to Come?

—

Managing Up

—MidSouth Bancorp (MSL) CEO Rusty Cloutier (Image: Michael Chu)

Reassuring the M&A Target's Employees

—Daryl Byrd, the CEO of Iberiabank (IBKC) (Image: Michael Chu)