Congress seals deal on Dodd-Frank reforms

(Full story

Reg relief is about to pass — get ready for the spin

(Full story

Banks are sitting ducks for ADA lawsuits

(Full story

Reg relief's done. What's next for banks?

(Full story

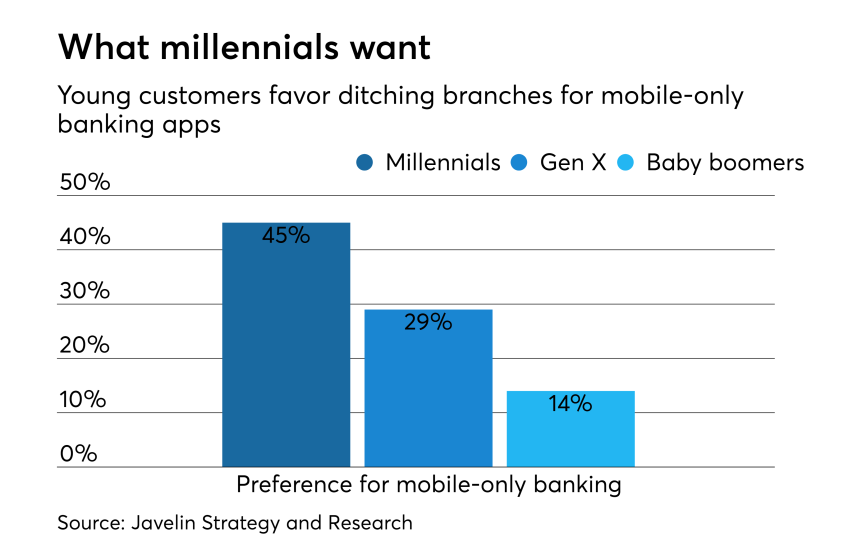

What a homegrown app for millennials has taught Wells Fargo

(Full story

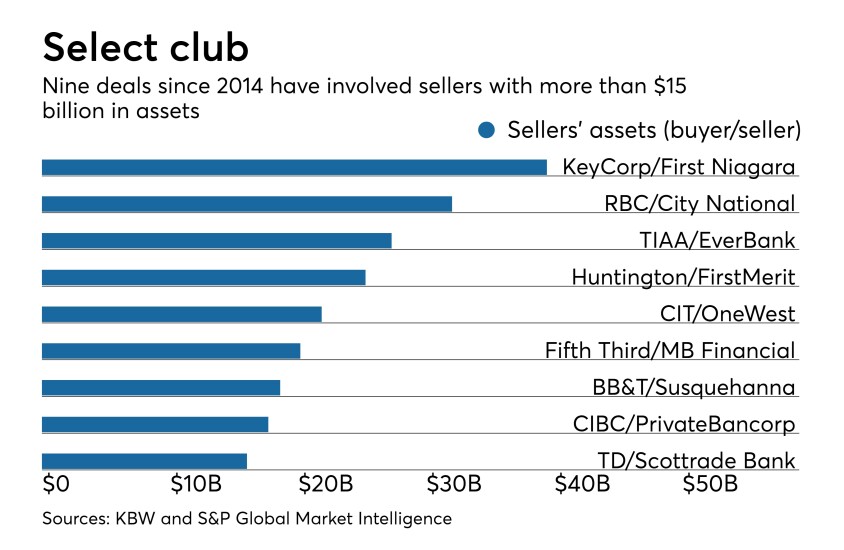

Does Fifth Third's merger math add up?

(Full story

Trump makes repeal of CFPB auto lending rule official

(Full story

HMDA measure in reg relief bill is misunderstood

(Full story

Think you've seen the Trump effect on regulation? Just wait

(Full story

OCC gives banks green light to compete with payday lenders

(Full story