The location of Fifth Third Bancorp's first bank acquisition in almost a decade is finally known — Chicago. But the big question is whether the bank, after being out of the M&A game for so long, can make the pricey deal work.

Leaders of the $142 billion-asset regional

Given the deal's nearly $5 billion price tag, management's significant cost-cutting projections and the roughly seven years it will take to earn back dilution to Fifth Third's tangible book value, it seems likely that the company will be on the M&A sidelines for the foreseeable future.

It remains to be seen if investors will ultimately embrace the deal: Fifth Third's shares were off about 8% Monday after appreciating by roughly 38% over the prior year. Execution will be closely watched, and there is little margin for error, said Chris Marinac, an analyst at FIG Partners.

“Their investor attitude was increasingly positive and you kind of sacrificed that" for the MB Financial deal, Marinac said. “Now Fifth Third has a target on its back to execute. They have to [perform] flawlessly to get investors back.”

Greg Carmichael, for his part, seems comfortable with the deal.

Carmichael, Fifth Third's chairman and CEO, said he views Chicago as an attractive market given its size and large swaths of middle-market prospects. Fifth Third has struggled to gain traction in the city, particularly with smaller middle-market firms. Adding MB Financial should help address that issue.

“Our retail franchise is one of the strongest we run in our business," Carmichael said in an interview. "What we haven’t done is go down in the middle market as [much as] we would have liked.”

Chicago is a famously competitive and fragmented market, challenging growth-minded banks for years. Despite Carmichael's optimistic assessment, Fifth Third's deposit market share around the city has fallen from 3.93% in mid-2014 to 2.84% in June 2017, according to data from the Federal Deposit Insurance Corp.

MB Financial's deposit share increased from 2.2% to 3.62% over the same period.

Competition for commercial loans is also intense. Fifth Third estimated that buying MB Financial should make it the area's second-biggest middle-market lender, largely by providing access to smaller prospects.

The city has more middle-market companies than Fifth Third’s top four Southeastern markets combined, Carmichael said. Once the deal closes, the company will bank roughly a fifth of them, he added.

It would have taken Fifth Third two years or more to build the same operation from scratch, Carmichael said. Acquiring MB Financial will allow management to focus organic growth efforts in cities such as Atlanta; Charlotte, N.C.; and Nashville, Tenn.

The acquisition makes sense because it gives Fifth Third scale in a targeted city without adding new markets, said Terry McEvoy, an analyst at Stephens. Buying a franchise in the Southeast may have added new markets where Fifth Third would have lacked scale on day one.

“Acquiring MB, which has been in business for decades with a well-known management team, is really important,” McEvoy said. “People may underestimate how important that is.”

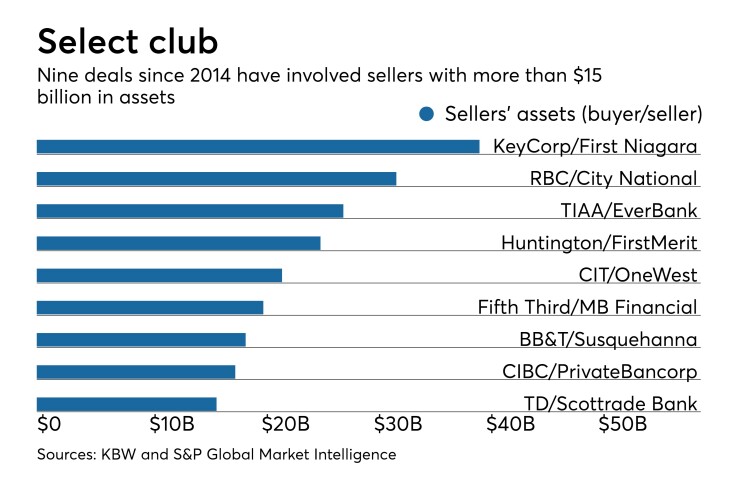

A sense of urgency may have also set in as the number of large banks in Chicago dwindled. PrivateBancorp, FirstMerit and Taylor Capital were all formidable banks in the market that have been bought in the last four years. Fifth Third, by its own admission, had no interest in a nickel-and-dime strategy in the city.

“A smaller, less-additive deal would be a distraction for a significant period of time,” Carmichael said. “There are very few that create the scale in such an attractive market. This is important to us.”

Carmichael has largely focused on improving Fifth Third’s fundamentals since becoming CEO in late 2015, and the company was working to hit certain profitability targets. The topic of M&A was discussed during its first-ever investor day in December, with Carmichael indicating that it was a possibility at the “right price.”

Retention will be an important test for Fifth Third as it closes and integrates the deal. The company has already said it plans to cut compensation costs by $159 million, adding that it will conduct a "best in breed" review when it comes to making decisions on retention.

Given Chicago’s competitive nature, it’s likely that rivals will look to aggressively poach talent during the disruption, said Brian Klock, an analyst at Keefe, Bruyette & Woods. As a result, outside pressures could influence whether management hits its targets.

“When you are expecting some of the financial benefits to be from cost saves, you're relying heavily on the people you're retaining," Klock said. "You need to pay attention to locking down the revenue producers to keep the market share you have and continue to grow it.”

Management at Fifth Third and MB Financial assured analysts during a conference call to discuss the deal that they are focused on keeping top talent.

Mitch Feiger, MB Financial's president and CEO, said retention efforts must emphasize how the transaction will help commercial lenders better serve clients by adding products and raising the legal lending limit. Feiger will become chairman and CEO of Fifth Third's Chicago region.

The $20.2 billion-asset MB Financial has experience buying and integrating in the Chicago area. It bought Taylor Capital in 2014.

“So we’ve done this a lot and the key to retaining talent isn’t about retention awards or anything of the sort,” Feiger said. “It’s about creating an environment that’s challenging in a place where they really want to work.”