10. Richard Fisher, Dallas Fed president

Although Fisher will rotate off the FOMC in 2012, he shows no signs of tamping down his rhetoric. In early December, he warned in a speech that America is headed for "social unrest" unless the U.S. can get control over its ballooning deficit. In what was clearly a critique of President Obama, Fed Chairman Ben Bernanke and just about every other policymaker in charge of economic policy, he added, "Our nation has a crying need for public leadership to correct what's wrong in the economy." (Image: Bloomberg News)

9. Tom Hoenig, nominee for FDIC Vice Chairman

It was ironic, then, when Republicans asked President Obama to nominate Hoenig as vice chairman of the FDIC, where he will now be tasked with helping the agency prepare for the next crisis (his nomination is still pending but enjoys support from both political parties). Still, most observers predict he will work well with new FDIC Chairman Marty Gruenberg and said it may be big banks, not the agency, which have reason to fear. Hoenig has loudly and consistently declared that the only way to make the system less complex is to make the banking business simpler. One way to do that? Break the big banks up. (Image: Bloomberg News)

8. Rep. Maxine Waters, D-Calif.

Waters has the edge in the race, but her potential rise is far from assured. Dogged by an ethics investigation into whether she improperly helped a struggling bank — in which her husband had a financial interest — gain Troubled Asset Relief Program funds, the case is likely to be the determining factor in whether Democrats give her the top panel job—or pass her over for another candidate. (Image: Bloomberg News)

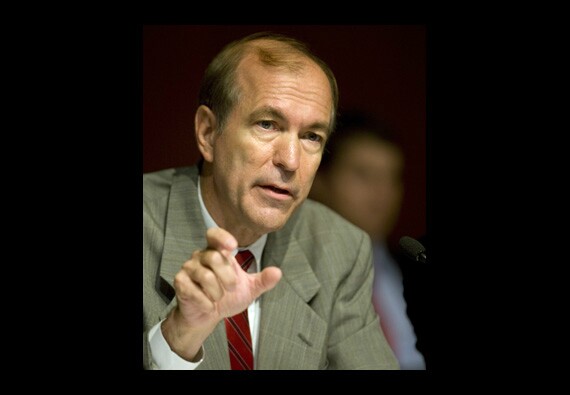

7. Rep. Scott Garrett, R-N.J.

But Garrett, the chairman of the House Financial Services subcommittee that oversees the GSEs, has not been content to let the matter lie there. The New Jersey Republican has pushed legislation to let a covered bond market flourish in the U.S. and a bill designed to help the secondary market wean its way off a government guarantee.

Rather than just offer an ideologically pure bill, however, Garrett's latter piece of legislation was a serious approach to trying to solve the problem of a secondary market without a government guarantee. While it would remove the guarantee, it would also give the Federal Housing Finance Agency more power to standardize the market — a move that angers some free-market conservatives but which industry players say is necessary.

The conventional wisdom is that nothing can happen in 2012 on GSEs. Even if he can't enact legislation, however, Garrett will at least be trying to move the debate forward. (Image: Bloomberg News)

6. Daniel Tarullo, Federal Reserve Board Governor

More importantly, however, Tarullo has also signaled that regulators will revisit the proposed liquidity guidelines. While they earned virtually no mainstream media attention, many bankers consider the proposal issued by international regulators to be virtually unworkable. Tarullo has said the U.S. agencies are willing to take another look at the plan — and he is likely to be one of the key players in how it shapes up. (Image: Bloomberg News)

5. Tom Curry, nominee for Comptroller of the Currency

The chief question is whether Curry, a former state commissioner, will embrace the OCC's interpretation of preemption after the Dodd-Frank Act once he is confirmed. The OCC says the regulatory reform law didn't really change preemption — a position the Obama administration has loudly criticized. What does Curry think? It's anybody's guess, but 2012 is the year we will probably start to have a clue. (Image: Bloomberg News)

4. Sen. Richard Shelby, R-Ala.

Yet it seems unlikely Shelby will cave, either. Despite immense pressure from the president himself, the Republicans appear to be mostly united behind Shelby. Whether that stays true is tough to say as the issue may take on new importance during the presidential campaign next year. (Image: Bloomberg News)

3. Raj Date, the de-facto head of the CFPB

Despite all the angst over the new consumer agency, both Warren and Date have proved remarkably even-keeled in guiding the CFPB's first year. It has focused on building up its staff, tackling consumer complaints and improving disclosures—not exactly the kinds of radical things that generally draw much criticism. But CFPB remains a lightning rod to critics of Dodd-Frank—and Date the man who must face them. (Image: Bloomberg News)

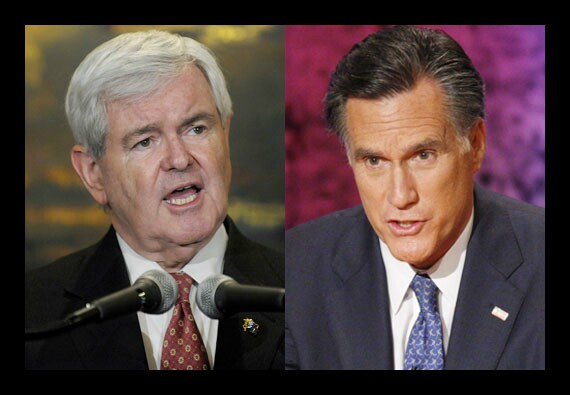

2. Newt Gingrich/Mitt Romney, Republican presidential candidates

1. President Barack Obama

He may also try new initiatives designed to reinforce his pro-consumer bona fides. Going after banks, at least these days, is an easy way to put points on the political scoreboard. (Image: Bloomberg News)