Richard Fisher, president of the Federal Reserve Bank of Dallas

Sen. Richard Shelby, R-Ala., objecting to a proposed settlement with mortgage servicers

Kenneth Cuccinelli, Virginia's attorney general, along with three other state AGs objecting to a proposed servicer settlement deal

Kevin Kabat, CEO of Fifth Third Bancorp

Rep. Maxine Waters, D-Calif.

Mariner Kemper, CEO of UMB Financial Corp.

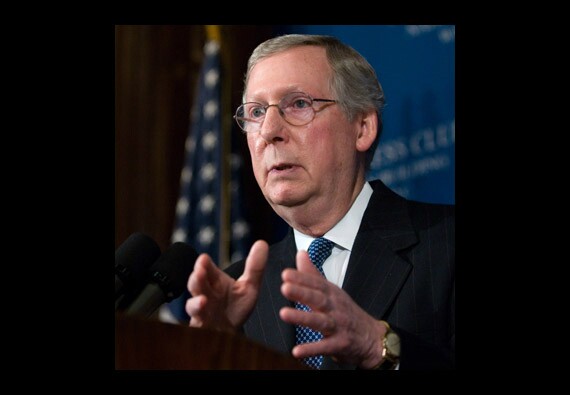

Sen. Mitch McConnell, R-Neb., Senate minority leader, on Senate GOP refusal to confirm any CFPB director without structural changes to the agency

Sheila Bair, former FDIC chairman

John Walsh, acting Comptroller of the Currency

Rep. Patrick McHenry, R-N.C., chairman, House Oversight Subcommittee on Tarp, Financial Services and Bailouts of Public and Private Programs, on Elizabeth Warren's testimony in front of his panel

Meredith Whitney, CEO of Meredith Whitney Advisory Group

Thomas Hoenig, former president of the Federal Reserve Bank of Kansas City, on whether Dodd-Frank made the system safer

Camden Fine, president and CEO of the Independent Community Bankers of America, on DOJ pursuit of certain fair-lending cases

Neil Barofsky, former special inspector general for the Troubled Asset Relief Program, and now a fellow at New York University's law school, on the slide in B of A's stock price

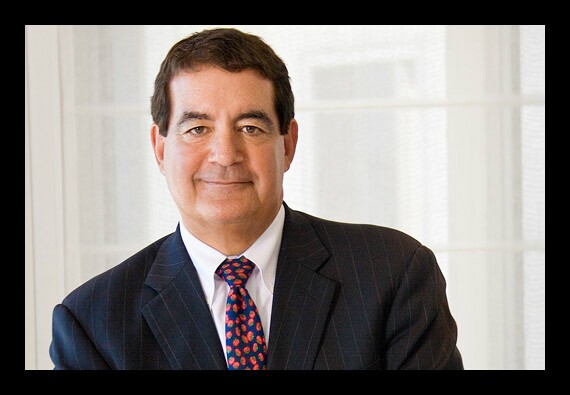

Bill Isaac, former FDIC chairman