JPMorgan Chase CEO Jamie Dimon

Is Wall Street too close to its regulator? The focus on JPMorgan Chase & Co.'s big loss is

Dallas Fed President Richard Fisher

The idea of "breaking up" banks "sounds violent" to Dallas Fed President Richard Fisher, but he told American Banker in a

Richard Cordray, head of the CFPB

The Consumer Financial Protection Bureau continued adding to the regulation mill this week, first publishing a notice on plans to

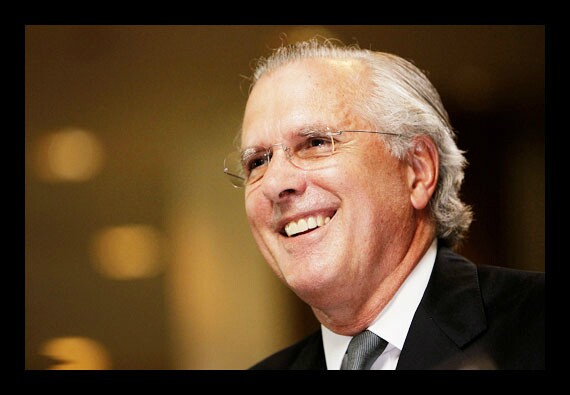

American Banker Editor At Large Barbara Rehm

Editor at large Barbara A. Rehm called out the Office of the Comptroller of the Currency for

Sen. Bob Corker

Senators, including Republican Bob Corker, seemed willing to consider

Martin Gruenberg, head of the FDIC

The small lending decline for the industry in the first three months of 2012 is not enough to make any long-term projections, said FDIC head Martin Gruenberg