Wells Fargo's latest problems go beyond potential $1 billion fine

(Full story

Ally's auto finance chief to depart, triggering series of moves

(Full story

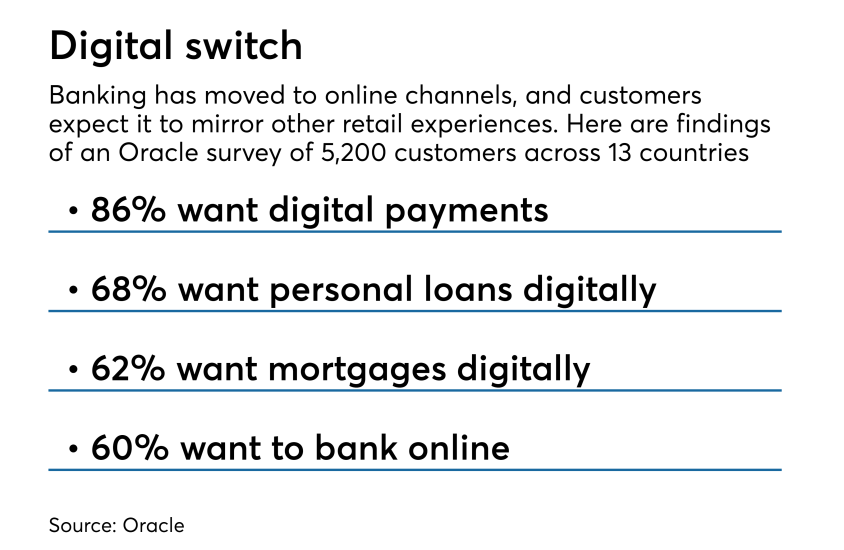

Adjusting to new digital demands goes beyond technology

(Full story

Goldman finally reveals more of its big plans for consumer banking

(Full story

This fintech partnership could serve as template for small banks

(Full story

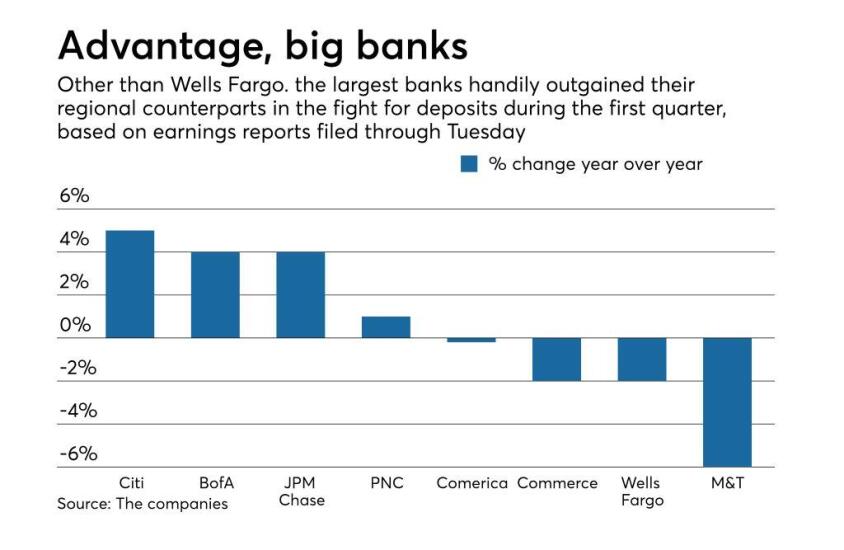

Regionals outflanked by big banks in battle for deposits

(Full story

The news of the data breach cast a shadow over relatively strong first-quarter earnings for the Atlanta bank.

(Full story

'Don't let the bastards get you down': Cam Fine says goodbye to D.C.

(Full story

Large U.S. banks scramble to meet EU data privacy rules

(Full story

Who needs branches? More small banks open accounts online

(Full story