First Out of the Gate Stumbles

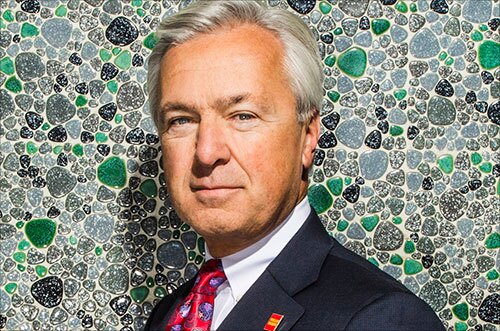

Wells Underwhelms

B of A's Bright Spots

Citi Avoids Foreign Entanglements

Goldman, Morgan Stanley Fall Flat

Regionals Rev Up Revenue

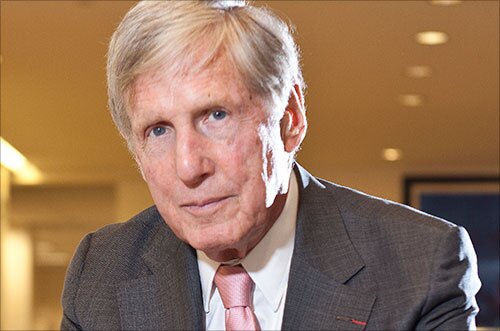

PNC Sits on Its Hands

To Buy or Not to Buy

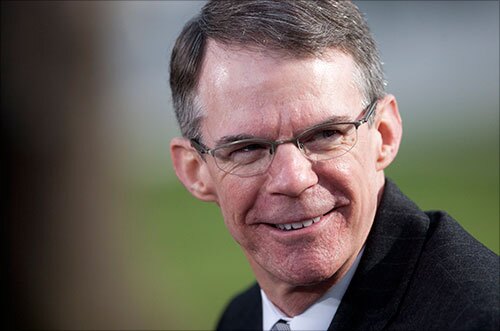

KeyCorp Staffs Up

M&T Misses, But Help Is On the Way

Regions' Energy Jitters

Zions Dodges Oil Slick