-

It's hard to decide which is more surprising: that the largest U.S. bank has almost abandoned the business of making home loans insured by the Federal Housing Administration, that lots of big banks could be right behind it, or that the FHA might not even need to care.

September 28 -

Marianne Lake has become more prominent at the nation's largest bank, emerging as the voice in discussing its performance and defending its size.

September 22 - North Carolina

Brian Moynihan, Bank of America's chairman and CEO, told investors Thursday that revenue from fixed-income and equity markets should decline by 5% to 6% in the third quarter compared with a year ago. The Charlotte, N.C., bank will continue to have a higher efficiency ratio relative to its peers because of the high costs of paying financial advisers.

September 17 -

The third quarter ends in two weeks, and top executives at Citigroup, Wells Fargo, and two regional banks are raising concerns about cost pressures, impediments to revenue growth and heightened lending risks.

September 16 -

Banks better get ready for a quick, steep increase in deposit costs after the Fed raises rates. Technology, new regulations and other factors have changed the slower-paced retail-banking game of old, JPMorgan Chase executives say.

July 14

JPMorgan Chase kicked off bank earnings season by raising lots of questions about its growth prospects — and everybody else's.

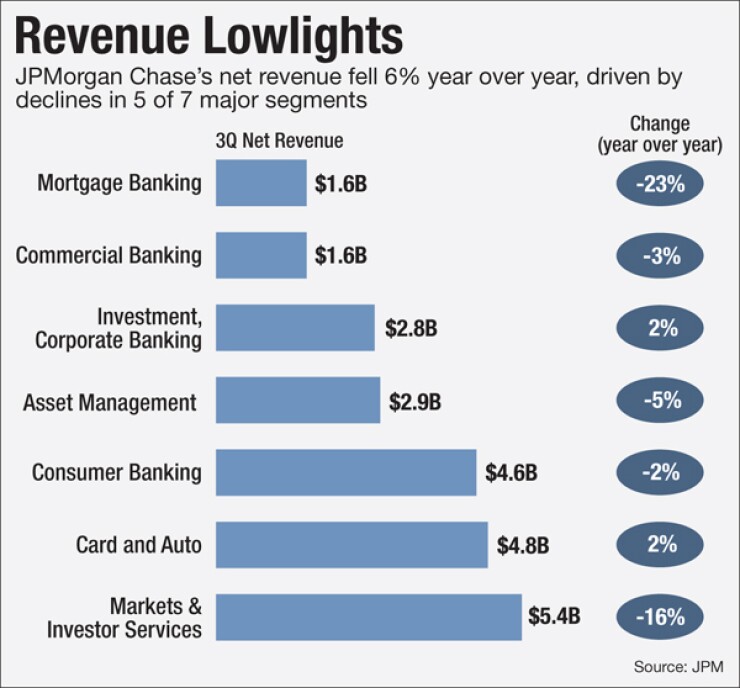

Net revenue fell 6.4% in the third quarter compared with a year earlier, and it wasn't just because trading was choppy. Net interest income contracted, mortgage banking fees plummeted, and slowdowns occurred in consumer operations, commercial banking and asset management.

Even strong third-quarter loan growth of 9% was mitigated by still-tight margins. A warning about JPMorgan's fourth-quarter earnings estimates, and new concerns about the economy, only heightened concerns about the industry's strength with more big banks scheduled to report this week.

"Analysts' [fourth-quarter] estimates appear high," cautioned Marianne Lake, JPMorgan Chase's chief financial officer, citing ongoing volatility in trading revenue.

Certainly the Fed's decision to take a pass on raising interest rates so far this year has made it difficult for big banks to generate much momentum, and now there is chatter about the possibility of a recession.

In one exchange during JPMorgan's earnings conference call, Mike Mayo, an analyst at CLSA, tried to draw JPMorgan Chairman and CEO Jamie Dimon into a discussion about the U.S. economy, but Dimon let Lake take the lead.

"We would say the U.S. economy is doing pretty well," Lake said reassuringly. "We're seeing good demand for loans in the consumer space and reasonably good sentiment in the business-banking space, and our core loan-growth numbers do show that. There's nothing particularly bumpy in the loan-growth numbers."

Lake also said she had a "different perspective" on the disappointing monthly jobs report released by the Labor Department this month that fueled economic concerns.

"While [the jobs report] was somewhat lower than people were expecting or possibly hoping for, it's still at around 140,000 [jobs created in September], almost two times what would be required to have stable unemployment," she said. "You can't overreact to it. It's not that we're seeing anything that's causing us any concern in our outlook for the fourth quarter; it [was] pretty solid, I think."

To be sure, JPMorgan was able to produce robust profits. The bank reported a 22% jump in third-quarter earnings to $6.8 billion, or $1.68 a share, compared with $5.57 billion, or $1.35 a share, in the same period a year earlier. JPMorgan earned $1.32 a share excluding $2.2 billion of tax benefits and other one-time items. A consensus of analysts surveyed by Bloomberg had expected earnings of $1.38 a share.

Some of the profit improvement has come from cost reductions; JPMorgan said it had cut 10,000 employees through Sept. 30.

Total loans were $809.5 billion, 9% higher than a year earlier. But the yield on interest-earning assets dipped to 2.16% in the third quarter, compared with 2.19% a year earlier. The bank expects core loan growth of 15% in the fourth quarter.

JPMorgan took the biggest hit in the quarter to its markets and investor services business line, where revenue fell 16% to $5.4 billion. But Lake emphasized that despite the drop in trading volume, the bank was still able to capitalize on market volatility.

"Look, the situation for us in markets was one where there was volatility regardless of how you want to characterize it and people were acting — our clients were acting on the back of that. We were able to capitalize on that flow," she said. "[It was] more about low levels of activity, people on the sidelines. It was tougher to make money because less was happening rather than anything else more significant than that. So far in the fourth quarter we're two weeks in, it's too early to say, but there's not been a tremendous change in the landscape."

Mortgage banking also took a hit. Though net income rose 29% in the third quarter to $602 million, net revenue fell 23% to $1.6 billion due to lower servicing revenue. Margins were down primarily because of the shift in the mix from refinance activity to home purchases, and from retail loan originations to correspondent lending.

The bank expects noninterest revenue for mortgages to be down $250 million year over year, Lake told analysts, bringing total net interest revenue down by roughly $1 billion.

In other areas, Lake said competition remains fierce in credit cards. JPMorgan announced the renewal of two key credit card partners, United Airlines and Southwest Airlines. Lake said she expects the revenue rate for credit cards to fall to 11.75% in the fourth quarter from 12.2% in the third quarter.

A few analysts questioned how the bank re-evaluates its oil-and-gas lending portfolio. Dimon, who responded to only a few questions from analysts, pledged to stick by energy customers.

"That's what we're here for, to lend to clients in particularly rough times," Dimon said. "You can't be a bank that every time something goes wrong you run away from your client. We also do things to stress-test down to $30 oil. … If that happened, we think we're going to have to put another $500 million or $750 million in reserves. [It's] just not something we worry a lot about."