-

Bankers said legislative fixes to the small-business rescue program should help more borrowers secure loan forgiveness, though new demand will likely remain tepid because the process is still extremely cumbersome.

June 5 -

Bankers have become more uncertain about how to serve marijuana businesses owing to confusion about which states deem them essential.

June 4 FS Vector

FS Vector -

Representatives of lenders as well as businesses that received pandemic bailout money told an oversight board Wednesday that delayed and confusing instructions from the government hampered the effectiveness of the main rescue program for smaller companies.

June 4 -

The demonstrations following George Floyd's death in police custody are forcing the industry to grapple with how it can — or if it should —advocate for equality and better race relations.

June 4 -

The bill, which passed the House last week on a 471-1 vote, now heads to President Trump’s desk for his signature.

June 3 -

The changes being sought would benefit both small businesses and banks, which would avoid the cost of servicing many low-yielding loans.

June 2 -

Bankers spent Monday cleaning up damaged branches, wondering if their small-business clients will need more emergency aid and contemplating how the racial and economic inequalities highlighted by days of violent protests nationwide can be corrected.

June 1 -

The Federal Reserve set up a liquidity facility to help banks meet demand for emergency small-business loans through the Paycheck Protection Program, but it's gone largely unused.

June 1 -

The agency is trying to get small lenders to help underserved businesses get the loans; although the British government is guaranteeing small-business loans, banks are required to collect on delinquents.

June 1 -

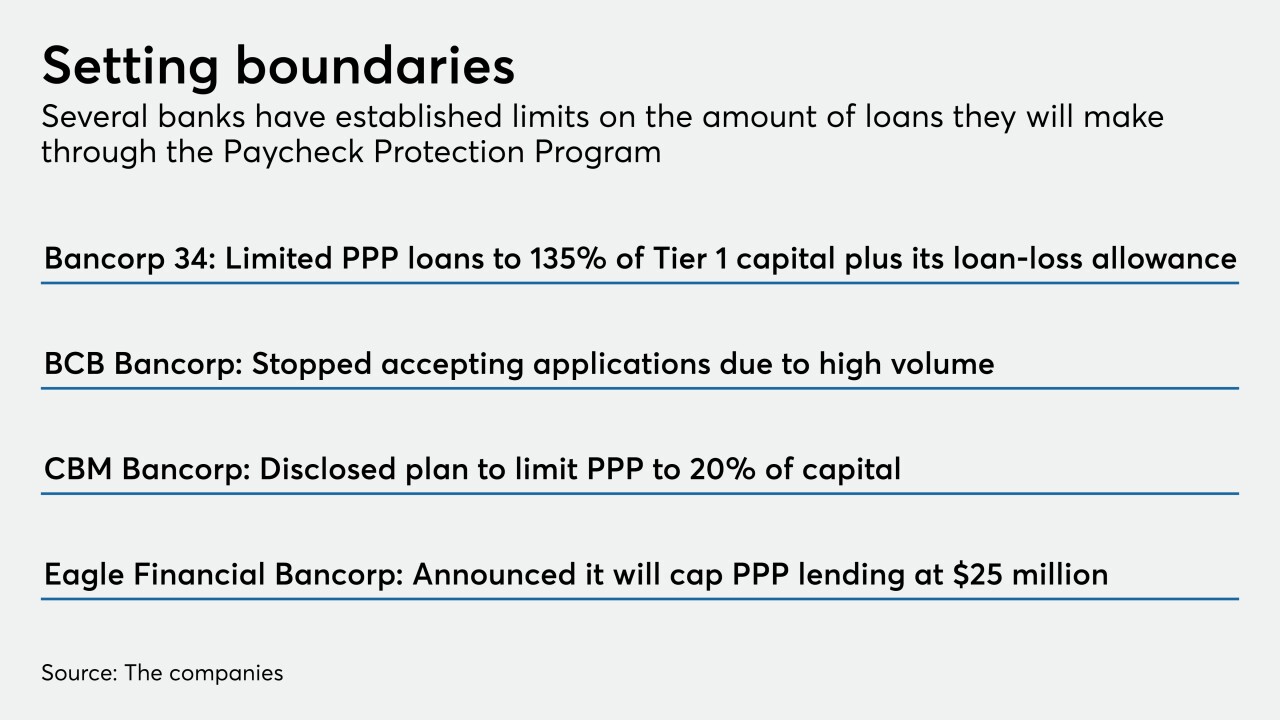

Many lenders are paying close attention to liquidity and capital ratios. Others are trying to avoid overtaxing employees who process, service and handle forgiveness of the loans.

May 29