-

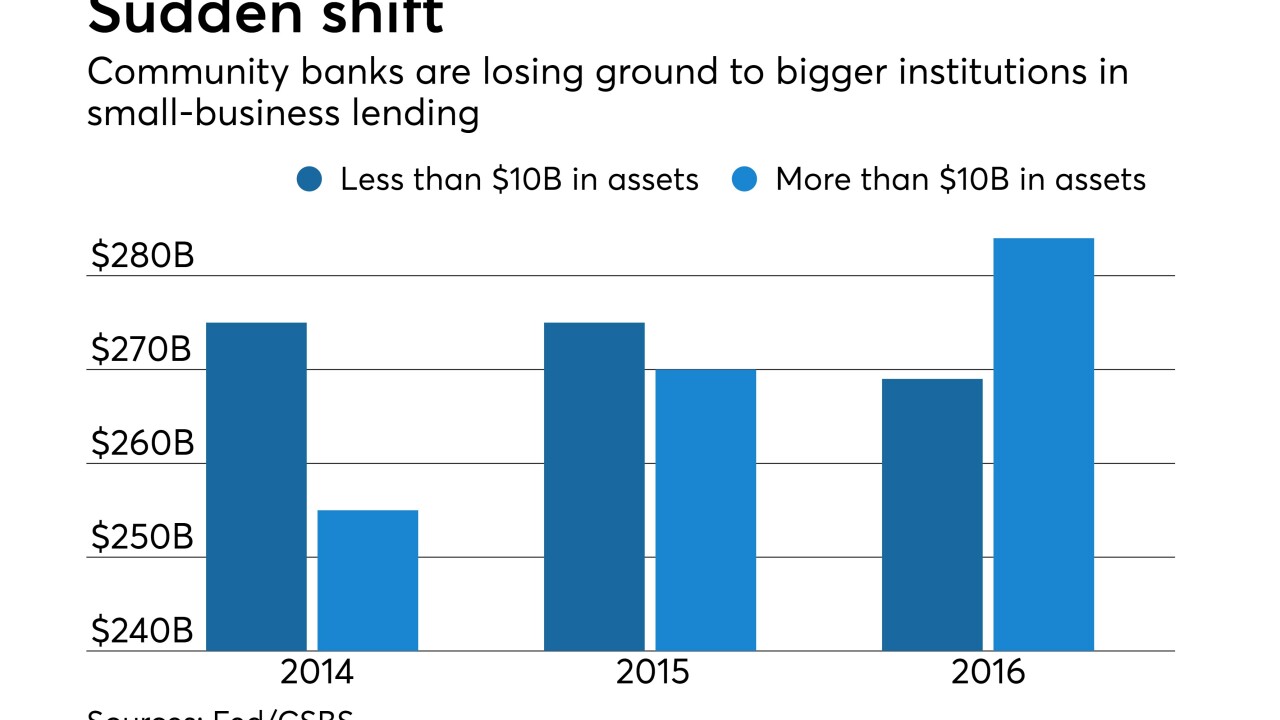

Bigger rivals are making inroads into small banks' bread-and-butter business line, yet the leaders of three community banks say they just need to keep doing what they do best — personal service — but work harder at it and incorporate new technology.

December 6 -

Women are not only less likely to be approved for loans than men, they are less inclined to apply for loans in the first place. Among the reasons: aversion to debt and fear of rejection, according to a new report.

December 6 -

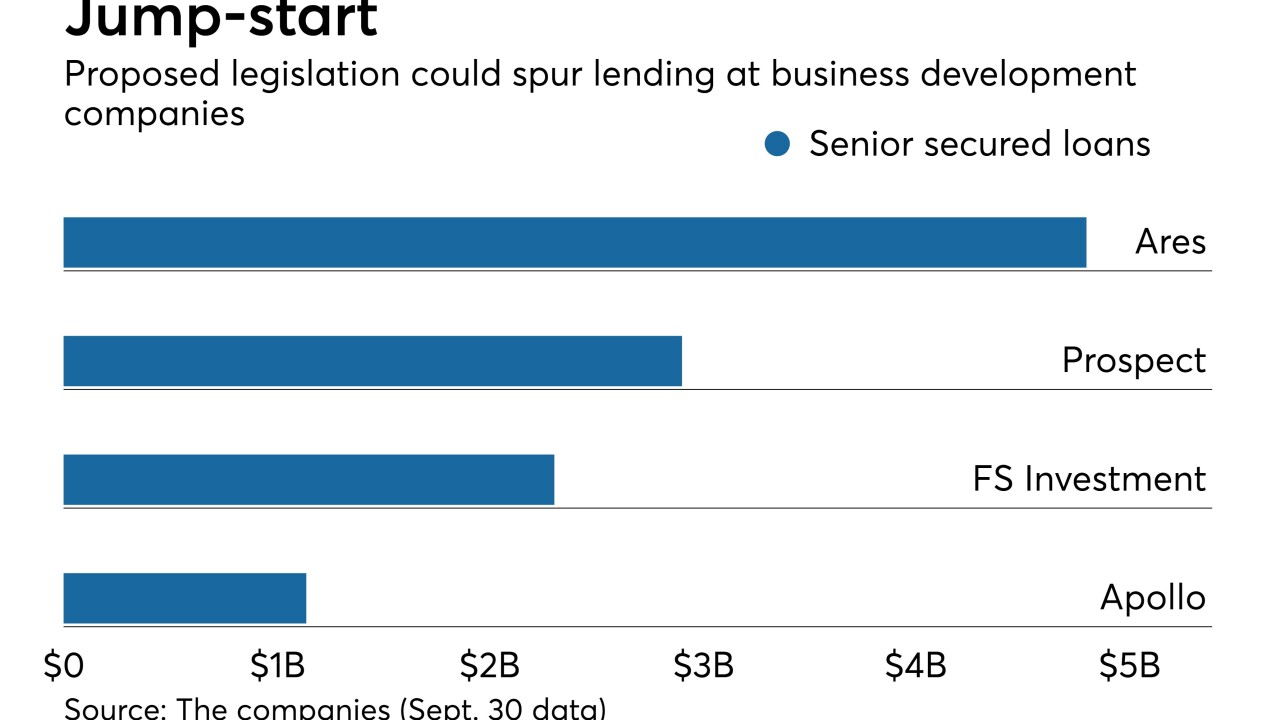

The Small Business Credit Availability Act aims to double the debt-to-equity ratio for business development companies. Increased leverage could spur more lending to small and midsize borrowers.

December 4 -

The pilot could help the agency improve its image after past criticism of slow responses to catastrophes.

November 28 -

Experts in digital lending share useful insights into the potential opportunities and pitfalls, covering everything from mortgages to small business.

November 15 -

Pat Hickman, CEO of Happy State Bank, wants his institution to remain viable in the face of stifling regulation. As for selling? That'll happen over his dead body, he says.

November 9 -

Amid the rise of online lending earlier this decade, banks were derided as being too slow to adapt. But over time it's become clear that banks hold key advantages over lending startups.

November 6 -

Capital Corps, led by Steven Sugarman, aims to provide financing to homeowners and small businesses that it believes are overlooked by banks. The firm features several former Banc of California executives.

November 6 -

The customer interface is just the tip of the iceberg in fintech, says Wells Fargo's Secil Watson. Plus, the tech trends in business banking, a power shift on sexual harassment as women support each other, and Michelle Obama's advice on raising boys.

November 2

-

Call-report data on commercial and industrial loans does not fully capture small-business lending by smaller institutions, a recent FDIC survey suggests.

November 1