-

Hal Schroeder of FASB claims that investors have no confidence in the current loss standard. Several investors at a prominent accounting conference disagree.

September 10 -

When lawmakers return from their August recess, a host of unresolved financial policy issues — from marijuana banking to anti-money-laundering rule — will greet them.

August 26 -

Readers react to states investigating payroll advance companies and the GOP's weak response to cannabis banking, heed a warning that nonbanks are prepared for CECL and more.

August 15 -

The accounting standard is coming regardless of a delay. It will bring some nonbank lenders to the forefront of banking competition.

August 15 Moody’s Analytics

Moody’s Analytics -

The CEO's tenure lasted just 18 months; the former FDIC chair says having Congress more involved in setting accounting standards "could well backfire on the banks."

August 5 -

JPMorgan Chase ends business loan partnership with OnDeck; Truist out to prove it can best the megabanks in tech; Capital One's data breach was bad, but it could've been worse; and more from this week's most-read stories.

August 2 -

Readers react to Capital One's massive data breach and The Bancorp's expansion in CRE securitizations, defend fintechs offering retirement plans and more.

August 1 -

Among other things, the letter asked the regulators to ease requirements for a new community bank leverage ratio and analyze the impact of the pending CECL accounting change.

July 30 -

The new accounting standard meant for publicly traded firms creates greater headaches for privately held community banks.

July 29 Bank of St. Elizabeth

Bank of St. Elizabeth -

Regulators should proceed with removing one of the margin requirements for trading swaps.

July 26

-

FASB may have voted to delay its controversial new credit loss standard, but credit unions who use that delay as an excuse to further procrastinate are setting themselves up for failure.

July 23 Experian

Experian -

A court ruling deals a blow to efforts by HUD to restrict nonprofit housing funds from operating on a national scale; most banks get another year to implement CECL; PNC chief William Demchak plans to enter more markets and more from this week’s most-read stories.

July 19 -

Readers react to House lawmakers attempting to overhaul the credit bureaus, express sarcasm to the Senate Banking Committee eyeing cannabis banking, criticize Sen. Elizabeth Warren's plans to overhaul Wall Street and more.

July 18 -

The company will work on Libra, but won’t issue digital currency without proper authority; the bank’s profit dropped 8% on reduced revenue.

July 18 -

After FASB's decision to give most credit unions and banks extra time to prepare, lobbying groups are pushing for more.

July 18 -

After FASB's decision to give most banks extra time to prepare, lobbying groups are pushing for more.

July 17 -

The decision gives the vast majority of banks and credit unions another year to implement the controversial accounting method for loan losses.

July 17 -

Credit unions could have an answer about when a new credit loss standard will take effect, while the National Credit Union Administration will hold its monthly board meeting this week.

July 15 -

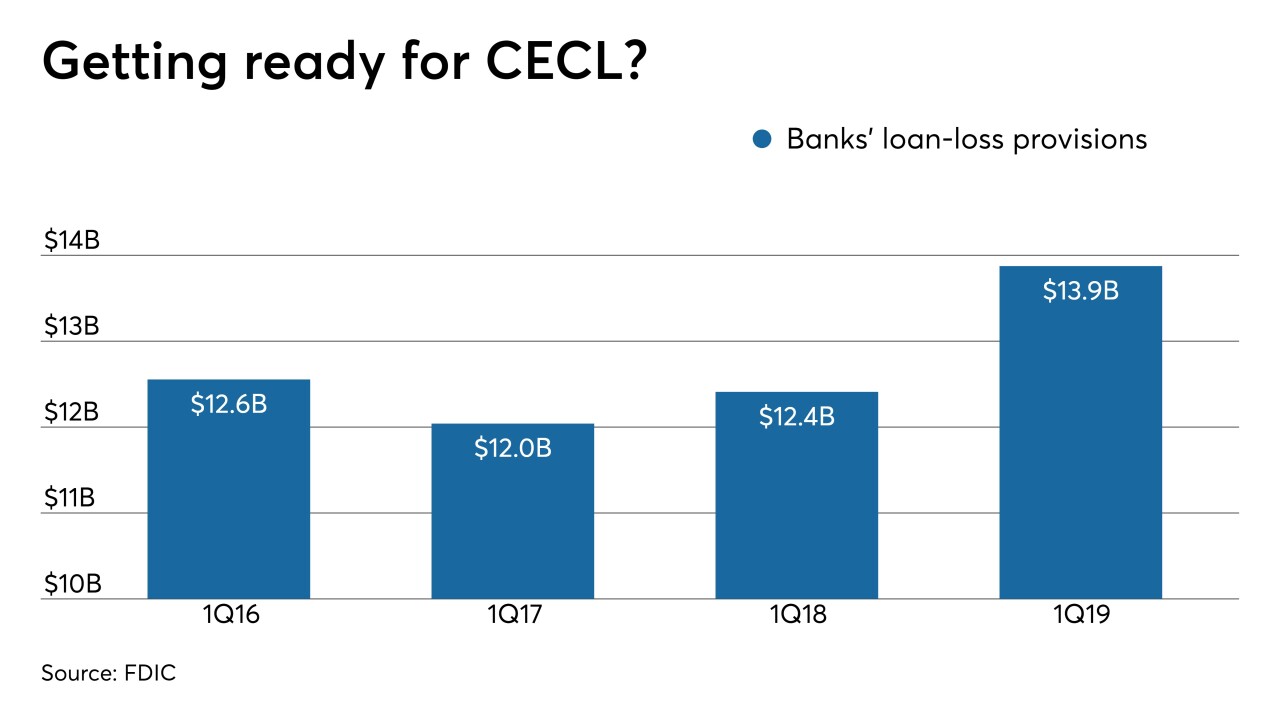

Beginning next year, banks will have to dramatically change the way they account for future credit losses, but experts disagree on the new rule's long-term impact.

July 11 -

Questioning whether core-banking technology is nearing a 'big shake-up'; Capital One keeps closing branches, even as rivals open them; FASB chair defends CECL, saying 'the benefits justify the cost'; and more from this week's most-read stories.

July 5