-

The head of the Senate Banking Committee invited the housing secretary to Idaho to discuss low-income housing shortages.

August 9 -

The Department of Housing and Urban Development approved a settlement in favor of the California Reinvestment Coalition against CIT Group's OneWest Bank, which Steven Mnuchin ran before he became Treasury secretary.

July 29 -

The ruling deals a blow to efforts by the Department of Housing and Urban Development to restrict nonprofit housing funds from operating on a national scale.

July 17 -

Many oppose a metric-based approach, but there are ways it could actually work.

July 12 Cato Institute

Cato Institute -

The central bank has a long history of fighting reforms to the Community Reinvestment Act, until now.

July 11 K.H. Thomas Associates

K.H. Thomas Associates -

The chamber passed a bill that would clarify how certain loans backed by the Department of Veterans Affairs are securitized, and legislation encouraging first-time homebuyers to participate in counseling programs.

July 10 -

As policymakers mull ways to update the 42-year-old Community Reinvestment Act, economists at the San Francisco Fed have put forth a novel proposal.

July 2 -

The president signed an executive order Tuesday establishing a White House council dedicated to examining regulatory barriers to affordable housing.

June 25 -

The bipartisan proposal aims to renew banks' interest in low-income housing tax credits and bring more lower-priced homes to markets that badly need them.

June 18 -

New York's sweeping rewrite of rent stabilization laws could pose a credit risk to lenders that finance capital improvements to regulated apartment properties, according to a report Monday by Fitch Ratings.

June 17 -

Readers weigh potential risks in the leveraged loans market, debate Herb Sandler's legacy, consider the role the Fed should play in real-time payments and more.

June 6 -

The merging banks, whose new headquarters would be Charlotte, N.C., will each double their charitable giving over the next three years in Atlanta and Winston-Salem, N.C.

June 5 -

The bank has hired Brandee McHale away from Citigroup to head its charitable foundation and implement a new strategy that will place a greater emphasis on rental housing and combating homelessness.

June 5 -

The head of Fannie Mae and Freddie Mac’s regulator blamed “burdensome” local regulations for a lack of housing supply, and also provided an update on the administration’s plan for GSE reform.

June 3 -

Wells Fargo is in negotiations to settle a U.S. probe into procurement of low-income housing tax credits as its top lawyer tries to clean up issues before handing off the chief executive officer role.

May 31 -

At a time when costs continue to soar and regulators weigh reforms for Fannie Mae and Freddie Mac, more than half of the Democratic presidential candidates have talked about housing on the campaign trail.

May 22 -

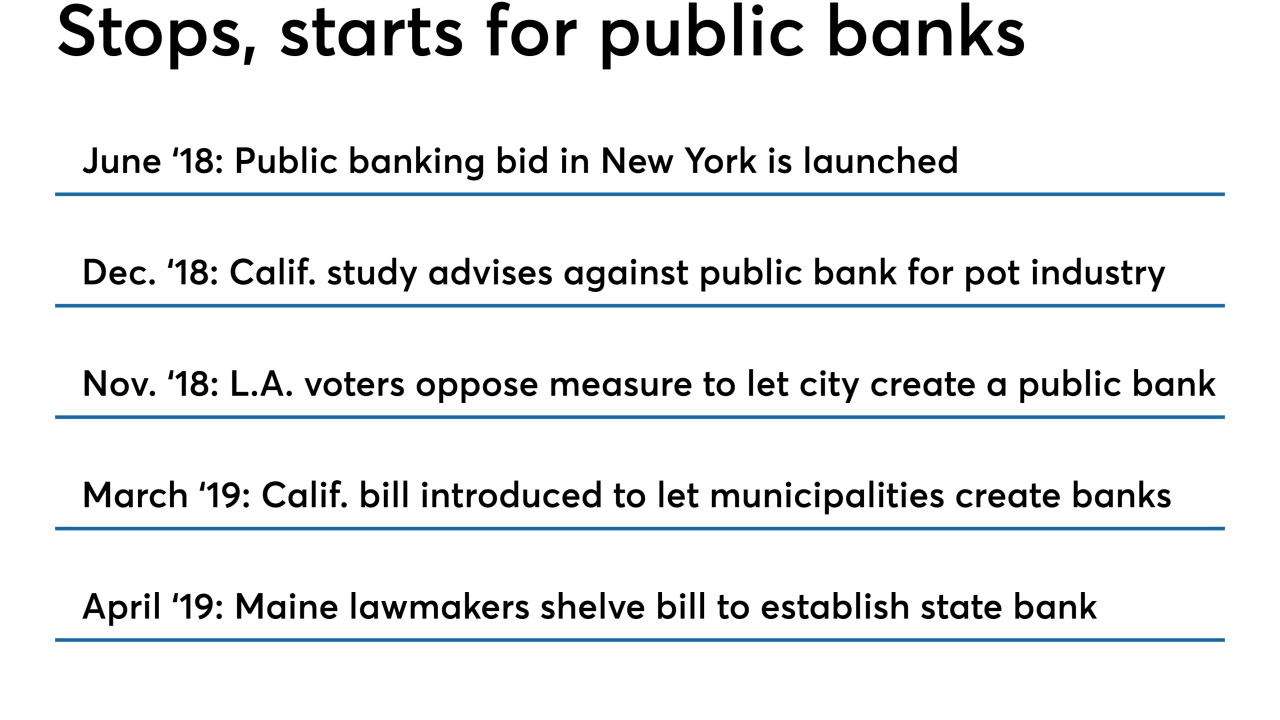

Undeterred by setbacks in other cities, a broad coalition of community groups is seizing on popular mistrust of traditional banks to press the case for a city-owned bank.

May 17 -

Housing advocates and Democratic lawmakers want to create more protections for tenants of rent-controlled apartments, but they are facing stiff opposition from property owners and the banks that lend to them.

May 10 -

Two nonprofits threatened by the effort say the Department of Housing and Urban Development tried to avoid scrutiny last month when it announced the new policy outside the formal rulemaking process.

May 6 -

The two banks’ CEOs used a public hearing to argue their merger will be a boon for underserved markets. But other speakers warned that bank consolidation hurts communities.

April 25