-

The Democratic congresswoman said the department under Secretary Ben Carson has turned "its back on its mission."

June 27 -

Instead of shrinking the GSEs, the housing regulator is letting them expand into a host of new products and programs.

June 27 American Enterprise Institute

American Enterprise Institute -

The groups applauded a proposal to establish minimum GSE capital requirements, but called for more immediate steps to release the companies from conservatorship.

June 19 -

The dominant player in manufactured housing lauded the Trump administration's review of construction standards, but other commenters worry the plan will undermine housing quality.

April 3 -

Lawmakers approved a measure to increase the program's funding by nearly $3 billion over four years.

March 26 -

The Federal Home Loan banks could "design and implement" their own system for deciding how to allocate resources for affordable housing initiatives under the proposal by the Federal Housing Finance Agency.

March 6 -

Banking and affordable housing advocates are encouraged by a provision in the tax reform legislation that could increase investment in underserved communities by allowing investors to defer capital gains taxes when they reinvest in federally chartered Opportunity Funds.

March 6 -

Since stepping down as CEO of Webster Bank last month, James Smith has spent much of his time co-chairing a panel tasked with solving his home state’s fiscal and economic woes. Banks, and perhaps even fintechs, could be a part of its comeback story, he says.

February 26 -

The House Financial Services Committee chairman is calling out Fannie Mae and Freddie Mac's regulator for authorizing payments to two housing trust funds while the mortgage giants have their own financial struggles.

February 16 -

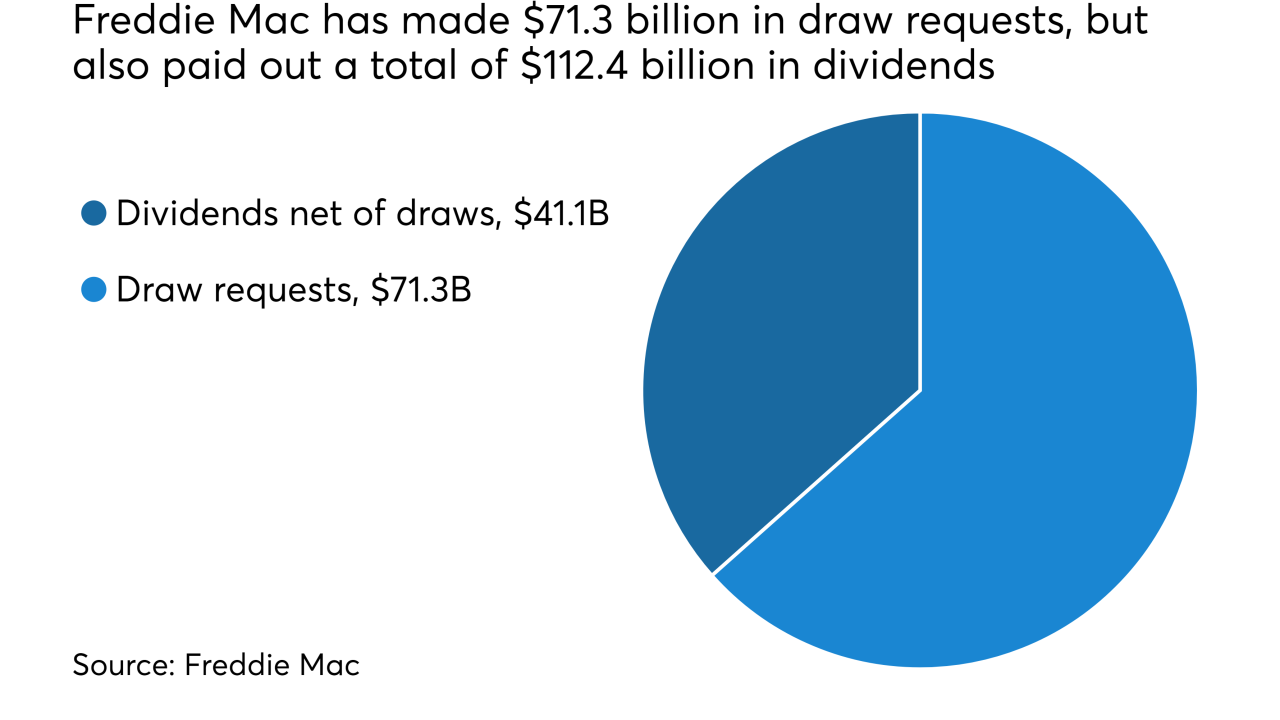

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15