-

Despite a legislative push by some senators and other stakeholders to jump-start housing finance reform, efforts to form consensus over a bill once again are stuck in neutral.

February 15 -

Supporters of an unreleased bill to revamp the housing finance system say the plan strikes a middle ground that can gain support from both sides of the aisle.

January 24 -

Craig Phillips, a top aide to Treasury Secretary Steven Mnuchin, said his department "broadly" agrees with the FHFA plan, which would return Fannie Mae and Freddie Mac to the private market and provide them an explicit government guarantee.

January 18 -

The tax law is expected to eliminate 300,000 affordable housing units over 10 years in part because it will reduce the value of banks’ low-income tax credits, which finance half of all affordable housing units.

January 3 -

For decades, Fannie Mae and Freddie Mac helped working-class Americans get mortgages. That essential and powerful role in the national economy is fading.

December 15 National Community Reinvestment Coalition

National Community Reinvestment Coalition -

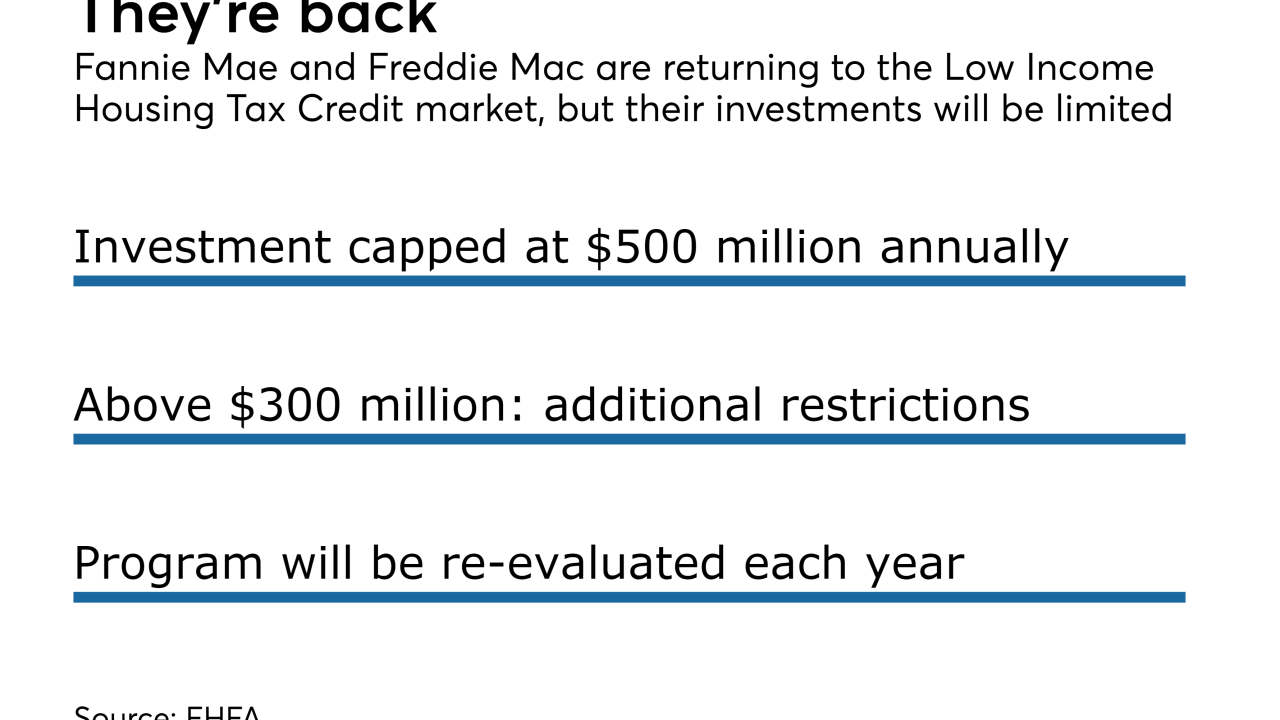

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Housing advocates are pressing Senate Republicans to expand the low-income housing tax credit program while pushing back against a House GOP plan that would eliminate financing for half of all affordable housing units.

November 14 -

In light of the recent disbursement of nearly $40 million in grants to credit unions from The Treasury Department’s Community Development Financial Institutions Fund, Credit Union Journal surveyed some credit unions which have received CDFI grants in the past to find out how these funds are being used.

September 26 -

The prospect of a lower corporate rate resulting from looming tax reform discussions may be a blessing for the industry, but it could be bittersweet for one particular group of bankers.

August 3 Situs

Situs -

While Freddie Mac is moving cautiously into buying manufactured housing loans not secured by land, Fannie Mae is moving more aggressively. Industry representatives are divided on which approach is superior.

July 24