-

It will take years to fully complete the project, but Mastercard has announced the availability of real-time account-to-account corporate payments for U.S. firms through its Mastercard Track Business Payment Service (BPS), with plans to add cross-border payments next year.

November 16 -

Even given the huge jump in digital transactions from e-commerce, card brands are holding out for COVID-19 vaccines as a path out of the payment declines that have accompanied 2020’s health and economic crises.

November 11 -

As the pandemic transforms the way corporations pay suppliers, many banks are watching nimble fintechs rush in with streamlined solutions customized for remote workforces. U.S. Bank didn’t want to risk getting cut out of that equation.

November 10 -

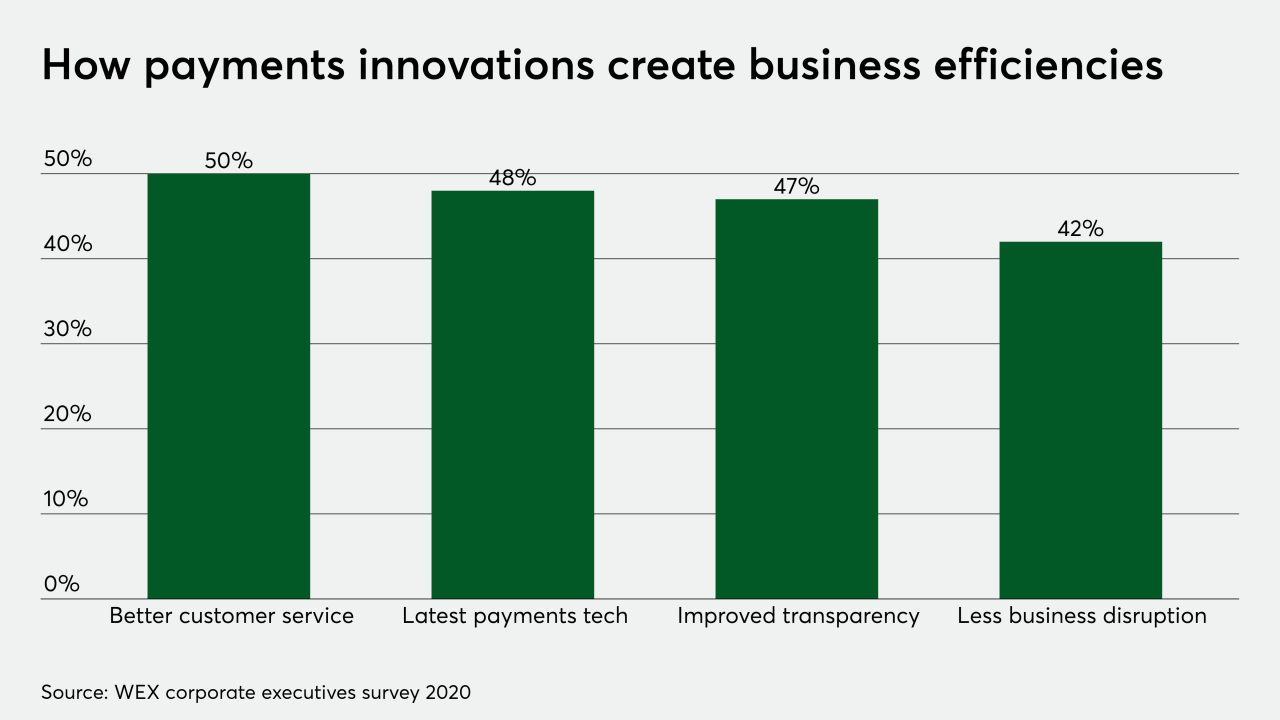

While we can’t know what the post COVID-19 landscape will look like, we do know that business expenses will ramp back up, and with them, higher expectations for digital payments from both suppliers and vendors, says Wex's Jay Dearborn.

November 9 Wex

Wex -

The person-to-person network is being used more often for purchasing, with consumer payments to small businesses up sharply.

November 2 -

Even as consumers shift more spending away from cash and the market for personal travel picks up, the coronavirus pandemic is still exerting a heavy toll on Mastercard's consumer and corporate spending.

October 28 -

Global expansion is challenging even under the best of circumstances – but payments don’t have to be, says Rapyd's Eric Rosenthal.

October 28 Rapyd

Rapyd -

Artificial intelligence technology captures invoice data in any format and from any source, creating opportunities for myriad benefits in the organization, says Kofax's Michelle Trapani.

October 27 Kofax

Kofax -

A California startup and a century-old Missouri bank, which began using The ClearingHouse's real-time payments network this summer, say businesses have embraced the technology to pay suppliers and gig-economy workers and quickly close real estate deals.

October 26 -

Two smaller banks with strikingly different roots — a startup financial institution in Irvine, Calif., and a century-old Missouri-based bank — are seeing similar trends emerge around demand for real-time payments.

October 26