-

Credit card networks and issuers have done a poor job in explaining the implications of the just-passed Oct. 1 deadline for moving to EMV chip-and-PIN cards, leaving many small businesses confused, lawmakers said Wednesday during a hearing on Capitol Hill.

October 7 -

Many bank executives share a vision of revamped branches stocked with tablets for sales and service purposes, according to a new report. But first, institutions must overcome numerous IT obstacles.

October 7 -

Robo-advisers have myriad conflicts of interest and fall short of the standard of care under fiduciary investment law. The Labor Department's endorsement of these algorithmic investment guides seems curious and misplaced.

October 7

-

The central bank originally established a 10-year time horizon for completing upgrades to the nation's aging electronic payment system. But a task force convened by the Fed thinks that's not ambitious enough.

October 6 -

Independence Bancshares in South Carolina last week fired its CEO and gave up its dreams of shaking up the payments world after losing nearly $9 million on the effort. Many details are still unknown, but it looks like a case study for what can go wrong when community banks invest in technology.

October 6 -

Synechron, a consulting firm to the financial services industry, has acquired Crossbridge, a London-based consulting firm.

October 6 -

Santander Group, the Spanish banking giant, has invested several million dollars in Ripple, one of the most prominent startups in the hotly discussed field of distributed-ledger technology.

October 6 -

The term has gone from a common brand name to a catch-all for innovative technologies in financial services to a somewhat patronizing plural noun to describe startups and their founders.

October 5 American Banker

American Banker -

Bank of Nova Scotia's online platform will introduce its first credit card Tuesday, according to people with knowledge of the matter.

October 5 -

An initiative underway at Freddie Mac seeks to integrate new and existing technology to create a comprehensive suite of quality control tools designed to help lenders manage their mortgage repurchase risks.

October 5 -

The New York State Department of Financial Services on Monday gave a third virtual currency company the green light to begin operations in the state.

October 5 -

Swift CEO Gottfried Leibbrandt talks about how the global messaging network is looking to stay relevant to its bank members; the potential and limitations of blockchain technology; and his views on the startups looking to disrupt banking.

October 5 -

A California company called NEFT wants to provide the online meeting place where debt-laden borrowers get together with lenders and credit bureaus to negotiate repayment plans. Backed by some prominent investors, NEFT says it offers carrots to get all the parties to participate.

October 5 -

Kabbage is one of many nonbank lenders looking to partner with traditional financial institutions. But the firm is facing a tough sell with bankers who worry about the risks associated with ceding control of the loan-underwriting process.

October 5 -

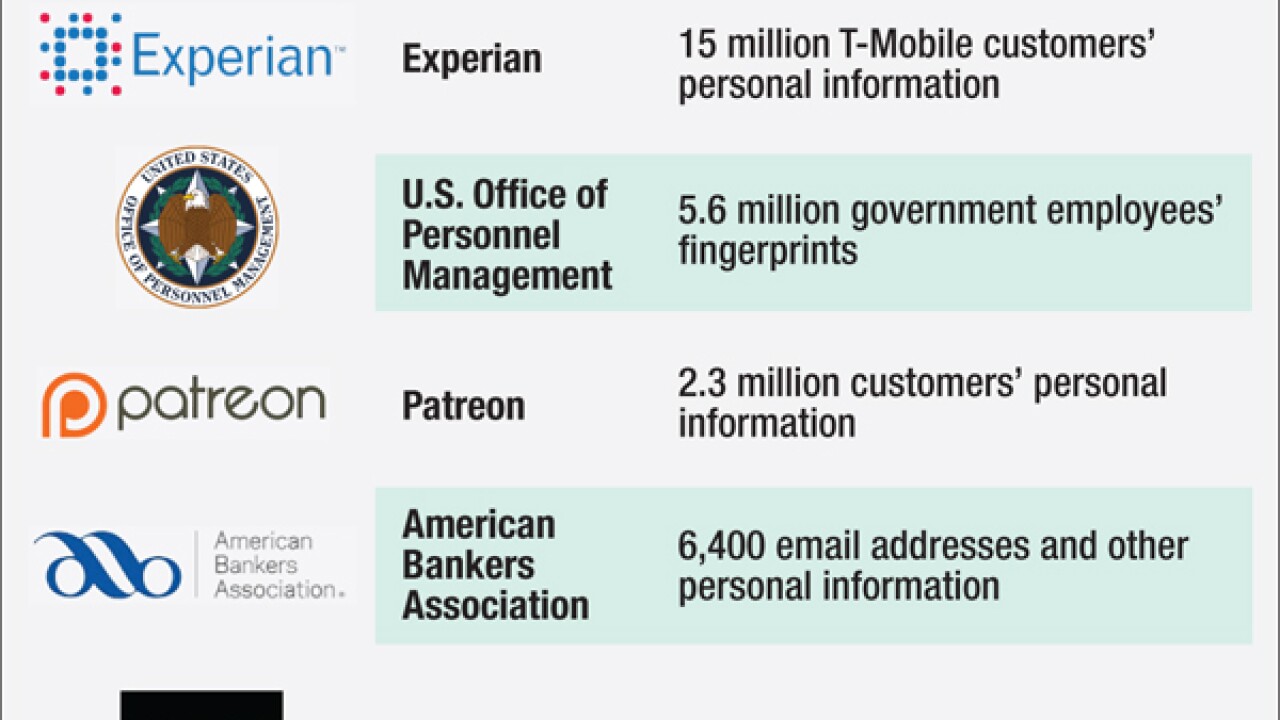

Hackers did not steal banking or payments data from Experian, but they might as well have. Breaches like the one sustained at the company call into question the entire system of identification that banks rely on to open accounts and conduct other everyday business.

October 2 -

Compared with other recent breaches, the theft of 6,400 user email addresses and passwords on the American Bankers Association's website might seem like small potatoes. But experts said the attack the first in the association's history was still significant and could have implications for banks.

October 2 -

"Pricing will have to be changed," American Banker declared in 1977, "to help motivate banks to start such programs with their own customers."

October 2

-

While large banks are risk-averse, conformist and bureaucratic, marketplace lenders are inspiring the best and the brightest with their high-energy cultures.

October 2

-

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

October 2 -

A server containing sensitive consumer information at Experian has been breached, with the records of as many as 15 million T-Mobile customers stolen, the companies said Thursday.

October 1