-

A Biden administration initiative to crack down on wealthy taxpayers hiding pass-through income would require financial institutions to send account flow data to the IRS.

May 20 -

After much anticipation, the Federal Reserve last year finally joined the Network for Greening the Financial System, which develops regulatory best practices for combating climate risks. But all U.S. banking regulators must participate for the effort to succeed, some observers argue.

May 18 -

A proposal still in the early stages to have banks report on customers’ account activity to help the government nab tax evaders is being panned by the industry as overly burdensome and a privacy threat.

May 17 -

Acting Comptroller of the Currency Michael Hsu said he plans to prioritize "solving urgent problems and addressing pressing issues" until the Biden administration selects a permanent head of the agency.

May 10 -

The Treasury Department announced that Michael Hsu, a senior official at the Federal Reserve, would lead the national bank regulator until a Senate-confirmed comptroller is in place.

May 7 -

COVID-19 has shown us that technology can rapidly evolve to meet customer needs, in areas from contactless payments to digital banking to mobile wallets. However, we still see great disparities when it comes to the use of contactless and digital banking by low- to moderate-income (LMI) workers. The question is, will emerging tech in the post-COVID economy provide an opportunity to include new people in the financial system-- or leave them even further behind?

-

The banks disclosed this week that they are under scrutiny for conduct that may have harmed consumers. The timing raises questions about whether the Consumer Financial Protection Bureau under President Biden is poised to bring more enforcement actions against large banks than it did under Trump-appointed Director Kathy Kraninger.

May 7 -

Organizations representing banks and other financial services firms said implementing the Office of the Comptroller of the Currency's overhaul of the Community Reinvestment Act could be wasteful as regulators discuss a new interagency plan to modernize the law.

May 6 -

The Biden administration may finally be close to naming an acting comptroller of the currency. Whoever gets the interim job or is confirmed to run the agency over the longer term will have a lengthy to-do list, from Community Reinvestment Act reform to deciding the fate of divisive Trump-era rules.

May 6 -

Cordray, named this week to lead the Education Department's office of federal student aid, cracked down on banks, student loan servicers and for-profit colleges when he was director of the Consumer Financial Protection Bureau.

May 4 -

A senior White House economic aide said the decision on selecting the next central bank chief will come after a thorough “process.”

May 4 -

Treasury Secretary Janet Yellen plans to name Michael Hsu, associate director of bank supervision at the Federal Reserve, to be the acting comptroller of the currency, according to The Wall Street Journal.

May 3 -

Titans of finance, already threatened by President Biden’s push for the biggest tax hike on wealthy Americans in decades, face another peril: Progressives are demanding action on a long-stalled requirement that Washington clamp down on Wall Street bonuses.

April 30 -

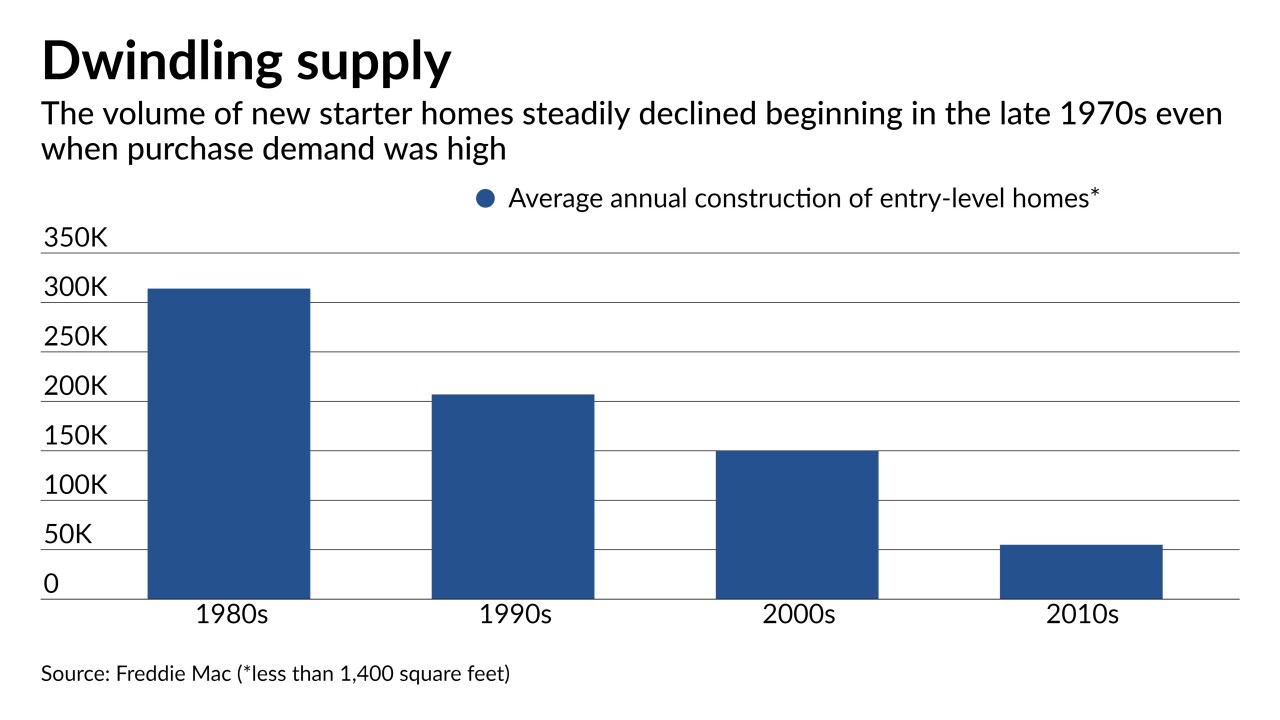

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27 -

Three months into President Biden’s term, the White House has yet to select a nominee to run the Office of the Comptroller of the Currency or pick an acting chief. That inaction will make it more difficult for Democrats to unwind Trump-era policies, critics say.

April 23 -

House and Senate GOP members have stepped up criticism of a plan to include banks in a global push to cut emissions, saying it could cut off financial services access for energy and fossil fuel companies.

April 21 -

With Congress pouring billions into a new grant program and state-based lending initiatives, community development financial institutions say they can move past survival mode to test new products and partner with larger financial institutions.

April 20 -

Municipal bonds have a direct effect on the social and cultural character of cities, metropolitan areas, counties, and states. Munis and the initiatives they support such as public education, housing subsidies, public transit systems, and more, can often be linked to local or regional politics. Join Lynne Funk, Executive Editor at The Bond Buyer and Destin Jenkins, Neubauer Family Assistant Professor of History at the University of Chicago as they explore how municipal bond mismanagement can have contrasting influences on the different ethnic groups in our cities.

-

Gensler is poised to confront everything from the fallout of the GameStop trading frenzy to the collapse of Archegos Capital Management.

April 14 -

The Department of Housing and Urban Development will revive a 2013 rule that makes lenders liable for practices that were unintentionally discriminatory as well as 2015 guidelines for how local jurisdictions comply with the Fair Housing Act.

April 14