-

A senior White House economic aide said the decision on selecting the next central bank chief will come after a thorough “process.”

May 4 -

Treasury Secretary Janet Yellen plans to name Michael Hsu, associate director of bank supervision at the Federal Reserve, to be the acting comptroller of the currency, according to The Wall Street Journal.

May 3 -

Titans of finance, already threatened by President Biden’s push for the biggest tax hike on wealthy Americans in decades, face another peril: Progressives are demanding action on a long-stalled requirement that Washington clamp down on Wall Street bonuses.

April 30 -

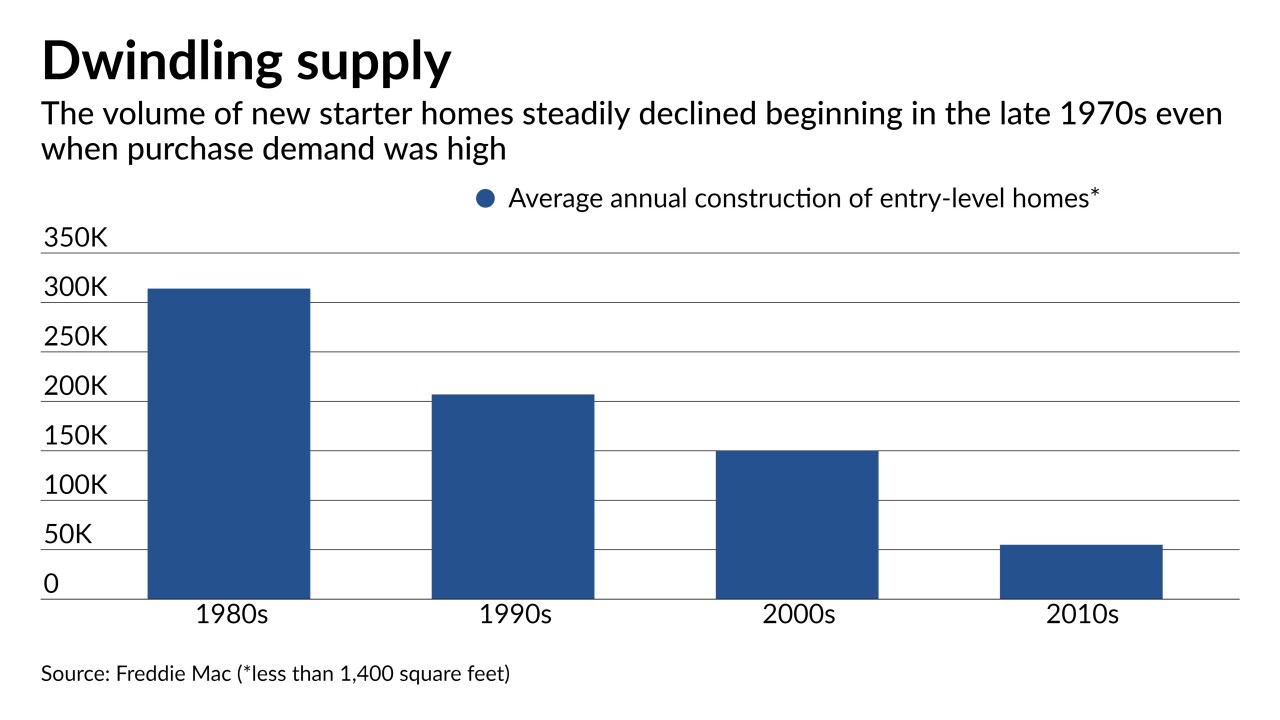

The end of the refinancing boom and impending rise in rates are not the only challenges lenders face. As one observer put it, they "can't make loans on homes that don't exist."

April 27 -

Three months into President Biden’s term, the White House has yet to select a nominee to run the Office of the Comptroller of the Currency or pick an acting chief. That inaction will make it more difficult for Democrats to unwind Trump-era policies, critics say.

April 23 -

House and Senate GOP members have stepped up criticism of a plan to include banks in a global push to cut emissions, saying it could cut off financial services access for energy and fossil fuel companies.

April 21 -

With Congress pouring billions into a new grant program and state-based lending initiatives, community development financial institutions say they can move past survival mode to test new products and partner with larger financial institutions.

April 20 -

Municipal bonds have a direct effect on the social and cultural character of cities, metropolitan areas, counties, and states. Munis and the initiatives they support such as public education, housing subsidies, public transit systems, and more, can often be linked to local or regional politics. Join Lynne Funk, Executive Editor at The Bond Buyer and Destin Jenkins, Neubauer Family Assistant Professor of History at the University of Chicago as they explore how municipal bond mismanagement can have contrasting influences on the different ethnic groups in our cities.

-

Gensler is poised to confront everything from the fallout of the GameStop trading frenzy to the collapse of Archegos Capital Management.

April 14 -

The Department of Housing and Urban Development will revive a 2013 rule that makes lenders liable for practices that were unintentionally discriminatory as well as 2015 guidelines for how local jurisdictions comply with the Fair Housing Act.

April 14 -

Dozens of European and U.S. banks are considering throwing their weight behind the White House’s Earth Day summit under plans being drawn up by former Bank of England Gov. Mark Carney.

April 9 -

The Department of Justice in the Trump administration hatched a plan to consider reforming its bank-merger review process, raising industry hopes about overhauling the outdated regime. But progressives want the agency to give more thought to the harm bank combinations cause consumers, including further branch closings.

April 7 -

President Biden said he hasn’t spoken with Federal Reserve Chair Jerome Powell since taking office more than two months ago, citing respect for the central bank’s independence and marking a sharp turn from his predecessor, Donald Trump.

April 7 -

Policymakers have scrutinized social disparities in the financial system and banks' climate-change risks. That has led to a new line of attack from Republicans who say agencies such as the Federal Reserve should stay in their lane.

April 6 -

The agency announced it was rescinding seven policy statements issued last year meant to help companies combat fallout from COVID-19 but that the bureau's current chief said came at the expense of consumers.

March 31 -

Legislation the president signed this week will extend the deadline for the Paycheck Protection Program to May 31 from March 31, giving businesses two additional months to apply for loans.

March 31 -

Although the Federal Housing Administration's insurance fund is "well above" its legal minimum, HUD Secretary Marcia Fudge said the mortgage agency has no plans to cut prices.

March 30 -

The full Senate could deadlock on Rohit Chopra’s nomination as the Banking Committee did. If that happens, Vice President Kamala Harris is expected to cast the decisive vote in his favor.

March 30 -

Mehrsa Baradaran, a University of California, Irvine, professor and former banking lawyer, has worked hard to close the racial wealth gap and could further such goals as head of the Office of the Comptroller of the Currency, wrote 34 caucus members in a letter to President Biden.

March 26 -

Former Obama-era regulators Kara Stein and Sarah Bloom Raskin, as well as Atlanta Fed President Raphael Bostic, have joined the field of potential nominees to lead the Office of the Comptroller of the Currency, according to sources familiar with the process.

March 25