-

The agency is recruiting more attorneys and shuffling personnel under new Democratic leadership as it prepares to toughen oversight of the financial services industry.

February 21 -

The operating environment is dramatically different than it was pre-pandemic and presents all-new challenges for financial institutions. Tried-and-true strategies that led to high performance for many years are no longer going to be successful. Join Bonnie McGeer, Executive Editor of American Banker, and Claude Hanley, Partner at Capital Performance Group, as they highlight important trends and comb through data from top-performing banks across the country for insights that will help regional and community financial institutions thrive in 2021. Executives will learn what metrics will be most critical to focus on to maintain high performance going forward.

-

While the Mortgage Bankers Association hailed the move, some experts say it could negatively impact housing inventory.

February 16 -

President Biden’s executive order requiring agencies to weigh the impact of pending policies on underserved groups could have a lasting effect on issues from reforming the Community Reinvestment Act to fair lending.

February 12

-

Transportation and clean-energy upgrades could create significant new lending opportunities, but some observers fear the government will foot the bill through a special tax on banks and other financial firms.

February 11 -

Federal Reserve Chair Jerome Powell says he has nothing but affection for his work, suggesting that the 68-year-old central banker could be open to a second term if asked.

February 11 -

Economist Lisa Cook has the backing of several key White House officials and allies outside the administration as a possible choice for President Joe Biden in filling a vacancy on the Federal Reserve Board of Governors, according to people familiar with the matter.

February 11 -

Homeowners still deferring payments on federally backed loans as of Feb. 28 will be permitted to request an additional three months of relief.

February 9 -

The Biden administration’s yet-to-be-named comptroller of the currency is widely expected to invalidate the GOP-backed measure that bars banks from shunning gun makers, fossil-fuel producers and the like. But another option is to recast it to promote investment in underserved communities.

February 8 -

Acting Director Dave Uejio wrote in a blog post that the Consumer Financial Protection Bureau needs more time to consider rules that were finalized under the Trump administration but have not yet gone into effect.

February 5 -

A growing number of states have chosen to decriminalize or legalize cannabis in recent years. As a result, the legal cannabis industry has experienced exponential growth. Yet banks and other financial institutions are still largely reluctant to partner with cannabis firms due to the lingering conflict between state and federal law. In this episode we will explore: (1) how financial institutions can navigate the regulatory, compliance, and operational challenges facing this sector; and (2) the steps the Biden Administration may take to improve the environment for banking this industry.

-

Trump appointee Jelena McWilliams is slated to be the agency's chair until mid-2023. But legal experts say a provision in the FDIC’s bylaws gives Democratic members of the governing board, now in the majority, an opening to reverse earlier rules championed by Republicans.

January 29 -

The administration’s initiative to offer universal high-speed internet service is a chance for bankers to provide underserved households with access to online financial education and low-cost digital accounts.

January 29 FIS

FIS -

Though the pandemic recession has driven up the delinquency rate on Federal Housing Administration loans, the president's appointees are widely expected to reduce mortgage insurance premiums by at least 25 basis points to make home loans less expensive.

January 28 -

Come away better prepared for what’s ahead after hearing Satish Kini and David Sewell of Debevoise & Plimpton and Darin Jarrett, Deputy BSA/AML Officer at American Express, in conversation with Bonnie McGeer, Executive Editor of American Banker, as they explore: •How the new administration might change the BSA/AML Act •Are there easy wins in relieving the burden of suspicious activity reports without undermining effectiveness? •New ways that companies are innovating within AML compliance and risk •What banks are doing to drive next-gen efficiency and effectiveness of risk and compliance

-

Marcia Fudge told senators that her first priority as secretary would be to assist renters and homeowners struggling financially due to the COVID-19 pandemic.

January 28 -

The rule, finalized in the waning days of the Trump administration and scheduled to take effect in April, would have punished banks for denying services to certain firms without documented reasons for doing so.

January 28 -

The president’s executive action looks to assess the impact of the previous administration's alterations to the Affirmatively Furthering Fair Housing and Disparate Impact rules, while reinforcing Biden’s vow to eliminate discriminatory lending practices.

January 27 -

The most likely picks for comptroller of the currency have pushed tech-driven approaches to financial inclusion and anti-money-laundering, and would bring new perspective to regulating cryptocurrencies.

January 27 -

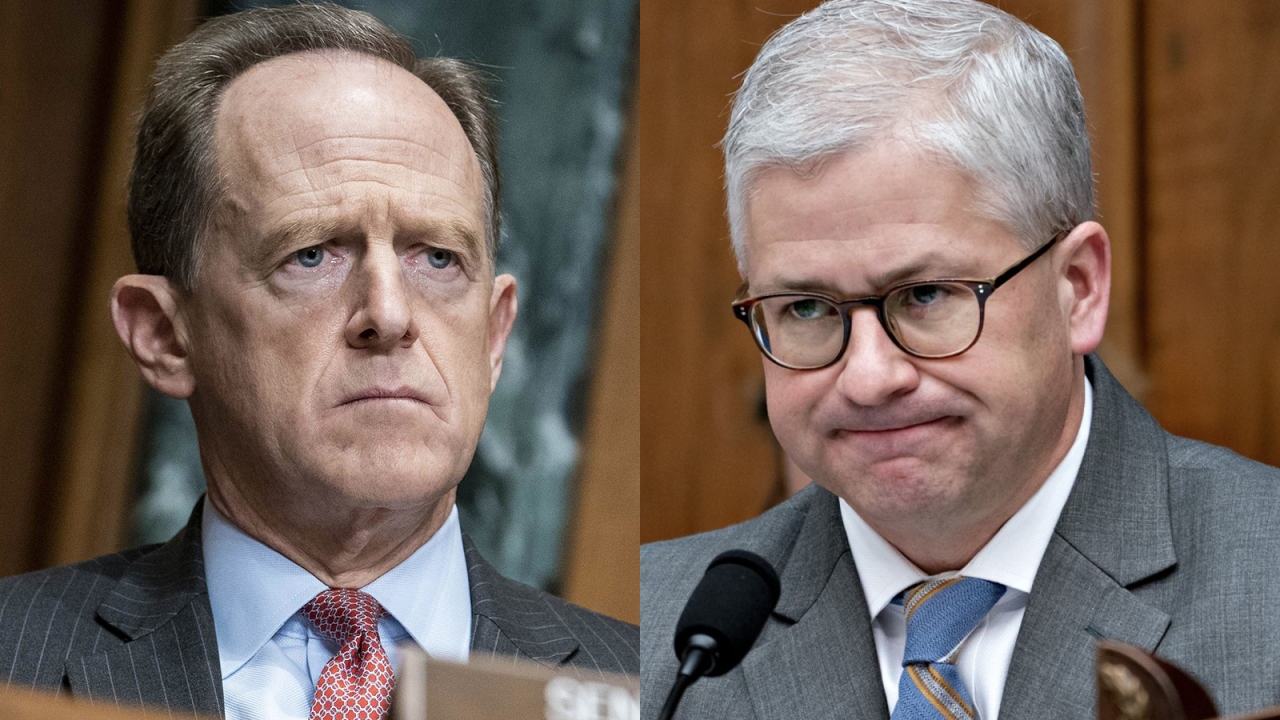

The Senate’s confirmation of Treasury Secretary Janet Yellen was notably bipartisan. But experts say congressional Republicans are poised to give nominees for the federal banking agencies heavier scrutiny.

January 27