-

Most of Sterling Bancorp's operations are in San Francisco and Los Angeles. The company plans to use some of the $93 million it will raise to expand in New York and Seattle.

November 9 -

Endeavor Bank in San Diego aims to be the third new bank to open this year. There is hope that as many as eight new institutions could open in 2018.

November 8 -

The company has agreed to buy CBBC Bancorp. It also raised $63 million to pay for the deal and fund future growth.

November 8 -

Capital Corps, led by Steven Sugarman, aims to provide financing to homeowners and small businesses that it believes are overlooked by banks. The firm features several former Banc of California executives.

November 6 -

The Federal Housing Finance Agency must set fees equal to the cost of capital that private banks hold against similar risk, not just the amount of capital that Fannie and Freddie think are right for themselves.

November 3

-

Kearny agreed to pay $408 million for Clifton Bancorp in a deal that will add 12 branches in northern New Jersey.

November 2 -

The company plans to use some of the offering's $48 million in proceeds to redeem preferred stock.

October 31 -

The bank is looking to raise $72 million, which it could use for organic growth and acquisitions.

October 30 -

The company, which agreed to buy Southwest Bancshares in Mobile, also plans to sell $45 million in stock to help fund the deal.

October 24 -

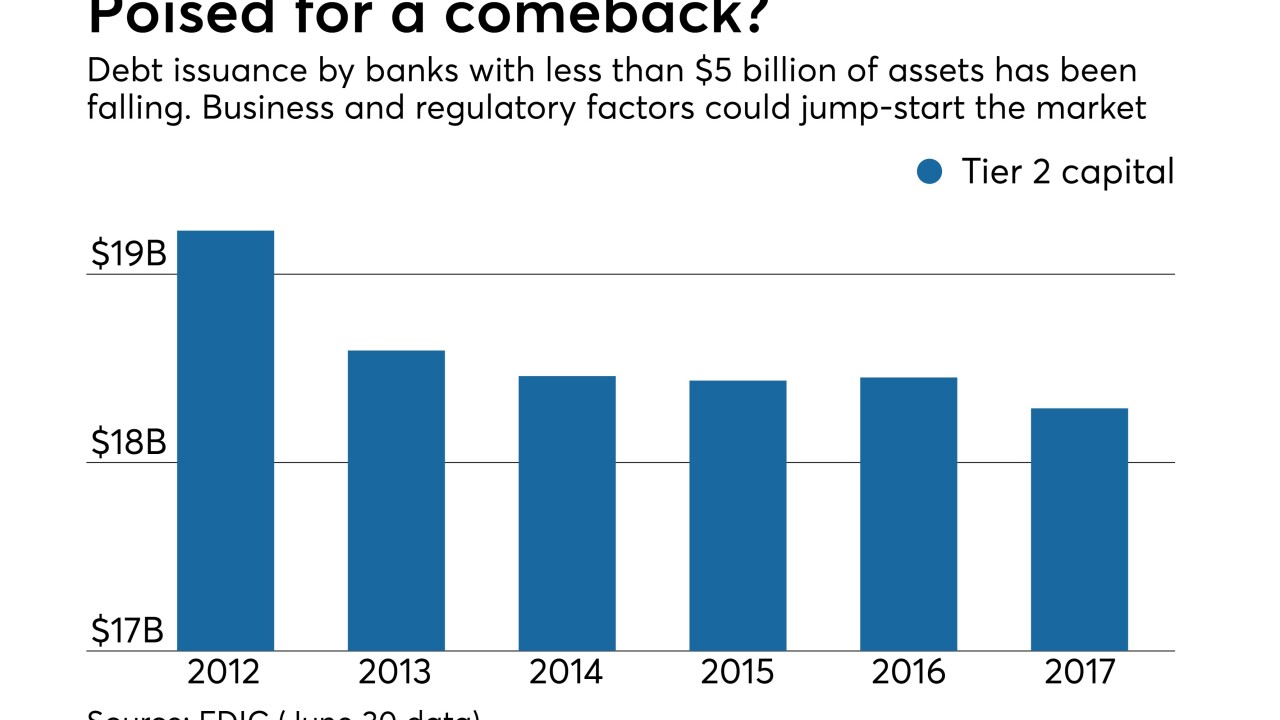

Increased investor appetite and the emergence of specialized debt ratings are expected to spur demand, and community banks are looking for ways to fund expansion and hedge against future economic downturns.

October 23