-

Premier Financial Bancorp in Huntington, W.Va., has received a $12 million loan from First Guaranty Bancshares in Hammond, La.

August 27 -

First Financial Bancorp. in Cincinnati has issued $120 million in subordinated debt and plans to use the proceeds for potential stock repurchases and to support growth.

August 27 -

Tri-Valley Bank in San Ramon, Calif., plans to raise $1.35 million in a private placement of its common stock.

August 25 -

SBT Bancorp in Simsbury, Conn., plans to raise about $7.5 million through a private placement of subordinated debt and $8.6 million through a public offering of common stock.

August 25 -

Federal Reserve Bank of Atlanta President Dennis Lockhart said he continues to expect the first interest- rate hike in nearly a decade this year, while cautioning that a stronger dollar, a weaker Chinese yuan and falling oil prices complicate the outlook.

August 24 -

Cecil Bancorp in Elkton, Md., has been ordered by federal regulators to raise more capital or sell itself.

August 21 -

Blue Valley Ban Corp. in Overland Park, Kan., has named an executive from a large investor in the company to its board.

August 20 -

Market Street Bancshares in Mount Vernon, Ill., has completed a $15 million debt offering.

August 20 -

Esquire Bank, a Garden City, N.Y., bank that specializes in financial services for law firms, has raised $19.1 million in a private placement of common stock.

August 19 -

Bankwell Financial Group in New Canaan, Conn., has issued $25.5 million in subordinated debt and it plans to exit the Small Business Lending Fund program.

August 19 -

Activist investor Joseph Stilwell is demanding that Carroll Bancorp in Sykesville, Md., pick up the pace on stock buybacks.

August 18 -

The recapitalization will allow City National Bank to continue as a certified Community Development Financial Institution, the bank said.

August 18 -

The $120 million-asset mutual thrift filed its application with federal regulators this month. Citizens expects the formation to be completed by the first quarter, Chief Executive Tommy Johnson said in an interview.

August 17 -

The Office of the Comptroller of the Currency has promoted Amrit Sekhon to deputy comptroller for capital and regulatory policy.

August 13 -

FNBH Bancorp in Michigan has been unable to make an important move without its primary regulator's OK in the six years since its nonperforming assets hit double digits. It's an extreme example of the tension between past problems and future visions that freezes many banks.

August 12 -

Bryn Mawr Bank in Pennsylvania has issued $30 million in subordinated debt.

August 7 -

Coast Bancorp has sold two buildings next to its bank's headquarters in San Luis Obispo, Calif., and has refinanced debt.

August 5 -

Summit Financial Group in Moorefield, W.Va., said its employee stock-ownership plan has acquired a stake in the company from a Louisiana bank.

August 5 -

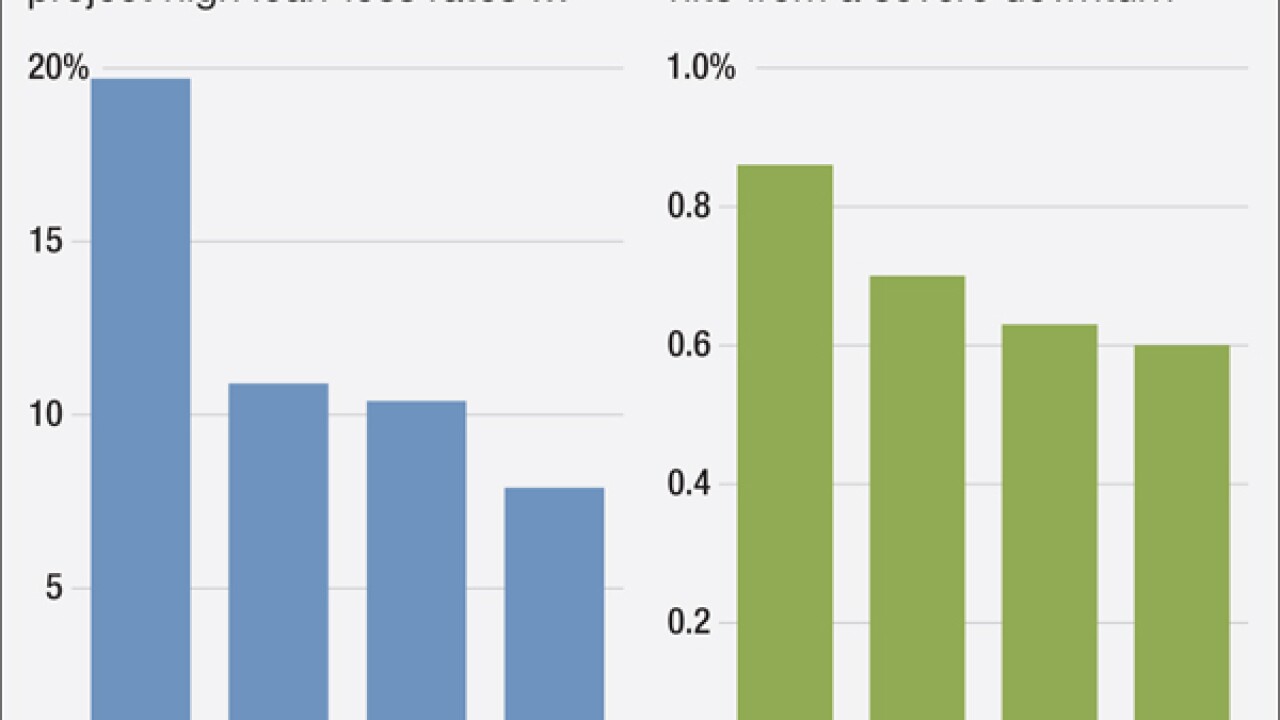

The first stress tests for regional banks show loan losses closely in line with the postcrisis period. However, an independent analysis suggests losses likely would be even higher.

August 4 -

First Foundation in Irvine, Calif., has begun an initial public offering to raise up to $100 million.

August 3