-

Activist investor Joseph Stilwell is demanding that Carroll Bancorp in Sykesville, Md., pick up the pace on stock buybacks.

August 18 -

The recapitalization will allow City National Bank to continue as a certified Community Development Financial Institution, the bank said.

August 18 -

The $120 million-asset mutual thrift filed its application with federal regulators this month. Citizens expects the formation to be completed by the first quarter, Chief Executive Tommy Johnson said in an interview.

August 17 -

The Office of the Comptroller of the Currency has promoted Amrit Sekhon to deputy comptroller for capital and regulatory policy.

August 13 -

FNBH Bancorp in Michigan has been unable to make an important move without its primary regulator's OK in the six years since its nonperforming assets hit double digits. It's an extreme example of the tension between past problems and future visions that freezes many banks.

August 12 -

Bryn Mawr Bank in Pennsylvania has issued $30 million in subordinated debt.

August 7 -

Coast Bancorp has sold two buildings next to its bank's headquarters in San Luis Obispo, Calif., and has refinanced debt.

August 5 -

Summit Financial Group in Moorefield, W.Va., said its employee stock-ownership plan has acquired a stake in the company from a Louisiana bank.

August 5 -

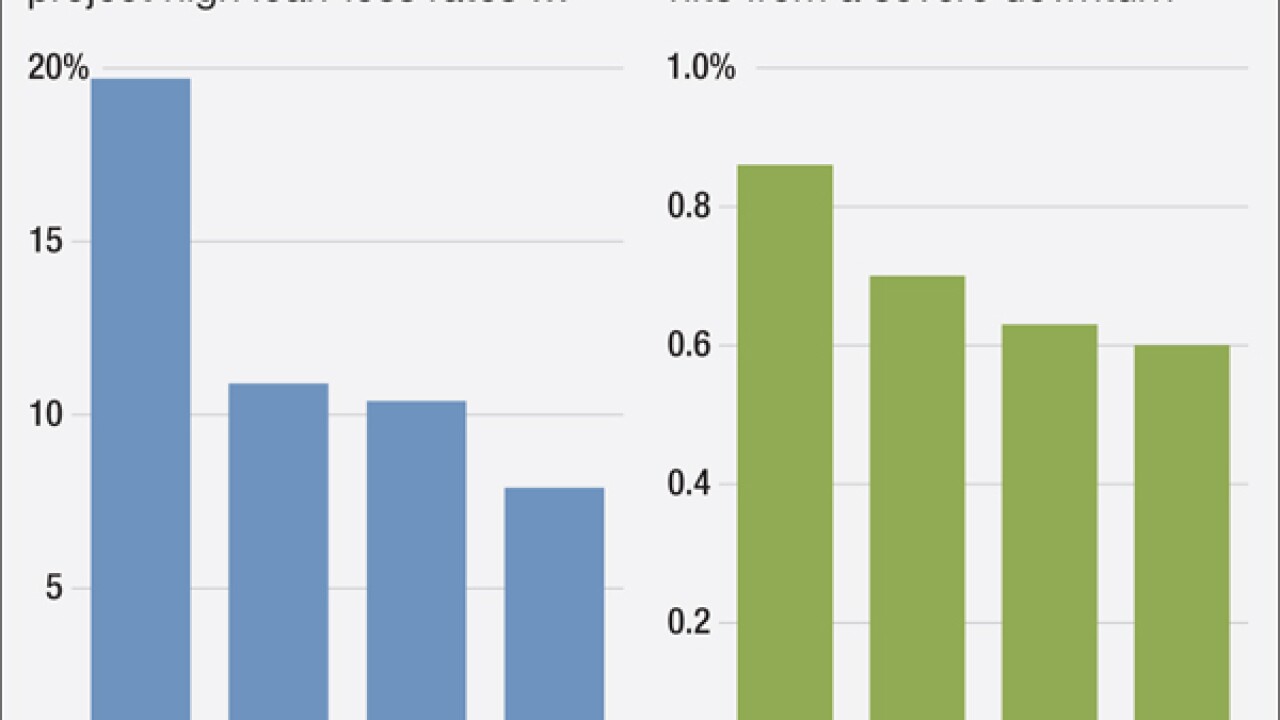

The first stress tests for regional banks show loan losses closely in line with the postcrisis period. However, an independent analysis suggests losses likely would be even higher.

August 4 -

First Foundation in Irvine, Calif., has begun an initial public offering to raise up to $100 million.

August 3 -

The bank plans to use the proceeds for general corporate purposes, including possible acquisitions such as potential FDIC-assisted transactions. Iberiabank may also use the proceeds for working capital and for investments in subsidiaries to support continued growth.

July 30 -

United Community Banks in Blairsville, Ga., has filed a shelf registration for senior notes to help pay for its acquisition of a South Carolina bank.

July 30 -

While rising rates may temporarily improve net interest margin and profits, they will not increase bank stock prices for at least three reasons.

July 29

-

Pinnacle Financial Partners in Nashville, Tenn., plans to raise $60 million in subordinated debt in a private placement.

July 27 -

A fifth of the financial institutions that participated in the Small Business Lending Fund have fully left the program and an increasing number of banks are joining them before the dividend rate jumps to 9% next year.

July 22 -

What asset threshold? Community banks may not be required by law to conduct stress tests, but about one in three have been asked by their examiners to do so, according to a recent survey of banks.

July 20 -

Meta Financial Group in Sioux Falls, S.D., agreed to sell $3.1 million of common stock to a group of existing investors and reached a separate agreement to issue prepaid cards for a business partner.

July 14 -

Banks better get ready for a quick, steep increase in deposit costs after the Fed raises rates. Technology, new regulations and other factors have changed the slower-paced retail-banking game of old, JPMorgan Chase executives say.

July 14 -

National Bank Holdings in Greenwood Village, Colo., plans to repurchase as much as $100 million of its common stock.

July 6 -

First Choice Bank, in Cerritos, Calif., has raised $30 million from a secondary stock offering.

July 2