-

Finance students at Marquette University will make loans to small businesses in Milwaukee from a revolving fund seeded by Town Bank and held on the books of a local CDFI.

August 31 -

Credit union trade groups are lauding the Senate's move to provide $250 million for the Treasury Department's Community Development Financial Institutions fund.

August 2 -

The Germantown, Md.-based credit union serves more than 14,000 members and holds about $130 million in assets.

July 12 -

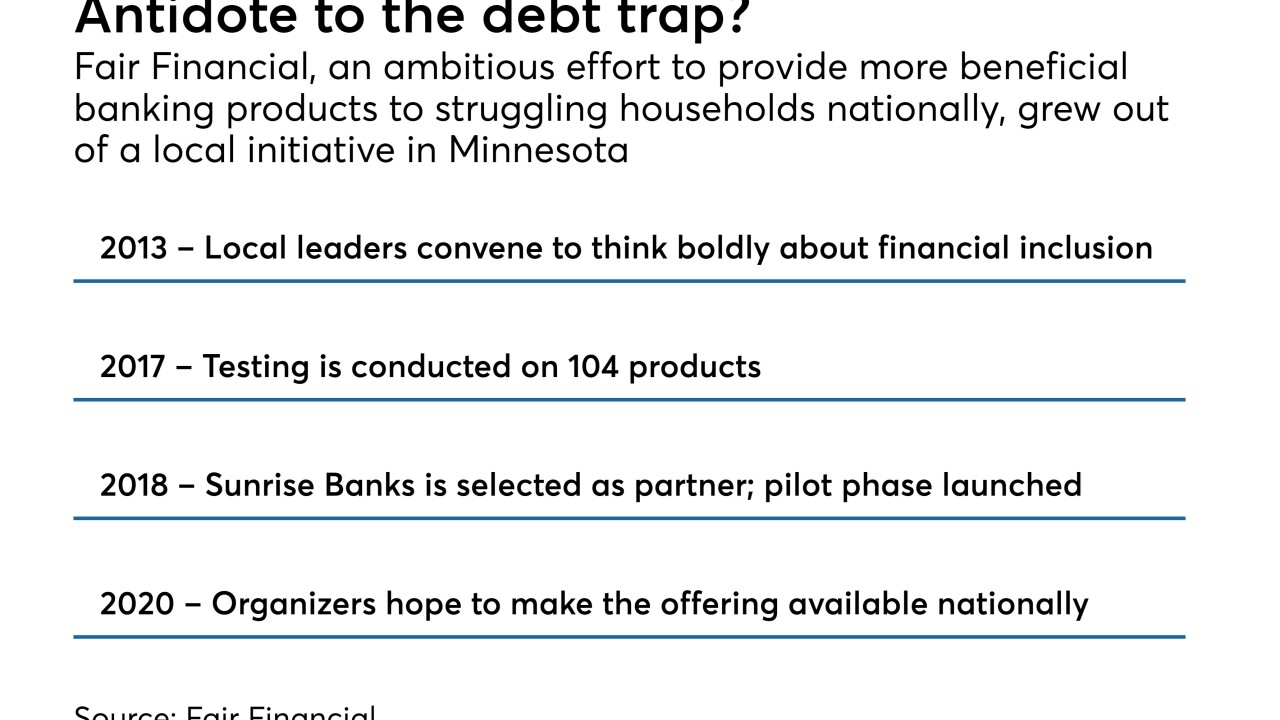

Fair Financial, a digital banking platform developed by a Twin Cities nonprofit in partnership with a local bank, launched a pilot program this week. By 2020, it plans to serve 5,000 customers across the country.

June 22 -

Lawmakers should prioritize programs that improve economic development in underserved communities, as appropriators begin debating next year’s spending levels.

June 22 South Carolina Community Bank

South Carolina Community Bank -

The retired CEO of 1st Choice Credit Union and CU of Atlanta has been named the 2018 recipient of the Pete Crear Lifetime Achievement Award from the African-American Credit Union Coalition.

June 19 -

Community Development Credit Unions grew outstanding loans by 13 percent in 2017, compared to 10 percent for non-CDFI-certified CUs.

May 31 -

For many borrowers, near-guaranteed approvals and faster turnaround times are more important than the lower rates offered by banks and credit unions.

May 22 -

Several credit union and bank groups have formed a rare united front in letters opposing the Trump administration's rescission package.

May 11 -

The Treasury's recommendations come as federal bank regulators have indicated they will soon release a proposal to reform Community Reinvestment Act policy.

April 3 -

HUD Secretary Ben Carson told lawmakers that overly rigid False Claims Act enforcement had forced lenders to suffer financially for what were just minor errors, but that lenders' fears of being sued were dissipating.

March 20 -

The first step for credit unions to get certified as community development financial institutions begins next week.

March 16 -

Banking and affordable housing advocates are encouraged by a provision in the tax reform legislation that could increase investment in underserved communities by allowing investors to defer capital gains taxes when they reinvest in federally chartered Opportunity Funds.

March 6 -

The Trump administration’s 2019 budget highlights the administration’s goal of reining in the post-crisis regulatory apparatus, with proposed cuts for several agencies including the Consumer Financial Protection Bureau.

February 12 -

The Trump administration’s 2019 budget highlights the administration’s goal of reining in the post-crisis regulatory apparatus, with proposed cuts for several agencies including the Consumer Financial Protection Bureau.

February 12 -

The special round of certification will close on Feb. 16, and credit unions approved for CDFI status will be notified by the end of March.

January 26 -

The Minneapolis bank is the first bank to join Community Reinvestment Fund's online service that matches small-business borrowers who don’t qualify for bank loans with community development financial institutions.

January 8 -

OneUnited is trimming branches and expanding digital offerings as it builds its brand as a backer of social justice that develops innovative products such as a Black-Lives-Matter-themed debit card.

December 11 -

Carver Bancorp, which has spent 70 years serving minorities in Harlem and surrounding neighborhoods, is struggling to turn a profit. As black-run banks nationwide struggle to stay afloat, Carver's CEO insists the institution is on the right track.

November 20 -

Clearinghouse CDFI will use funds from the $2 million investment to support affordable-housing and economic development projects in communities and Native American reservations in California, Nevada and Arizona.

November 20