-

The legislation, signed Monday by Gov. Rick Scott, authorizes 60- to 90-day loans of up to $1,000. It makes Florida the first state to pass a law designed to blunt the impact of the CFPB’s payday lending rule.

March 19 -

The agency's decision to lift a 2002 consent order against Ace Cash Express could lead to a revival of partnerships between national banks and payday lenders.

March 19 -

On Dec. 31, 2017. Dollars in thousands.

March 19 -

The e-commerce giant is muscling its way into a number of businesses that banks have long dominated.

March 18 -

First the House and now the Senate have included provisions in their regulatory relief bills that bankers say would go a long way toward clearing up confusion over how to treat high-volatility commercial real estate loans.

March 15 -

As it expands to the West Coast, the bank will first target car dealers at which it is already an indirect consumer lender.

March 14 -

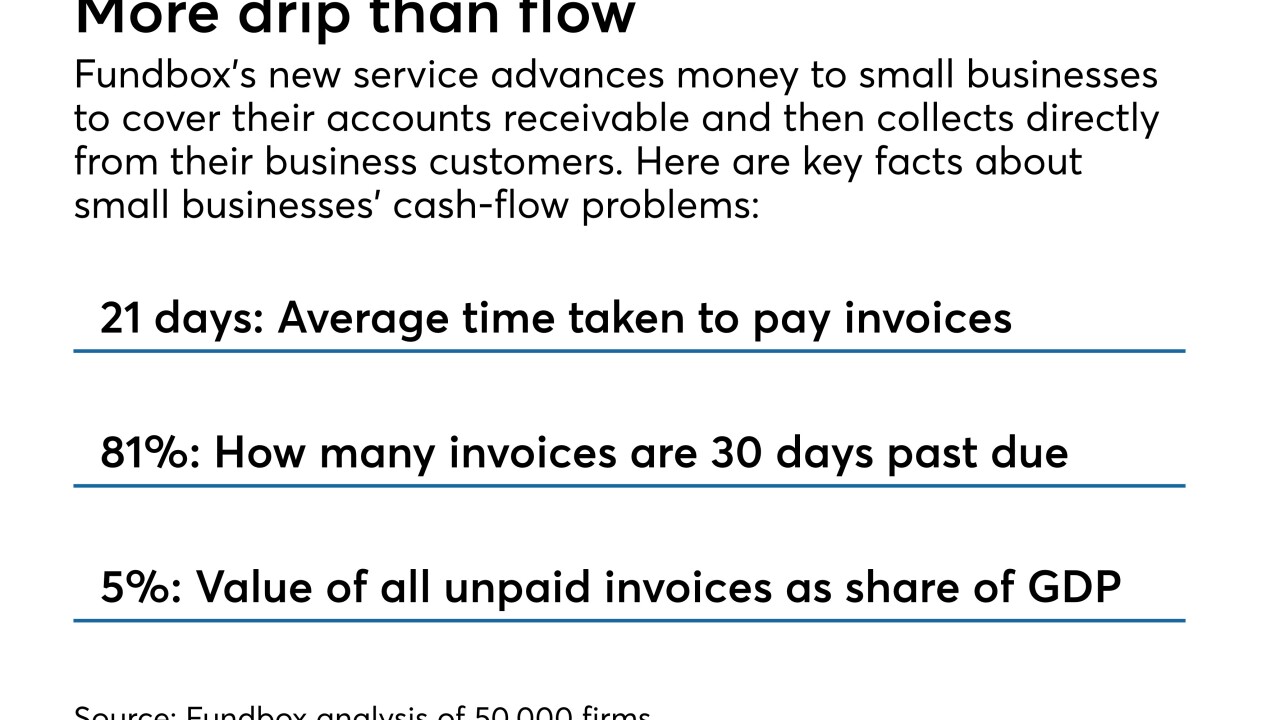

Fundbox is testing a payments and credit network for small businesses and their business clients that may offer an alternative to traditional lenders, credit card issuers and supplier financing.

March 14 -

The online giant has succeeded in disrupting every area of retail, but in banking it faces a high barrier to entry and fierce determination from banks like Citizens Financial and Bank of the West to keep upping their games.

March 13 -

The online lender is hiring Kenneth Brause, a CIT Group executive, to succeed CFO Howard Katzenberg.

March 13 -

Amazon.com is planning to offer a credit card to U.S. small-business customers, furthering its push to supply companies with everything from reams of paper to factory parts, according to people with knowledge of the matter.

March 12 -

On Dec. 31, 2017. Dollars in thousands.

March 12 -

The SBA may back off of poultry loans after its inspector general determined that farmers are often controlled by big corporations. That could cause headaches for lenders with a focus on that business.

March 12 -

Franklin Synergy and MidFirst both plan to deploy the online lending platform, which according to its creator can render loan decisions in just under three minutes.

March 12 -

House legislation to reverse a federal court decision on state interest rate caps would increase access to credit, not expand predatory lending as critics have argued.

March 7 The Clearing House Association

The Clearing House Association -

Wells has helped gun and ammunition companies access $431 million in loans and bonds since the 2012 Sandy Hook shooting. Other financial firms that are active as bookrunners for gunmakers include Morgan Stanley, TD Securities, Bank of America and JPMorgan Chase.

March 7 -

Financial agencies must prepare themselves to evaluate the practical effects of automated decision-making in lending and other programs to better detect fair-lending violations.

March 7 Deciens Capital

Deciens Capital -

Deposit prices are starting to rise, deposit growth is slowing, commercial loan growth remains tepid (with some exceptions) and concerns are mounting about the economic toll of U.S. trade policy, bank executives said just a few weeks ahead of the end of the quarter.

March 6 -

The company received bad news about the commercial loan after it reported a narrow profit in mid-February.

March 6 -

Sterling would gain $458 million in loans and an origination platform by acquiring Advantage Funding Management.

March 6 -

Online lenders build a seamless customer journey from screening to underwriting to origination to servicing to funding, writes Krista Morgan, CEO and co-founder of P2Binvestor.

March 5 P2Binvestor

P2Binvestor