-

The fragmentation of the U.S. regulatory system and uncertainty around what agencies will regulate fintech firms could slow down innovation.

July 18 Adjoint

Adjoint -

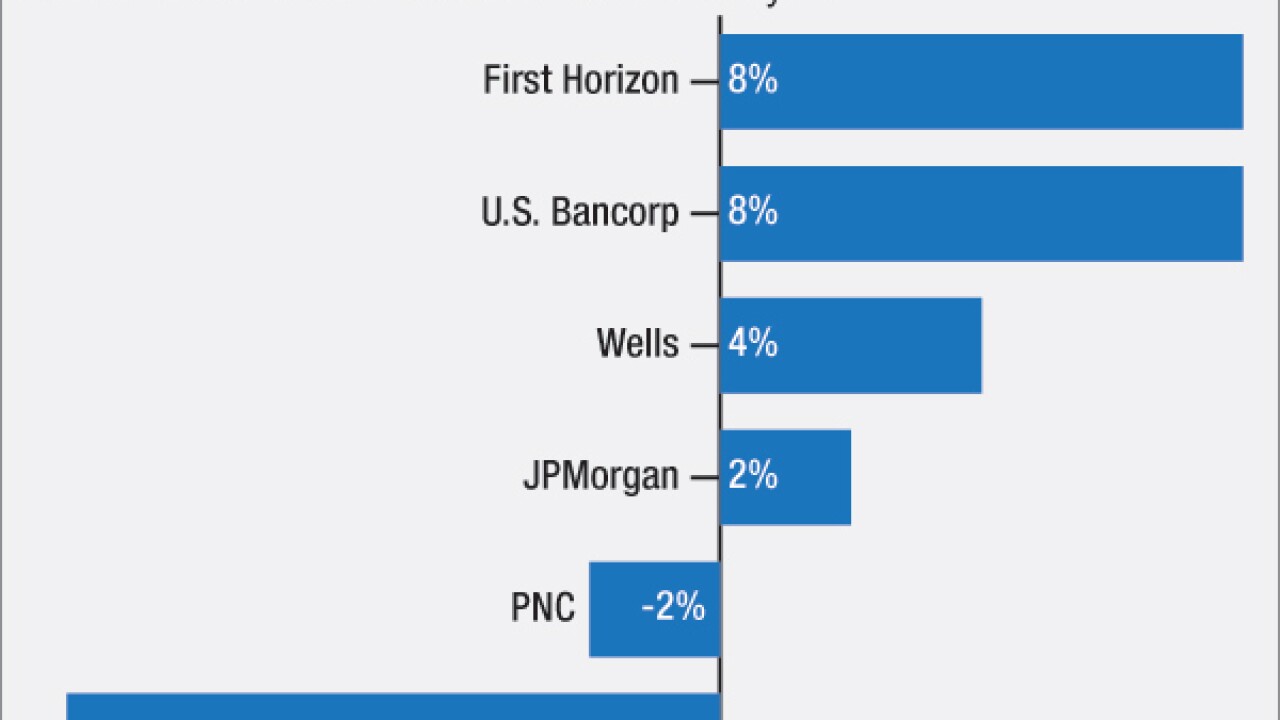

It's liable to be an uphill climb as banks try to boost revenue and hold profit steady over the rest of the year. Here's why.

July 15 -

The Senate approved a bill Thursday by unanimous consent that includes major reforms to the Federal Housing Administration condominium loan program and the Rural Housing Service loan program.

July 15 -

Loans tied to franchises were often an area of concern for banks before the financial crisis. Industry growth, improved credit metrics and a need to diversify commercial loan portfolios are prompting several banks to take a second look at the business.

July 14 -

In 1999, the OCC issued a charter to the internet bank AeroBank, but the startup's efforts to raise capital were thwarted when dot-com-boom money went chasing shinier options. Nonetheless, the banks experiences resonate with fintech banks trying to obtain a national charter today.

July 13 -

Online marketplace lenders found themselves in the congressional crosshairs Tuesday just as some lawmakers are attempting to provide the industry with sought-after reforms.

July 12 -

The $25 billion-asset company said in a press release Tuesday that BankUnited Small Business Finance is now making loans in Ohio, Washington and Wisconsin.

July 12 -

WASHINGTON The head of the American Bankers Association on Tuesday defended financial institutions' partnerships with fintech firms but argued that banks top nonbank startups in serving as "trusted custodians" for their customers' funds.

July 12 -

Attempting to impose the fundamental laws of a particular lending universe on another will lead to an eventual collapse of a particular firm or industry segment.

July 12 The 42nd Group

The 42nd Group -

Charles Schwab Bank, BBVA Compass and Mechanics Bank are among the latest investors in a California microfinance firm that specializes in small-business lending.

July 12