-

Federal rules for technology-based firms providing the fast-moving sector certainty and consistency would be a benefit, even if rules are suboptimal.

April 8 Mercatus Center at George Mason University

Mercatus Center at George Mason University -

The findings from the California Department of Business Oversight, which also included data on interest rates and delinquencies, could be a precursor to new state regulations.

April 8 -

The bank says the partnership will improve the online experience for borrowers. It is just the latest example of banks and online lenders teaming up to speed up decision-making and win over new customers.

April 7 -

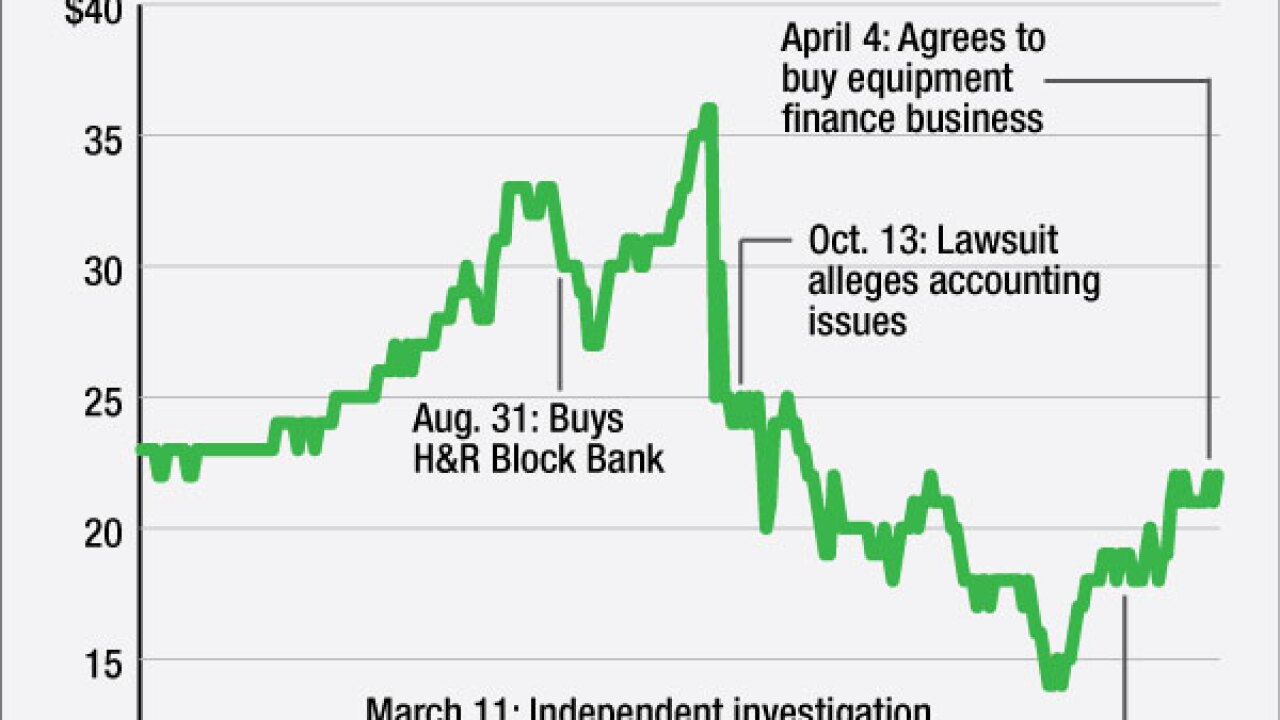

BofI Holding is looking to make more acquisitions and its leader says he doesnt think accusations from a former employee are unlikely to hold up a deal, even though theyve dragged down the stock price.

April 7 -

BlueVine, an online business lender based in Palo Alto, Calif., is branching into unsecured lending.

April 7 -

Lending Club, Prosper Marketplace and Funding Circle are locking arms to create a new trade group that will represent the marketplace lending industry in Washington.

April 6 -

As more employers offer student loan repayment assistance to their workers, lenders that specialize in refinancing debt like Citizens Financial and SoFi see an opportunity to reel in more customers.

April 5 -

The former head of the FDIC has a longstanding interest in small-dollar consumer lending.

April 1 -

AmeriServ Financial in Johnstown, Pa., will record a first-quarter loss because an unnamed energy-sector client plans to liquidate under bankruptcy protection.

March 31 -

The payments pioneer is transforming its merchant cash advance into a business loan, a move that has significant legal and regulatory implications.

March 30 -

Word that Hancock Holding in Mississippi would more than double its loan-loss allowance has triggered broader questions about how the oil slump could spread beyond the energy portfolios of a whole class of banks.

March 30 -

Opus Bank in Irvine, Calif., has hired Jeffrey Zaks, a CIT Group banker, to lead its new media and entertainment lending group.

March 29 -

Buyers of certain syndicated corporate loans have had an incentive to drag their feet closing trades; they will soon pay a hefty price if they don't do their part. The reform should help lenders get assets off their books faster.

March 29 - Arkansas

With energy stocks enjoying the biggest rebound since the beginning of the oil rout, short sellers have shifted their sights to regional banks that do business with the industry.

March 29 -

Hancock Holding is warning of more pain in its energy portfolio as low prices continue to hamper oil and gas firms ability to repay their loans.

March 29 -

As online business lenders grow in number, size and prominence, a new trade group is being launched to represent their interests in Washington.

March 29 -

Bay Banks of Virginia in Kilmarnock has increased the size of its fourth-quarter loss, after a commercial borrower pleaded guilty to creating false financial statements.

March 28 -

The subprime consumer lender currently rejects many of its personal loan applicants. It hopes to qualify more borrowers by offering cash to those who are willing to put their cars up as collateral.

March 28 -

A program recently started in New York helps entrepreneurs improve their business plans and cash flow before sending them to a bank. The nonprofit lender behind the program, meanwhile, hopes to boost small-business borrowers' credit scores and lower their rates.

March 28 -

San Francisco Fed President John Williams discusses the potential for new fintech products to make predatory lending easier, whether big banks need to be broken up, and the likelihood of another recession.

March 28