-

With a permanent director confirmed, the agency should take steps to establish a small-business data collection rule mandated by the Dodd-Frank Act.

January 23 U.S. Chamber of Commerce

U.S. Chamber of Commerce -

The McLean, Va., company also reported a decline in charge-offs on credit card loans.

January 22 -

CEO Greg Carmichael says the Cincinnati bank will hire bankers in Denver, Dallas and Houston as part of a broader expansion into fast-growing markets that are home to lots of midsize firms. It is also interested in buying more fee-based businesses.

January 22 -

The shutdown is keeping the agency from approving about 300 loans per day, according to CBA President Richard Hunt.

January 22 -

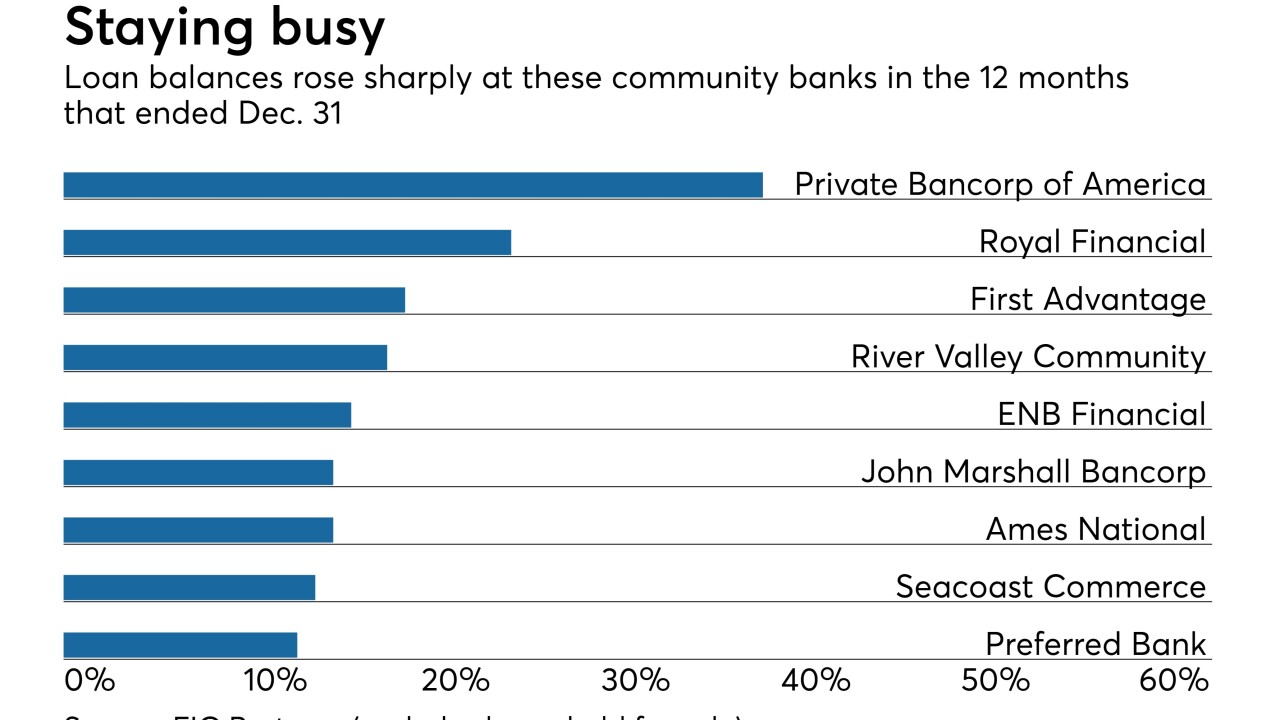

Smaller institutions are booking loans at a faster clip than bigger lenders, raising concerns that they are relaxing standards in order to win business.

January 22 -

The consent order against California Check Cashing Stores is part of a broader crackdown by the Department of Business Oversight on small-dollar lenders trying to skirt interest rate limits.

January 22 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

Strong demand for commercial loans helped offset weaker growth in consumer lending and a decline in fee income.

January 18 -

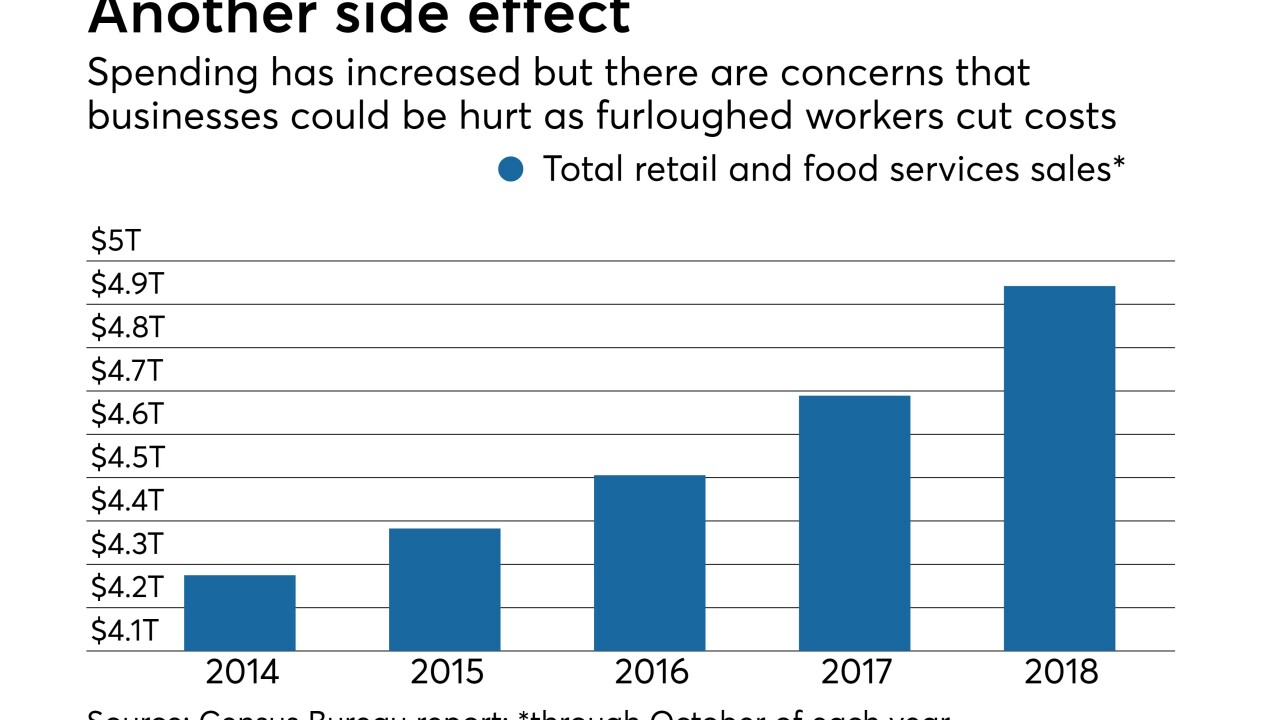

Credit union and bank executives say the federal work stoppage hasn’t hit business lines yet, but that could change if things drag on much longer.

January 18 -

The acquisition of VAR Technology Finance bolsters the bank's efforts to expand into new areas of lending.

January 18 -

Demand for commercial loans surged in the fourth quarter and executives at the Buffalo company see the momentum continuing in the new year.

January 17 -

During the National Credit Union Administration's monthly meeting on Thursday, Chairman J. Mark McWatters noted that the agency was making progress on hiring more women and minorities.

January 17 -

The New York company added eight new client teams in 2018 and established a new division that caters to private equity firms on both coasts.

January 17 -

Federal regulators should consider applying guidance that is nearly two decades old to end uncertainty about the legality of particular bank partnerships.

January 17 Pepper Hamilton

Pepper Hamilton -

Farm Service Agency staff will have three days to work on existing loan applications and provide tax documents for existing loans.

January 17 -

The online student lender said it is reallocating some jobs and "sunsetting" others.

January 16 -

Some in the industry worry the Fed may balk at allowing OCC charter recipients into the payments system, but Otting downplayed those concerns.

January 16 -

Now that Wells must abide by the central bank's asset cap through year-end, it may have to divest more nonessential assets and take other steps to open up room for core loan growth.

January 15 -

Loans grew 6% at JPMorgan Chase, but the bank is "not going to be stupid" and assume that will last forever, its CEO says. Here are some precautionary steps it's taking.

January 15 -

A recent proposal to allow the government-sponsored enterprise to offer more credit in agricultural regions is deeply flawed.

January 15United Bank & Trust