-

CenterState in Florida and Union Savings in Connecticut are adding specialists to their retail locations at a time when many other banks are cutting back or have been relying heavily on universal bankers.

May 24 -

During the ascension of marketplace lending, banks responded to the competitive threat in several different ways. Now some banks are better positioned than others to take advantage of the online sector's recent woes.

May 24 -

Nonperforming commercial-and-industrial loans are soaring, and loans to farmers and construction firms not just oil and gas companies are a big reason.

May 23 -

The nascent industry's early success will mean very little if these new companies don't take necessary steps to position themselves for the long term.

May 23

-

Banks and nonbanks should accept that more fintech regulation is inevitable, but how far regulators go will depend in part on how well companies demonstrate they are managing risk.

May 20

-

One of the country's largest online lenders is cutting jobs and shelving expansion plans in response to investors' rapid retreat from the beleaguered sector.

May 20 -

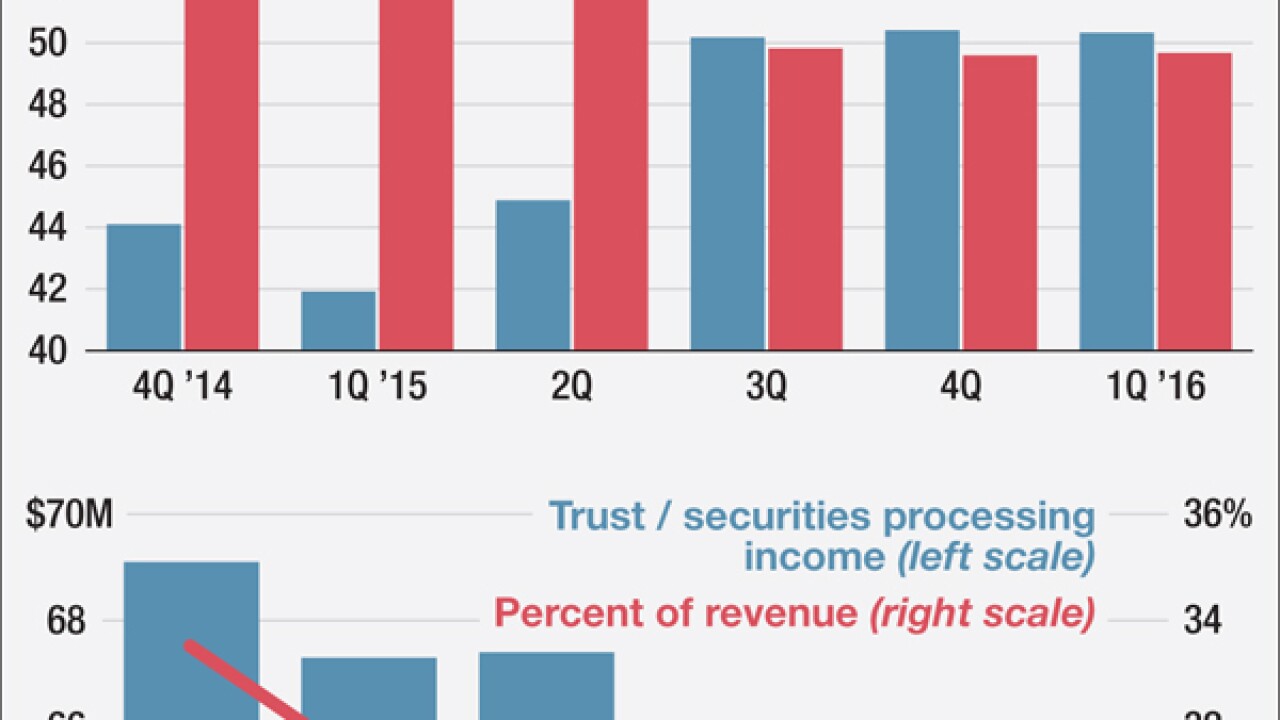

UMB Financial took its lumps last year when its funds management business suffered from large outflows. The challenge prompted UMB to tighten up on expenses and rely more on revenue tied to its balance sheet.

May 19 -

The financial services sector would benefit from companies banks included submitting dedicated disclosures on the impact of climate change.

May 19

-

A study commissioned by the Massachusetts Bankers Association found a correlation between a spike in credit unions with low-income designations and an increase in member business lending in the state.

May 18 -

New York's bank regulator is investigating LendingClub Corp. over loans issued to consumers and its relationships with financial institutions, saddling the embattled company with another probe after its chief executive was forced to resign earlier this month.

May 18 -

Following the scandal-tinged departure of CEO Renaud Laplanche, the company is contemplating drastic steps to restore the confidence of loan buyers. Scenarios that would have been far-fetched a short time ago such as diluting shareholders and funding loans off its own balance sheet are now under consideration.

May 17 -

Prosper Marketplace Inc. has met with investors including Fortress Investment Group about potential capital injections, according to a person with knowledge of the matter.

May 17 -

LendingClub Corp., which plunged 51 percent last week after the surprise departure of its leader and disclosure of faulty internal controls, said the scandal is prompting investors to suspend debt purchases and spurring government probes.

May 16 -

Too many fintech companies are selling superficial products. Entrepreneurs need to start solving hard problems and offering real value.

May 16 The 42nd Group

The 42nd Group -

BancAlliance, a network of community banks that has been snapping up loans from LendingClub, is weighing whether to suspend purchases on the online platform after the company said it's overhauling internal controls.

May 13 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

May 13 -

The disruption of the taxi industry caused by Uber and Lyft continues to hurt banks that finance taxi medallions. Anticipating more chargeoffs to come, these banks are aggressively boosting their reserves, restructuring delinquent loans and reselling or leasing out foreclosed medallions.

May 12 -

Digital upstarts that seemed on top of the world a few months ago have suffered a series of setbacks of late that raise questions about their long-term survival. Here's a look at the developments that have brought some once-high-flying online lenders back to earth.

May 12 -

Say what you will about these companies' longevity, were it not for the likes of Lending Club you wouldn't see banks like Wells Fargo introducing expedited loan products.

May 11 -

First Connecticut Bancorp in Farmington has committed to making $5 million in small-business loans over the next year.

May 11