- Texas

Texas Capital Bancshares in Dallas has hired a TD Bank executive to expand its lending to franchise-related businesses.

March 17 -

A small Connecticut bank takes the plunge into mobile-friendly mortgages in a bid to turn an attractive pool of student-loan borrowers into lifetime customers.

March 17 -

Moodys Investors Service, which put three of Citigroups securitizations of unsecured consumer loans originated by Prosper Marketplace under review for a downgrade, was not invited to rate the latest offering.

March 17 -

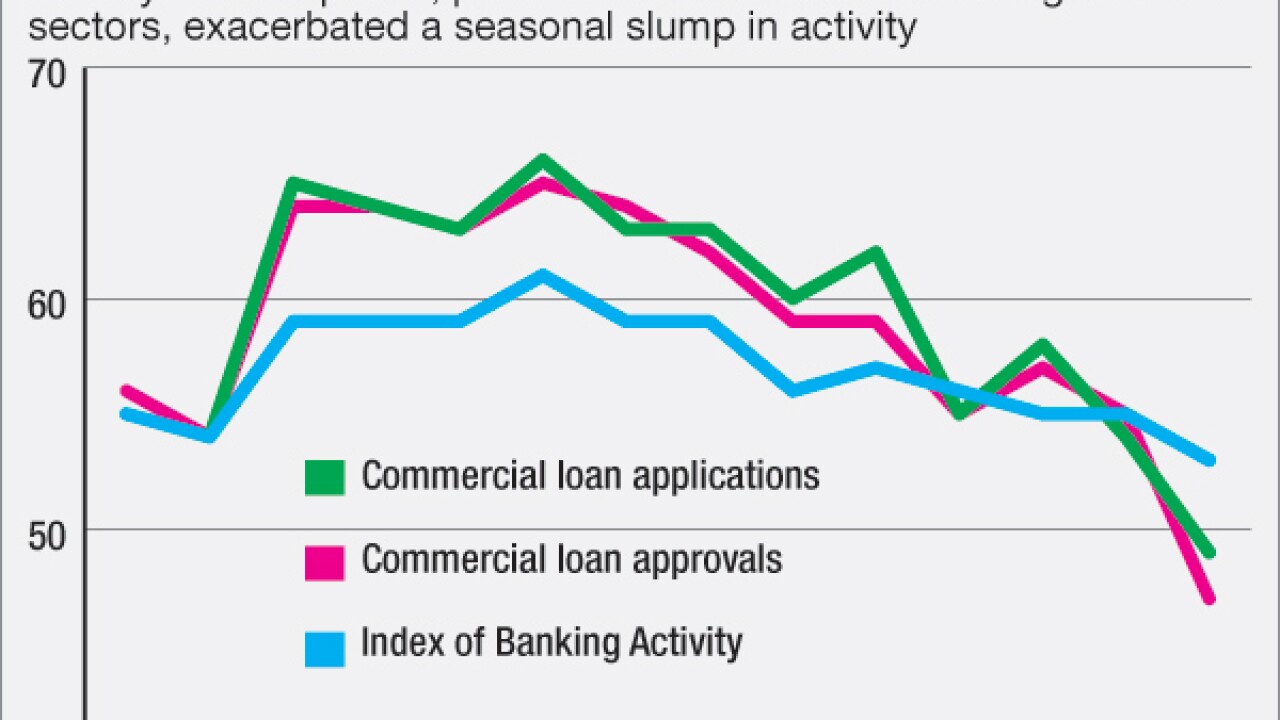

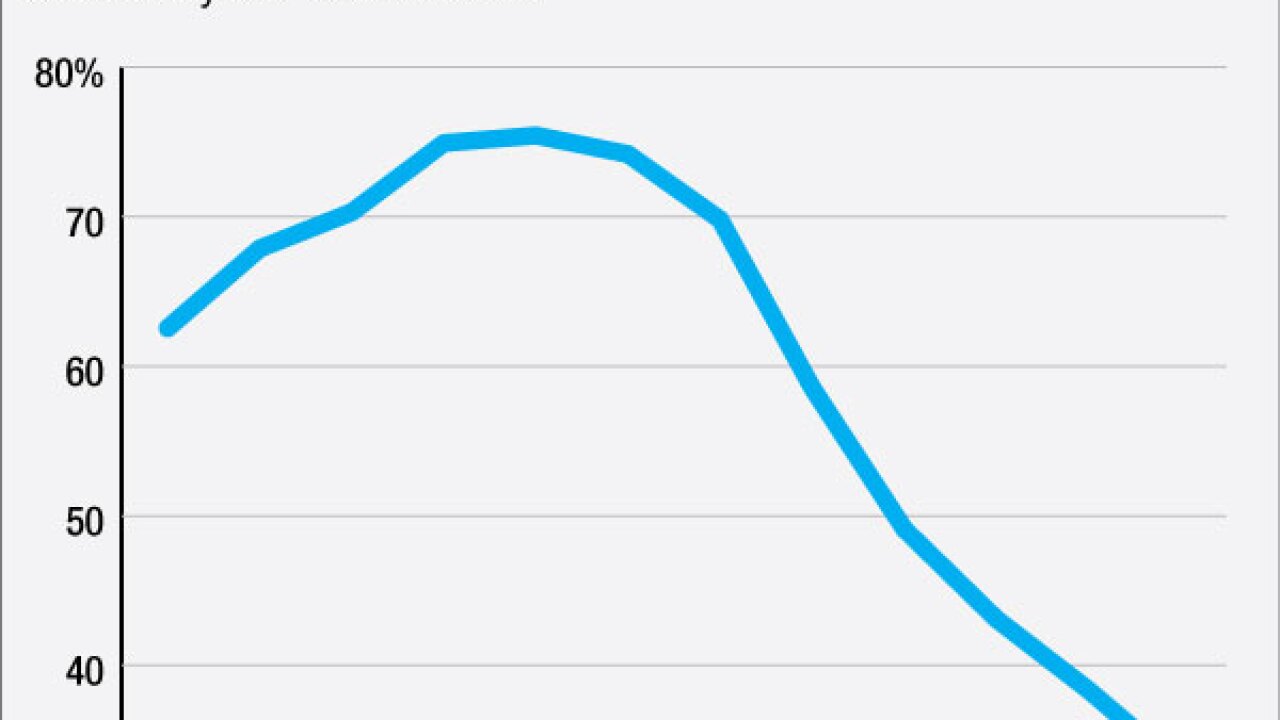

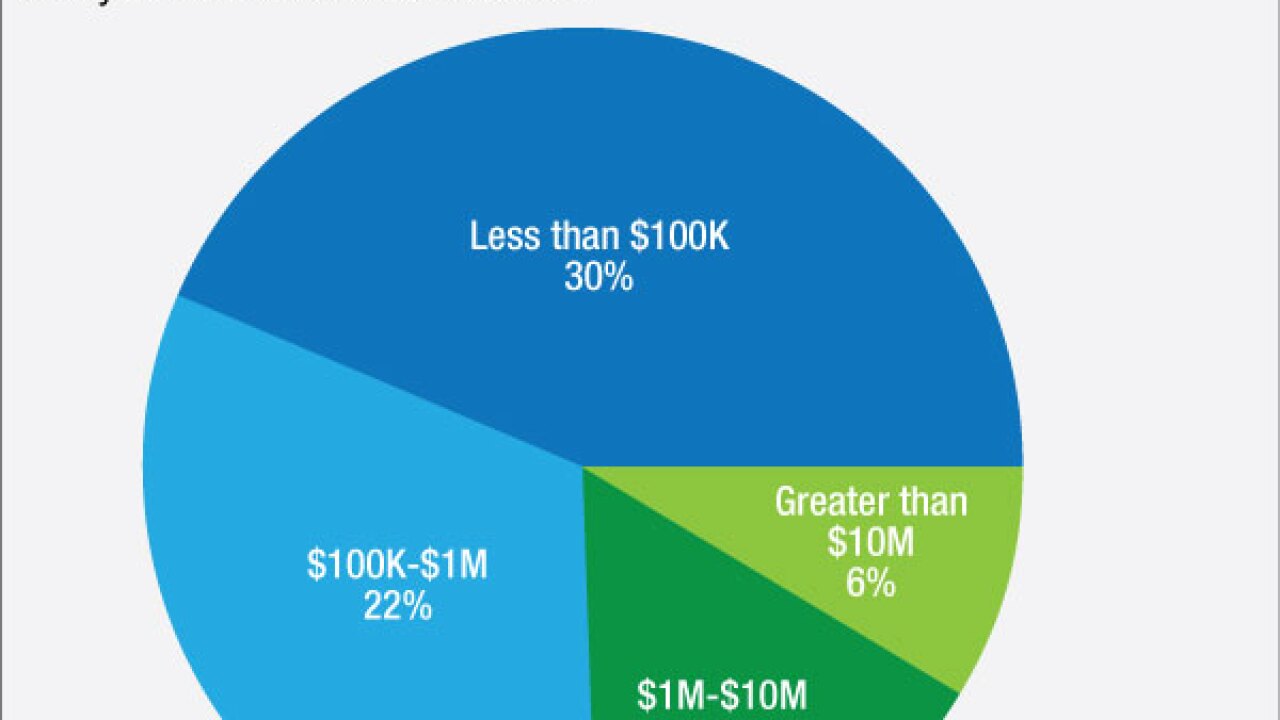

American Banker Research's Index of Banking Activity, which had the lowest reading in its nearly four-year history in January, revealed that issues in oil-producing states are contributing to decreases in commercial loan applications and approvals.

March 16 -

Loans outpacing GDP and the expressed optimism of CEOs on recent earnings calls are among the signs that growth figures are too good to be true.

March 16

-

The San Rafael, Calif., company has stayed at roughly the same asset size for six years now, even though it has the capacity and desire to become much larger. The reasons speak to the competitiveness among lenders and the fickle nature of bank M&A.

March 15 -

A leading alternative lender has admitted that balance sheets and liquidity matter, and that it is a problem that such lenders need to keep growing lending volumes to prosper.

March 15

-

Prosper Marketplace on Monday announced a three-year agreement to offer financing to consumers making improvements to their homes through the website HomeAdvisor.com.

March 14 -

Berkshire Hills Bancorp in Massachusetts invested in technology to beef up its small-business lending, an area ripe for the picking by alternative lenders.

March 11 -

The Federal Home Loan Bank of San Francisco is exploring ways to use $40 million it received as part of a private-label securities settlement to support small-business development and job creation to help future homebuyers.

March 11