-

Live Oak Bancshares in Wilmington, N.C., one of the largest 7(a) program lenders in the U.S. last year, has promoted Greg Thompson to chief operating officer.

January 8 -

Associated Banc-Corp in Green Bay, Wis., will increase its fourth-quarter allowance for loan losses by $13 million to compensate for potential late payments or defaults on loans in its energy portfolio.

January 8 -

A compilation of our favorite stories of 2015, as selected by the people who assigned and edited them.

January 8 -

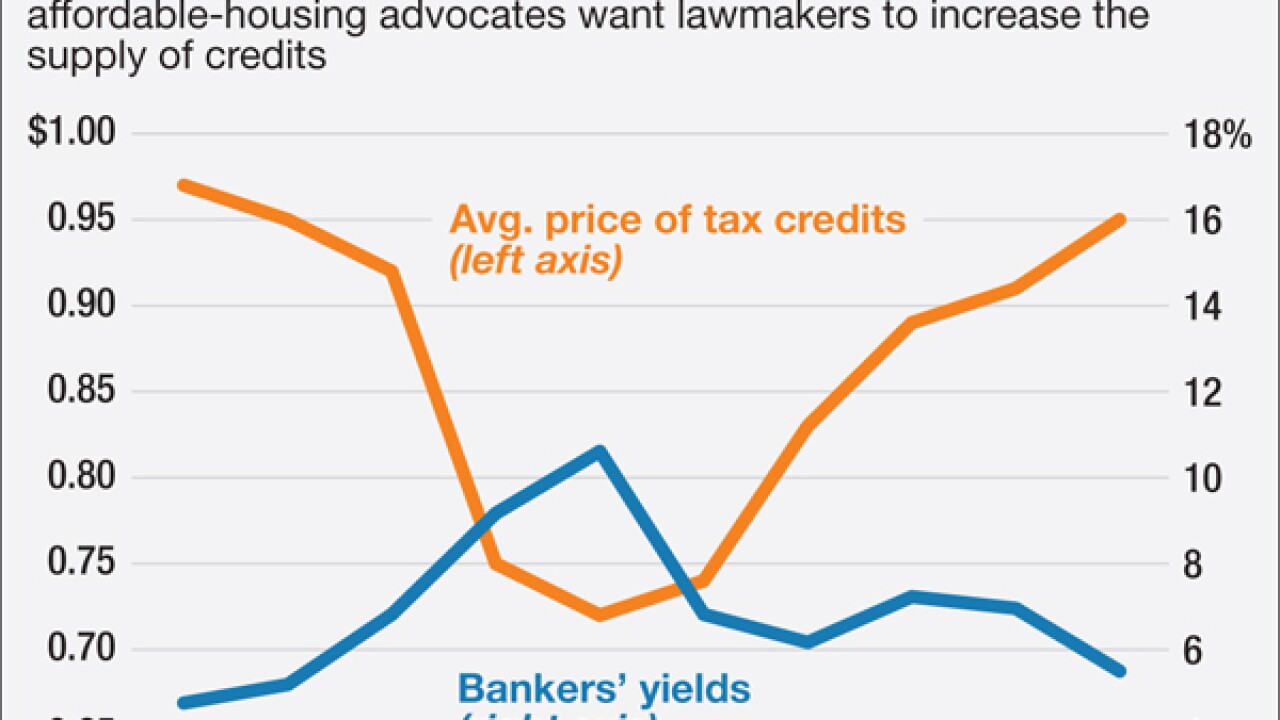

A recent tax change will provide more stability to banks and developers that use the low-income housing tax credit program, and the supply of below-market-rate apartments should increase as a result. But it's not enough to create the economic incentives needed to meet skyrocketing demand for affordable housing in the U.S.

January 8 -

Maybe disruptors, not bankers, are the ones who need to worry about an abrupt paradigm shift. Though many bankers fear having fintech startups pick off the most profitable parts of their business, history suggests this "unbundling" of banks is a recurring, temporary phenomenon that is generally followed by a period of "rebundling."

January 7 -

The Federal Reserve's interest rate increase has commercial real estate debt and equity financing players even more upbeat about their prospects in 2016.

January 7 -

Joseph Chillura, CEO of the $3.5 billion-asset USAmeriBank, runs a privately held company that should be an ideal candidate for industry consolidation. While trying to keep an open mind, Chillura seems intent on staying on the sidelines as other Florida banks strike deals.

January 7 -

The Seattle-based tech giant, in its latest foray into the financial services business, has begun offering installment loans to British consumers.

January 6 -

CommonBond, a New York firm that makes student loans through an online platform, said Tuesday that it has raised more than $275 million in debt funding from Barclays and others.

January 5 -

Opportunities abound, in affordable housing, capital raising, consumer lending and more. We aim to get you thinking about how new developments on many fronts could affect your business as you plan for the coming year and beyond.

January 3