Community banking

Community banking

-

Consumer demand for digital financial services will inspire a wave of new partnerships.

November 14 -

Banks are putting more effort in deposit gathering and fee-based products to offset thinning margins and increased payoffs by small-business clients.

November 13 -

The State Bank Group and The Provident Bank are backing Neocova, which focuses on community banks.

November 13 -

The FDIC is pursuing the penalty five years after hitting the Delaware company with a consent order tied to BSA and AML compliance.

November 13 -

Gov. Phil Murphy signed an executive order Wednesday establishing a board that would come up with a plan to create a public bank in New Jersey.

November 13 -

Such credits, which reflect borrowers with financial challenges, increased significantly during the third quarter.

November 13 -

Sen. John Kennedy, R-La., has proposed a bill to bar companies such as Rakuten from using industrial loan companies to access the banking system.

November 13 -

The issue, tied to how the company reconciles corporate accounts to its general ledger, is not expected to impact past financial statements.

November 13 -

The Louisiana company's willingness to combine with First Horizon without a big initial payday is fueling talk that other banks could be keen on selling at relatively inexpensive prices.

November 12 -

A group has filed paperwork with the FDIC to form Legacy Bank in Temecula.

November 12 -

The Pennsylvania company gained $67 million in assets under management as part of the acquisition.

November 12 - Banking brands

The company, which plans to become Altabancorp, said the initiative removes brand confusion and puts its size and scale on display.

November 12 -

Many in the industry have cheered regulators’ interest in improving the supervisory rating system, but they may shy from commenting publicly about their experiences in a confidential process.

November 11 -

Dealmaking through early November is slightly ahead of last year's clip thanks to a recent flurry of merger announcements. However, excluding BB&T-SunTrust, values and multiples are shrinking.

November 11 -

Community bank leaders at an ABA-hosted meeting questioned the timing for a new accounting standard for loan losses and discussed their struggles to keep pace with new technology.

November 11 -

Most consumers, even those in rural communities, have become accustomed to digital services. That's something certain community banks better face up to, panelists at the ABA conference said.

November 10 -

Scottsdale Community Bank's organizers took advantage of a state law letting them raise capital months before seeking deposit insurance.

November 8 -

The veteran banker succeeded Randy Sims, who recently retired. Sims had been the Arkansas company's CEO since replacing Allison in 2009.

November 7 -

Washington Trust warned that it could lose $3 million in annual revenue after two top advisers left to join a brokerage firm. Other banks are facing similar hits.

November 7 -

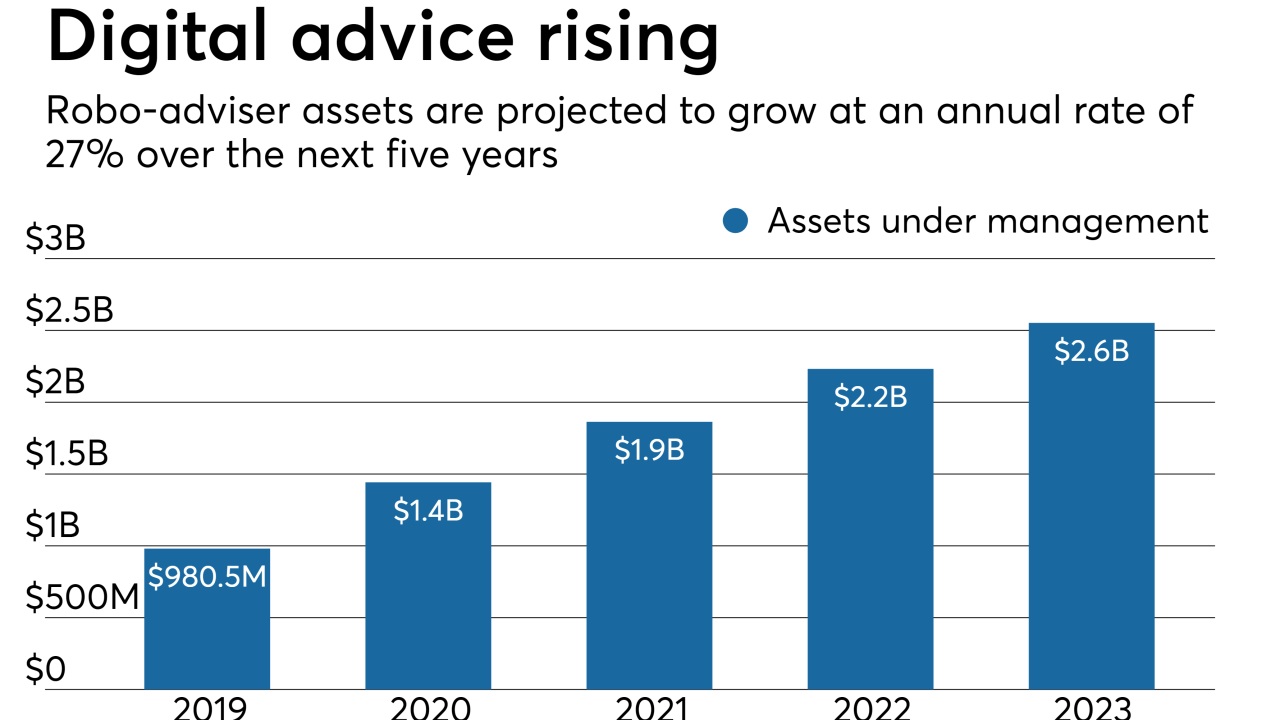

A new partnership will let some community banks and credit unions roll out robo-advice platforms without a significant investment of their own.

November 7