Community banking

Community banking

-

Valley, which had focused on Florida in recent years, will double its market share in Bergen County with the $740 million acquisition.

June 26 -

Ken Lehman recently bought a block of shares in Village Bank & Trust Financial.

June 26 -

Brad Goedken wants agreements for HarborOne Bancorp to include better protections, such as cost reductions if a service fails.

June 25 -

The number of minority depository institution charters is declining even as their financial performance is going up, according to a new study by the FDIC.

June 25 -

The biggest challenge for credit union acquirers involves retaining commercial customers at the banks they buy. That's why constant communication, and having more commercial products and services, matter.

June 25 -

The deal with Frandsen Financial is the 12th bank M&A transaction this year involving a seller in Wisconsin.

June 24 -

Seed, a San Francisco startup, has developed a platform that lets small businesses quickly open accounts online. That's an important feature for Cross River as it courts more fintech clients.

June 24 -

Shore Community Bank, which has five branches in Ocean County, will sell for $53 million.

June 24 -

Sterling Bancorp must enhance its BSA policies and hire an outside firm to review its account activity.

June 24 -

Independent Bank in Texas, the seller, gained the business after buying Guaranty Bancorp.

June 24 -

Facebook's plans to launch its Libra cryptocurrency dominated much of the discussion at American Banker's Digital Banking conference last week, but attendees also debated what big tech company might strike next and what future digital innovations are in store.

June 23 -

All of the Seattle company's directors, including CEO Mark Mason, were backed by shareholders despite a challenge by Blue Lion Partners.

June 21 -

Public-sector development of a speedier settlement service, to operate alongside the one being developed by The Clearing House, is crucial for seeing that institutions of all sizes are able to take advantage of this technology.

June 21 -

Community bankers want to cut the time it takes for customers to establish digital accounts to mere minutes, but it's hard to do that and make other improvements without increasing fraud risk.

June 20 -

The Cincinnati bank could add about $30 million a year in noninterest income with its deal for the capital markets firm Bannockburn Global Forex.

June 19 -

First Internet is poised to acquire an SBA lending team to help it meet an ambitious loan target for the year — a target the CEO plans on doubling in coming years.

June 19 -

A Wisconsin credit union's agreement to acquire a small Chicago bank, the eighth credit union-bank deal this year, led bankers to once again call for policymakers to slow the trend. A credit union trade group complained that banks are trying to stifle competition.

June 18 -

There’s a long list of reasons traditional lenders haven't kept up with the needs of entrepreneurs, says Judith Erwin, the head of Grasshopper Bank in New York. One is not asking for enough feedback.

June 18 -

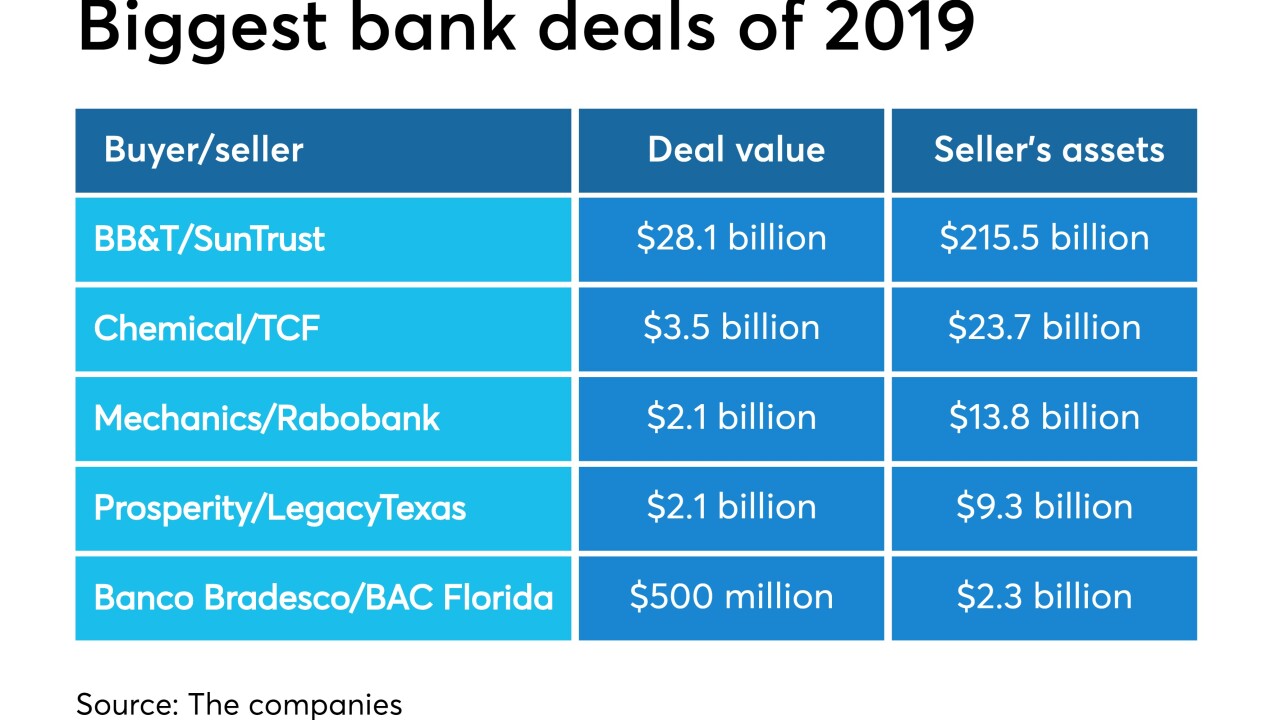

Deal values this year have been smaller than last year despite the hubbub over BB&T-SunTrust. Prosperity's agreement to buy LegacyTexas raises the possibility that the size of bank deals could start climbing.

June 17 -

The new regulation mandated by Congress expands eligibility for a simplified reporting form to financial institutions with $5 billion of assets.

June 17