Community banking

Community banking

-

Brenda Kerr will be responsible for creating a strategy for the bank's retail operations.

November 15 -

New Valley Bank & Trust is set to become the state’s first new bank since 2008.

November 15 -

Tepid loan and deposit growth has been a persistent theme in 2018, but that could soon change for community and regional banks in the New York and Washington markets.

November 14 -

The company is selling 14 branches, including several around Chattanooga, Tenn., and its mortgage business to FB Financial so it can focus on its Atlanta operations and national lending businesses.

November 14 -

Blue Hills Bancorp in Massachusetts completed a second-step conversion and was poised to bulk up on acquisitions. It struck its one and only deal this fall — and it was not the kind it had in mind.

November 14 -

The Mississippi bank will pay up to $100 million to expand in southwest Alabama and Dallas.

November 14 -

The Arkansas company will pay $170 million to buy Reliance Bancshares.

November 14 -

The company will also restate financials for the first half of 2018 to correct how it classified cash flow activities tied to commercial mortgage warehouse lending.

November 13 -

The proposed merger of two family-owned institutions would create a $5 billion-asset bank in Texas.

November 13 -

Organizers of Community Bank of the Carolinas in Winston-Salem have raised $13.6 million. The group has to bring in at least $25 million.

November 13 -

After bringing in a new leader and overhauling its board, Freedom Bank in northern Virginia is looking at digital upgrades and expansion into new markets to stay relevant.

November 12 -

Entrepreneurship among veterans has been declining over the past 20 years, according to a report by the SBA and the New York Fed.

November 12 -

The industry saw some well-known executives step down from their roles or take on new ones during the past month.

November 11 -

Entrepreneurship among veterans has been declining over the past 20 years, according to a report by the SBA and the New York Fed.

November 9 -

Northern Oak Wealth Management is a registered investment adviser with $800 million in assets under management.

November 9 -

The Nashville, Tenn., company had opposed a request by Gaylon Lawrence to boost his ownership to 15%.

November 9 -

Readers sound off on the 2018 midterm election results, OCC's Otting defending his agency's right to charter fintechs, and predictions the plastic credit card is nearly dead.

November 8 -

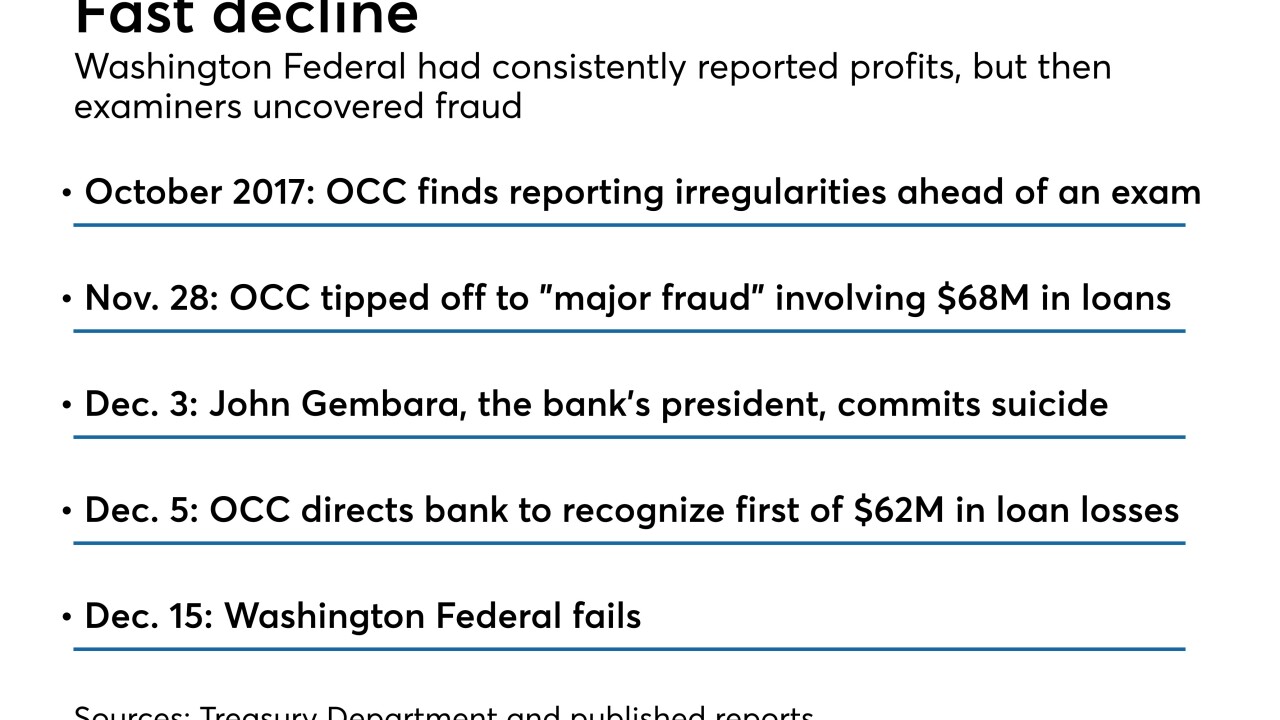

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

Raises for the rank and file have fueled investor complaints that banks aren’t keeping a lid on expenses. Executives say the pay increases have lowered turnover and improved customer service.

November 8 -

Will it be a bigfoot from Amazon, Google and Apple, or death by a thousand bites from niche rivals? Or can banks and credit unions rally and fend off the insurgents?

November 8